A bootstrapped startup from Bengaluru’s buzzing tech hub or a family-run enterprise in Ahmedabad suddenly grabs headlines, with founders ringing the bell at the BSE or NSE amid cheers from retail investors glued to their UPI apps. That’s the electrifying vibe of an Initial Public Offering (IPO) in India, the moment a private company steps into the spotlight of the world’s fastest-growing major economy, raising billions while navigating the watchful eyes of SEBI.

But beneath the Diwali-like celebrations lies a rigorous, rule-bound odyssey involving merchant bankers, compliance wizards, and market mavens. If you’ve ever scrolled through apps like Groww or Zerodha wondering how homegrown giants like Zomato or Swiggy made it big, you’re in for a treat. We’re unpacking the listing process tailored for Indian investors, laced with desi examples and insights from the trenches.

What is an Initial Public Offering?

In simple words, an Initial Public Offering or commonly known as IPO is a private company’s debut sale of shares to the public, regulated by the Securities and Exchange Board of India (SEBI) to raise funds for growth, debt repayment, or rewarding early backers. It’s not just a cash grab; it’s a strategic pivot that catapults firms into the big leagues, but with strings attached like mandatory disclosures and quarterly scrutiny.

In India, where retail participation has exploded (thanks to demat accounts crossing 15 crore), IPOs are more than finance; they’re a slice of the Great Indian Dream.

Flashback to Coal India’s blockbuster 2010 IPO, which mopped up ₹15,199 crore and remains the gold standard. Fast-forward to 2025: India’s primary market is on fire, with 78 IPOs listed so far. A 20% dip from 2024’s record 326, yet raising over ₹1.5 lakh crore amid global jitters. This resilience? It’s fuelled by our bull run in equities and a young investor brigade chasing 20-50% listing pops.

The Step-by-Step Guide to the IPO Process

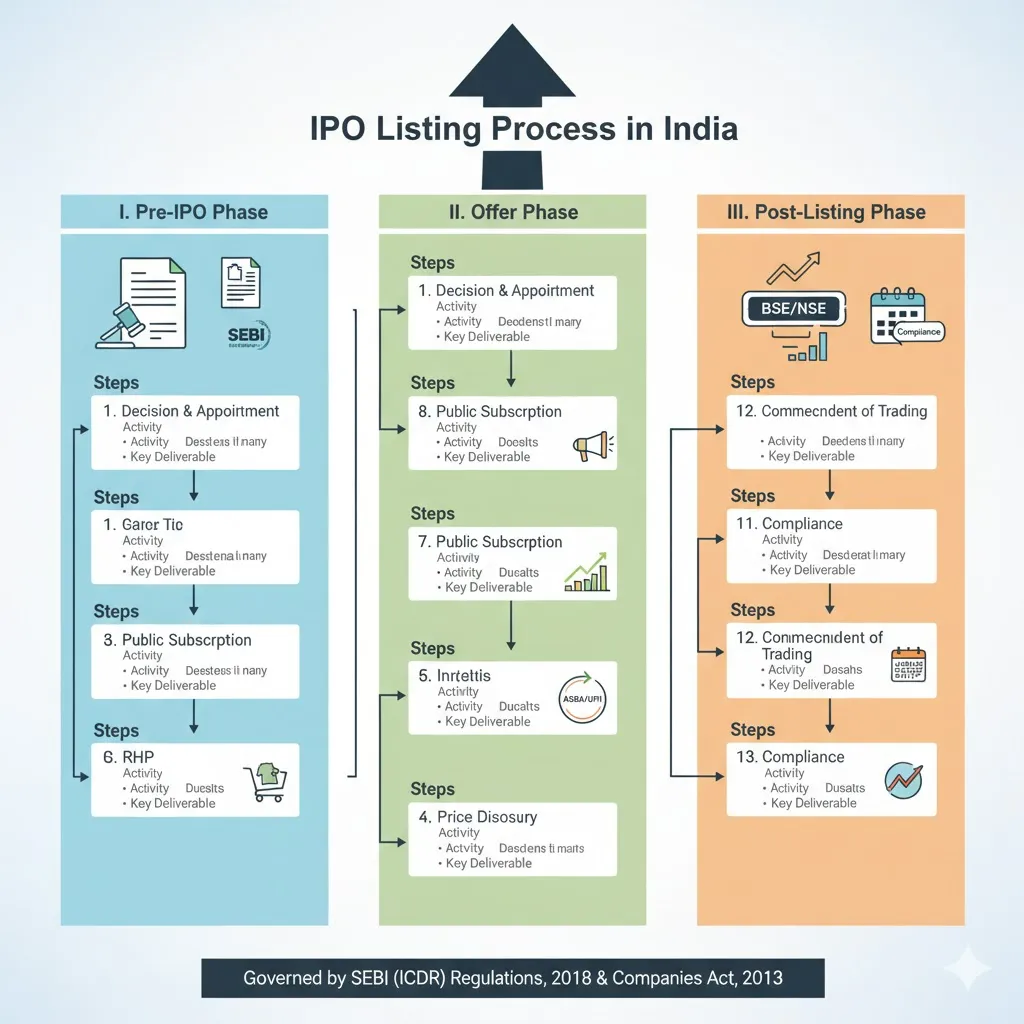

The Indian IPO trail isn’t a joyride. It’s a 6-12 month gauntlet under SEBI’s ICDR (Issue of Capital and Disclosure Requirements) Regulations, blending book-building (demand-driven pricing) with fixed-price options.

Here’s the roadmap, from DRHP drafts to NSE chimes:

- Preparation and Hiring Intermediaries: The company appoints a SEBI-registered merchant banker (Examples : Kotak Mahindra or Axis Capital) as the lead manager, plus underwriters, auditors, and legal advisors for due diligence. Valuation happens here using DCF models or peer comps to set the stage.

- Drafting and Filing the DRHP: The Draft Red Herring Prospectus (DRHP) is filed with SEBI and exchanges (BSE/NSE), spilling beans on finances, risks, and biz plans. SEBI’s 21-30 day review follows, with tweaks via the Red Herring Prospectus (RHP). This “tell-all” doc is your bible as an investor—read it on SEBI’s site.

- Roadshows, Pricing, and Subscription: Hype builds via roadshows in Mumbai, Delhi, and global hubs. Anchor investors (big funds) bid first, then the 3-day window opens for retail, HNI, and QIBs via ASBA/UPI. Pricing? Book-building sets the cut-off based on bids—hello, oversubscription drama!

- Allotment, Refunds, and Listing: Shares are allotted (lot sizes apply for retail), refunds processed, and boom—listing on T+3/T+4. Stabilisation by underwriters kicks in briefly. Post-listing, lock-ins protect against insider dumps.

For a quick visual, here’s a handy infographic on the IPO listing process:

Key Players: The Desi Squad Behind the Scenes

- Merchant Bankers: The strategists (e.g., JM Financial), handling filings and roadshows.

- Underwriters and Registrars: Banks like HDFC absorb unsold shares; firms like Link Intime manage allotments.

- SEBI and Exchanges: The referee (SEBI) and venue (NSE/BSE) ensuring fair play.

- The Founders and Team: From startup CEOs to promoter families, they’re the heart—think Byju’s early buzz (pre-storm).

Challenges and Curveballs on the Indian Turf

IPOs aren’t all rangoli and returns. Market swings, as in early 2025’s volatility from US tariffs, have 37 listings trading below issue price, spooking retail folks. Overvaluation bites hard (recall Paytm’s post-IPO tumble), while SEBI’s scrutiny on governance delays filings. 58 DRHPs are in limbo. Sector woes like EV competition (Ather’s muted debut) or regulatory red tape add spice. Yet, alternatives like QIB quotas or SME platforms offer nimble paths.

Real-World Spotlights: 2025’s Indian IPO Stars

2025’s been a mixed bag, but standouts shine. Swiggy’s ₹11,327 crore behemoth debuted with a 9% pop, rewarding food-tech fans amid quick-commerce wars. FirstCry, the baby products unicorn, listed strong at 47% gains, tapping India’s diaper boom. Ather Energy’s EV push? A cautious 2% premium, but eyes on green mobility. Late 2025 buzz? Pine Labs’ fintech flair, BoAt’s audio swagger, and Hero Fincorp’s lending leap are queued up, promising ₹5,000+ crore action.

Wrapping It Up

In India’s IPO arena, it’s a cocktail of ambition, regulation, and rupee roulette. For budding entrepreneurs in Tier-2 towns or SIP-savvy millennials, mastering this unlocks wealth-building gems. Dive into Chittorgarh or Moneycontrol for calendars, and remember: DYOR before that UPI tap. Your next multibagger could be brewing—who’s ready to bid?

🔍 Expanded Knowledge for Capital Markets!

Just finished reading about IPO Listing? Now, discover another critical fundraising method!

👉 Learn About Changes to Rights Issue