Table of Contents

Introduction

Micro, Small, and Medium Enterprises (MSMEs) play a major role in India’s economic growth. The MSMEs contribute significantly to Indian GDP, exports, and employment creation. Since MSMEs produce and manufacture a variety of products for both domestic as well as international markets, they have helped promote the growth and development of various product segments and industries.

For the very significance in their presence and their role in the economy, the Government of India had enacted the Micro, Small and Medium Enterprises Development Act (MSMED Act) of 2006. The major objective of the Act is to promote the growth and development of MSMEs, enhance their competitiveness, and provide a legal framework for their operations, including addressing issues like timely payments.

This article discusses the New revised limits for MSME Classification as per the latest Notification issued by the Ministry of MSME.

What is MSME?

Micro, Small, and Medium Enterprises (MSMEs) are businesses defined by their investment in equipment and annual turnover limits, as outlined by the Government of India in the MSMED Act, 2006. The MSMED Act of 2006 categorizes these enterprises into micro, small, and medium businesses based on specific investment and turnover limit criteria.

Revision in MSME Classification Limits

Recognising the importance of the MSMEs, the government has periodically revised the MSME classification criteria to better reflect the changing business trends and help entrepreneurs avail essential benefits such as loans, subsidies, and tax incentives. In the Union Budget 2025, the H’ble Finance Minister, Mrs. Nirmala Sitharaman announced a major revamp to the New MSME classification, increasing the investment limit by 2.5 times and doubling the turnover limits.

The revised MSME criteria are to come into effect from April 1, 2025. After the announcement in the Union Budget, 2025, the Ministry of Micro, Small and Medium Enterprises had issued a Notification on 21st March, 2025 notifying the revisions proposed in the Union Budget. Download the Notification below.

Revised MSME Classification Limits (w.e.f 01.04.2025)

Micro Enterprise

As per the revised classification limits, Micro Enterprises are those enterprises whose

- Investment in Plant and Machinery does not exceed Rs. 2.50 crores

- Turnover does not exceed Rs. 10 crores

Small Enterprise

As per the revised classification limits, Small Enterprises are those enterprises whose

- Investment in Plant and Machinery does not exceed Rs. 25 crores

- Turnover does not exceed Rs. 100 crores

Medium Enterprise

As per the revised classification limits, Medium Enterprises are those enterprises whose

- Investment in Plant and Machinery does not exceed Rs. 125 crores

- Turnover does not exceed Rs. 500 crores

How does the revision affect the MSMED Act, 2006?

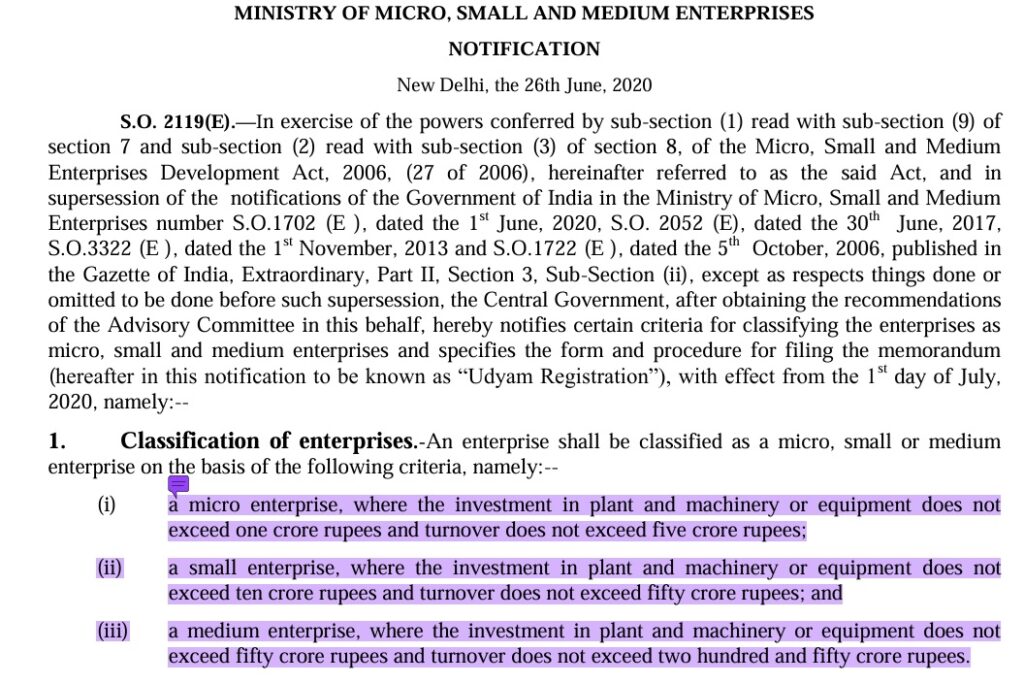

The Classification of Enterprises into Micro, Small or Medium Enterprises were governed under the provisions of Section 7 of the MSMED Act, 2006. In 2020, however, the Ministry of MSME issued a notification in exercise of the powers conferred by section 7(1) r.w.s 7(9) and section 8(2) r.w.s 8(3) of the MSMED Act, notifying changes in the classification criteria of the MSMEs.

Consequently, the Act remains unchanged till date but the definition stands updated by virtue of the notification dated 26.06.2020. The changes proposed in the Union Budget have been incorporated by way of amendment to the notification and hence, the MSMED Act, 2006 remains unchanged. In other words, the highlighted portion of the screenshot below stands amended by virtue of the recent Notification dated 21.03.2025

Benefits of being classified as an MSME

- Export assistance

- The ministry of MSME facilitates the export of MSME products and services by providing information, guidance, incentives, and support to exporters and by participating in trade fairs and exhibitions, both domestic and international.

- Consultancy

- The ministry of MSME provides consultancy services to MSMEs on various aspects, such as technology upgradation, marketing, finance, management, and legal issues, through its network of field offices and partner organizations.

- Entrepreneurship development

- The ministry of MSME conducts training programmes, workshops, seminars, and awareness campaigns to promote entrepreneurship among potential and existing entrepreneurs, especially women, youth, and marginalised groups.

- Collateral Free Loans

- Public and private sector banks offer specialised loan products at lower interest rates for MSMEs, reducing financial barriers to growth.

- Some of these loans are collateral-free and based on the classification criteria.

How to register with the MSME Ministry?

How to register as an MSME?

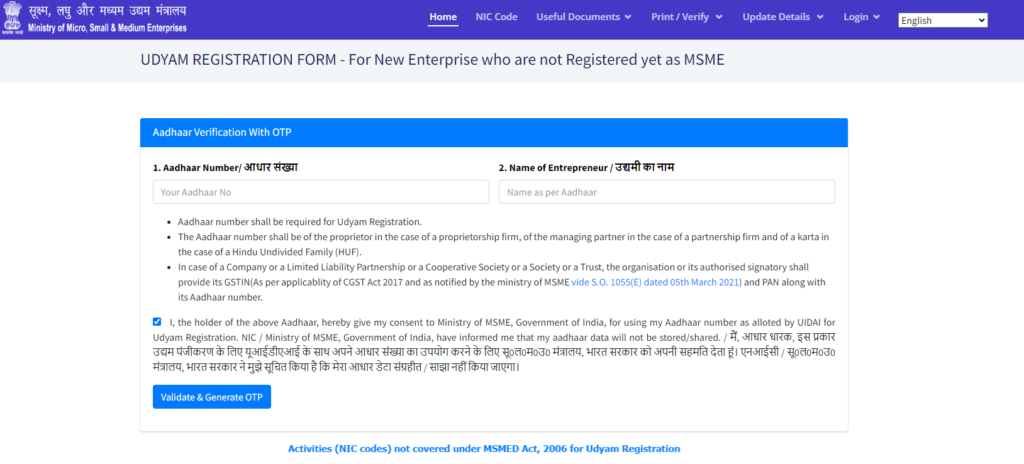

Visit https://udyamregistration.gov.in/UdyamRegistration.aspx

Enter your Aadhar Number and validate with an OTP

On validation, You will be required to enter other details like

1. PAN

2. Name of Business

3. Address of Business

4. No of Workers

5. Turnover for the Previous Year

6. Investment in Plant and Machinery

After validation you will be allotted a UDYAM (MSME) Number

You can view and Print the Certificate from the Portal itself.

Conclusion

The revision in the MSME Classification limits significantly raises the threshold limits thereby bringing into the definition large number of enterprises. This aligns with the rapidly growing Indian Economy. Given that the MSMEs are contributing a great deal to the Nation’s GDP, the further inclusion of entities would prove to be a added boost.