The anticipation is finally over! The Central Board of Direct Taxes (CBDT) has announced that the tax audit due date extended along with the due dates for other statutory audit filings for the Assessment Year 2025-26. Through Circular No. 14/2025 dated 25th September 2025, a much-awaited relief has been announced for tax professionals and businesses across India. Let’s dive into how this unfolding saga reached its positive conclusion, the highlights of the official circular, and what this means for Indian taxpayers and auditors.

A Season of Uncertainty and Hope

September has always been a nerve-wracking month for Chartered Accountants and businesses in India. As the statutory deadline for tax audit report filing approached, a chorus of requests for extension echoed across the profession. This year stood out with even greater uncertainty, as multiple High Courts including Karnataka and Rajasthan stepped in, recognizing the practical hardship afflicting the community.

As recently as September 24, the Karnataka High Court directed the CBDT to extend the audit due date to October 31, 2025, responding to representations about challenging work environments, technical glitches, and the volume of filings required in a short span. On September 25, similar orders from the Rajasthan High Court and public updates from leading professionals created a crescendo of pressure on the CBDT to finally act.

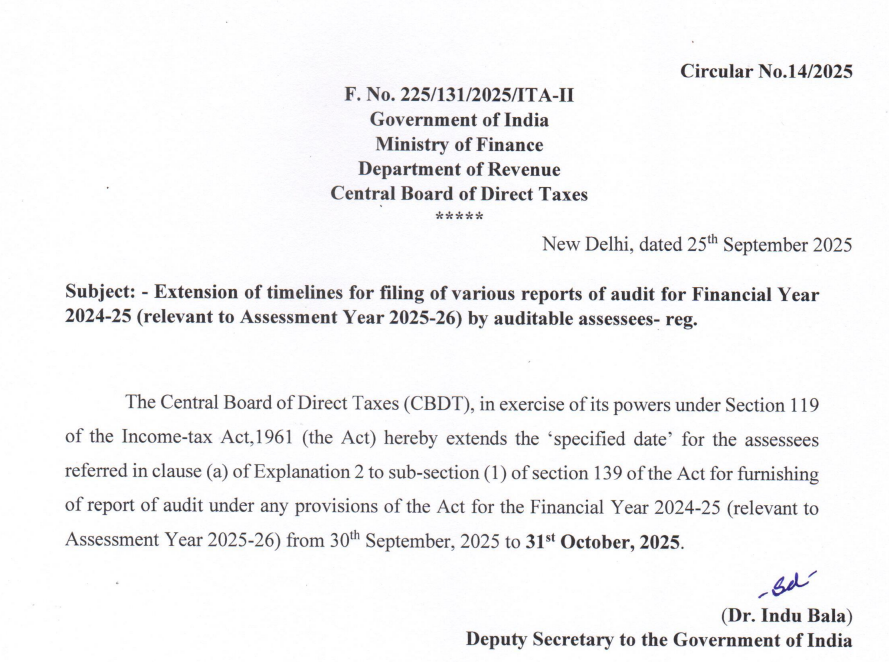

The Official Circular

On September 25, 2025, the Central Board of Direct Taxes removed all doubts by issuing Circular No. 14/2025. Here are the main takeaways:

- Extended Deadline: The specified due date for furnishing audit reports under any provision of the Income-tax Act, 1961, for Financial Year 2024-25 (relevant to AY 2025-26) is now 31st October 2025, instead of 30th September 2025.

- Who Benefits: This applies to all assessees required to submit an audit report under the Income-tax Act, including those covered under clause (a) of Explanation 2 to Section 139(1).

- Legal Backing: The extension has been granted by the CBDT under powers conferred by Section 119 of the Income-tax Act, underscoring the department’s responsiveness to evolving ground realities.

- Widespread Communication: The circular was disseminated to the Ministry of Finance, Revenue Secretary, all CBDT members/officers, ICAI, various chambers of commerce, and also publicized on the official Income-tax website.

Behind the Scenes: How was the Tax Audit Due Date Extended

The path to this extension weaves together legal, professional, and administrative threads:

- Persistent Advocacy: KSCAA, CASA, and other regional CA associations including the Institute of Chartered Accountants of India led extensive representation campaigns to highlight the growing demands on tax practitioners, compounded by systemic inefficiencies and new audit requirements every year.

- Litigation Pressure: The legal battle in the Karnataka and Rajasthan High Courts played a crucial role. Both courts recognized not just the volume of work, but practical compliance difficulties in a digital era defined by network slowdowns and strict timelines.

- CBDT’s Responsive Approach: Even as the department deliberated, public updates and court directions pressed for swift action, resulting in a positive, timely notification.

🔗Download the Rajasthan HC’s order here

The end result: Over a month’s worth of breathing room for every professional and business grappling with audit submissions.

Why the Extension Matters So Much

Every year, lakhs of audits must be completed by CAs and submitted through the government portal. But the importance of the extension goes beyond mere convenience:

- Quality over Speed: With more time, CAs can focus on delivering higher-quality audits, ensuring thoroughness, accuracy, and compliance without the specter of penal consequences for unavoidable delays.

- Reduced Portal Glitches: Audit documentation submission is heavily dependent on the stability and uptime of the e-filing portal. With extra weeks, the pressure on the digital infrastructure is eased, reducing the frequency of upload failures and system errors.

- Client Well-being: Businesses, especially small and medium enterprises, often find it hard to provide all documents on tight timelines. The extension gives them needed flexibility to interact with advisors and close last-minute gaps.

- Mental Health and Sustainability: Far from being an academic consideration, workload compression during audit season takes a very real toll on the workforce. The extension is a lifeline for the well-being of thousands of professionals.

What’s Next? Advice for CAs and Taxpayers

Now that the extension is formal, here’s how stakeholders should plan the weeks ahead:

- Update Internal Calendars and Client Communications: Immediately inform clients about the new due date to spread out the workflow and enable better planning.

- Do Not Procrastinate: Treat this as an opportunity to enhance quality, not a reason to delay unduly. The extended window is best used for catching issues early and submitting accurate, comprehensive filings.

- Stay Alert for Changes: Carefully read the full text of Circular No. 14/2025 for any nuances, exceptions, or reporting clarifications.

- Prepare for Future Filing: Keep an eye on any possible changes in deadlines for allied statutory filings like ITR deadlines, as the audit report deadline typically impacts related compliance.

Looking to the Future : A Message for Policymakers

The events of this year are a strong reminder of the need for timely and proactive reforms. While judicial intervention saved the day this time, establishing a robust preemptive consultation process between CBDT, ICAI, and major professional bodies could help the income-tax administration get ahead of such annual logjams.

Continuous improvements to audit portals, stable deadlines, and better process transparency would benefit not just professionals and taxpayers but the larger compliance ecosystem.

Though the initial CBDT’s press release had a language that was not in the usual tone, the professionals are happy with the extension that they have got. The CBDT still continues to refuse to accept that the Income Tax portal suffers from Technical glitches. The bureaucratic silence and refusal to acknowledge the existing issues in the portal only suggests that either the same is wrongly being conveyed to the ministry or the bureaucrats want to save the portal designers.

Conclusion

This year’s extension is a testament to what can be achieved when all stakeholders like professionals, legal experts, and public administration work together to create a more practical, humane, and effective tax compliance framework. The new due date of 31st October 2025 is now official. Use this time wisely, uphold the standards of the profession, and look forward to a smoother audit and compliance cycle!

Stay tuned to TaxRoutine Updates!

Subscribe and Follow our posts!