Case Details

- Case Citation: Civil Appeals Nos 734-747 of 1964

- Date of Judgement: 14th January 1965

- Court: Hon’ble Supreme Court of India

- Jurisdiction: Civil Appellate Jurisdiction

- Nature of Case: Civil

- Bench: P.B. Gajendragadkar (CJ), K.N. Wanchoo, and S.M. Sikri, JJ.

Introduction

The landmark case of Shanthi Prasad Jain v Kalinga Tubes Ltd (1965) stands as a foundational decision in Indian Corporate Law. Decided by the Supreme Court, it delved into the principles of “oppression” and “mismanagement” under the Companies Act, 195611. The case highlights the importance of fair conduct in managing a company’s affairs, particularly in the context of shareholders’ agreements. The appellant, Shanthi Prasad Jain, a minority shareholder, challenged a share issuance that he claimed unfairly diluted his stake. While his allegations were ultimately dismissed, the judgment set important boundaries on what constitutes oppression, making it a key reference point for interpreting shareholder disputes and internal corporate governance.

Case Background

Kalinga Tubes Ltd., initially a private company, was managed primarily by the Patnaik and Loganathan groups.22 In 1954, the appellant, Shanthi Prasad Jain, entered into an agreement with these groups to have equal shareholding and representation on the Board of Directors. The company, however, was not a signatory to this agreement. The share capital was increased to Rs. 61 lakhs, and shares were distributed among the three parties in nearly equal proportion. In 1957, the company was converted into a public limited company. In 1958, the board resolved to further increase the subscribed capital by issuing new shares to outsiders worth Rs. 39 lakhs.

Shanthi Prasad Jain filed a petition under Sections 397 and 398, claiming that the actions of the majority amounted to oppression and mismanagement. He also challenged the legality of the general meeting held on March 29, 1958, and claimed that the 1954 agreement had been violated. The single judge of the High Court accepted the appellant’s plea and held that the majority’s conduct was oppressive. On appeal, the Division Bench of the High Court reversed the decision, dismissing the allegations of oppression and mismanagement. The matter was then brought before the Supreme Court.

Issues Raised

- Whether the 1958 allotment of shares amounted to oppression or mismanagement under Sections 397 & 398 of the Companies Act, 1956?

- Whether the 1954 agreement was binding on the company and if the 1958 resolutions were valid in law?

Legal Provisions

- Section 397 of the Companies Act, 1956: Relief in case of oppression.3

- Section 398: Relief in case of mismanagement.4

- Section 81: Issuance of further shares by public companies.5

- Section 399: Eligibility to apply under Sections 397 & 398.

Contentions

Appellant (Shanthi Prasad Jain)

The appellant contended that the 1954 agreement promised equal shareholding and board control, which was breached. He alleged that issuing new shares without offering them to existing shareholders was designed to dilute his holding and control. He also argued that the haste in allotting shares was to defeat an injunction and amounted to oppression, and the withdrawal of Rs. 7 lakhs by the Patnaik and Loganathan groups showed mismanagement.6 The issuance of new shares at par to third parties, not to existing shareholders, also led to oppression and mismanagement.

Respondent (Kalinga Tubes Ltd. & Others)

The respondent contended that the 1954 agreement was not binding on the company, especially after it became public. The shares were allotted as per the law (Section 81 of the Companies Act, 1956), as the new shareholders were independent individuals, not benamidars or stooges. They emphasized the need for funds and urgency for expansion and eligibility for loans from the Industrial Financial Corporations.

Order of the Court

The Supreme Court dismissed the appeal and upheld the decision of the Division Bench of the High Court, holding:

- There was no oppression under Section 397 as no element of unfair prejudice or lack of probity was established. There was also no mismanagement under Section 398 as the affairs of the company were not shown to be conducted in a manner prejudicial to its interest.

- The 1954 agreement, not being binding on the company and lacking enforceable terms on future share allotment, could not support the appellant’s claims. Thus, the issuance of new shares was lawful and in accordance with Section 81 of the Act.

- Regarding the lack of confidence and differences among shareholders in early 1958, it was emphasized that mere distrust does not constitute oppression unless it demonstrates unfair treatment of minority rights.

Ratio Decidendi

For a claim under Section 397, it must be shown that the majority’s conduct was burdensome, harsh, and wrongful, and involved a lack of fair dealing and probity towards minority shareholders in the exercise of their proprietary rights. Mere loss of confidence between the parties of shareholders is insufficient to prove or establish oppression. Unless it is shown to be mala fide or fraudulent, the issuance of shares for legitimate business expansion, even if it dilutes the minority holding, does not constitute oppression. 7The Court emphasized that oppression must be continuous and not based on isolated events.

🔗 Know more on Ratio Decidendi by clicking here

Case Observations

- The 1954 agreement lacked legal enforceability, especially after the company’s conversion into a public limited entity. Haste in share allotment was prompted by the company’s financial needs and not designed to oppress, as the new shareholders were bona fide and not proxies or benamidars.

- The decision of the majority to make the shareholding more broadly based was a sound business decision, not an act of oppression, as the loss of the appellant’s support did not materially affect the company’s functioning or interest.

- Judicial interference under Sections 397 & 398 requires a clear demonstration of oppression or mismanagement, not mere discontent or dissatisfaction.

📘 Stay Updated on Companies Act!

Don’t miss important changes, notifications, and practical insights under the Companies Act.

🔗 Visit Companies Act SectionCase Impact and Significance

The case is a benchmark for distinguishing between legal business strategy and oppressive intent. It became a landmark judgement defining the protection of minority shareholders and clarified that lawful corporate decisions, even if adverse to some shareholders, do not instantly amount to oppressive action. The case also reaffirmed the supremacy of the company’s articles of association.

Subsequent Development

Even though the Companies Act, 2013 replaced the earlier provisions with Sections 241 & 242, the principles from this landmark case remain a cornerstone and intact.8

Conclusion

The case establishes critical jurisprudence on shareholders’ “oppression” and “mismanagement”, drawing a fine balance between majority rule and minority protection. The Supreme Court clarified that mere inequality in shareholding, which excludes from management, or frustration of expectations arising out of an informal agreement, does not amount to legal oppression or mismanagement. It reaffirms the high threshold required to invoke Sections 397 and 398, favoring corporate autonomy over internal shareholder disputes unless legal or equitable breaches are apparent.

- https://testbook.com/landmark-judgements/shanti-prasad-jain-vs-kalinga-tubes-ltd ↩︎

- https://lawfyi.io/s-p-jain-vs-kalinga-tubes-ltd-on-14-january-1965-case-summary/ ↩︎

- https://indiankanoon.org/doc/146869/ ↩︎

- https://indiankanoon.org/doc/280790/ ↩︎

- https://www.drishtijudiciary.com/landmark-judgement/shanti-prasad-jain-v-kalinga-tubes-ltd-air-1965-sc-15 ↩︎

- https://www.linkedin.com/pulse/oppression-mismanagement-under-companies-act-rituparna-duttagupta ↩︎

- https://shareholderoppression.com/blog/shareholder-oppression-and-business-litigation-what-the-sleeping-duck-case-teaches-us ↩︎

- https://www.casemine.com/commentary/in/articles-of-association-supersede-private-agreements-in-public-companies:-insights-from-pushpa-katoch-v.-manu-maharani-hotels-ltd./view ↩︎

About the Author

More Judicial updates coming your way

Subscribe to TaxRoutine.com today!

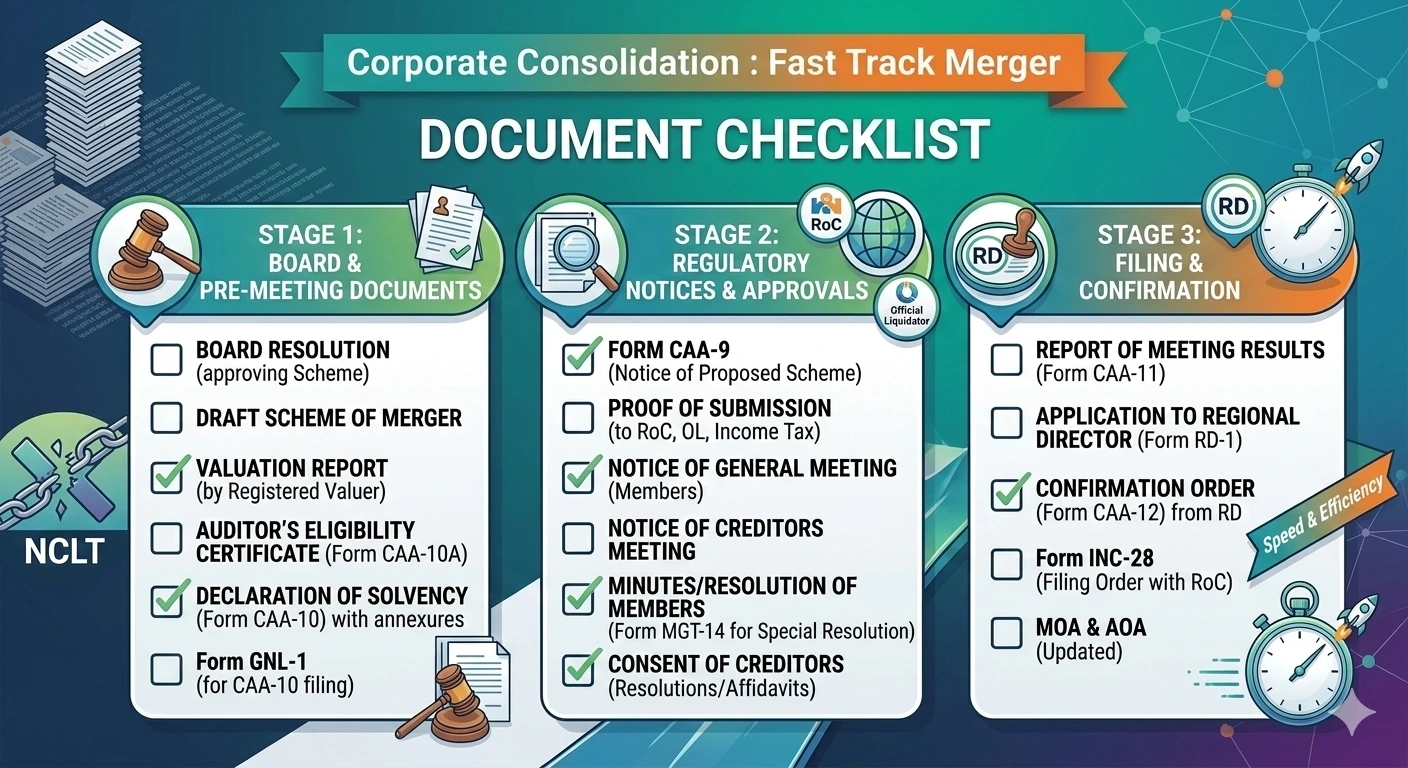

- Tax Implications of Fast-Track Mergers in India

- Fast-Track Merger Document Checklist (Section 233 – Practitioner Guide)

- Streamlining Corporate Consolidation: A Guide to Fast Track Mergers for Group Companies

- Compliance Calendar March 2026

- GST Cash Ledger vs. Income Tax “Cash Ledger”: Concept and Challenges

- Multiple GST SCNs for same year permissible : Madras HC

Pingback: OPPRESSION AND MISMANAGEMENT:“JUSTICE AND EQUITABLE” TEST