Introduction

GSTR 9 is an Annual Return to be filed by taxpayers whose aggregate turnover during the year exceeds Rs.2 crores as notified under Notification no. 15/2025 – Central Tax dated 17th September 2025

This return provides a consolidated summary of outward supplies, Input Tax Credit(ITC) claimed in the monthly returns, taxes paid, and any demands or refunds incurred during that year.

This return enables the taxpayer to make proper reconciliations with the books of accounts and disclose additional liabilities if any in the annual return.

The annual return will be enabled only when all the monthly returns (i.e GSTR -1 & GSTR-3B) are filed by the taxpayer.

Applicability of GSTR-9

GSTR-9 is applicable to every registered taxpayer other than the following persons:

- Casual Taxable Person

- Non-Resident Taxable Person

- Input Service Distributor

- Unique Identification Number Holders

- Online Information and Database Access Retrieval Service (OIDAR providers)

- Composition Dealers

- Persons required to deduct taxes under Section 51 (TDS)

- Persons required to collect taxes under Section 52 (TCS)

Understanding Tables of GSTR-9 and its changes

Table 4: Details of Outward and Inward supplies made during the Financial Year on which tax is payable.

In table 4 details of outward supplies made during the year with the break up of supplies made to B2B customers, B2C customers, SEZ units made with payment of tax, advances received on which tax is payable and invoice has not been issued and the credit notes issued to the above transactions are to be reported.

The supplies which are liable to be taxed under Reverse charge mechanism are also to be reported.

Table 5: Details of Outward and Inward supplies made during the Financial Year on which tax is not payable.

In table 5 details of outward supplies made to SEZ units, zero-rated sales on which tax is not payable is to be reported.

Note : Table 4 and Table 5 will be auto-populated from GSTR -1 and GSTR-1A

Table 6: Details of ITC for the financial year

Table 6A : Amount of ITC availed through form GSTR-3B – This is an auto populated figure from the filed GSTR-3B returns (being sum total of Table 4A of GSTR-3B).

The Gross value reported in GSTR-3B (i.e the value before reversals) are to being auto-populated in this column.

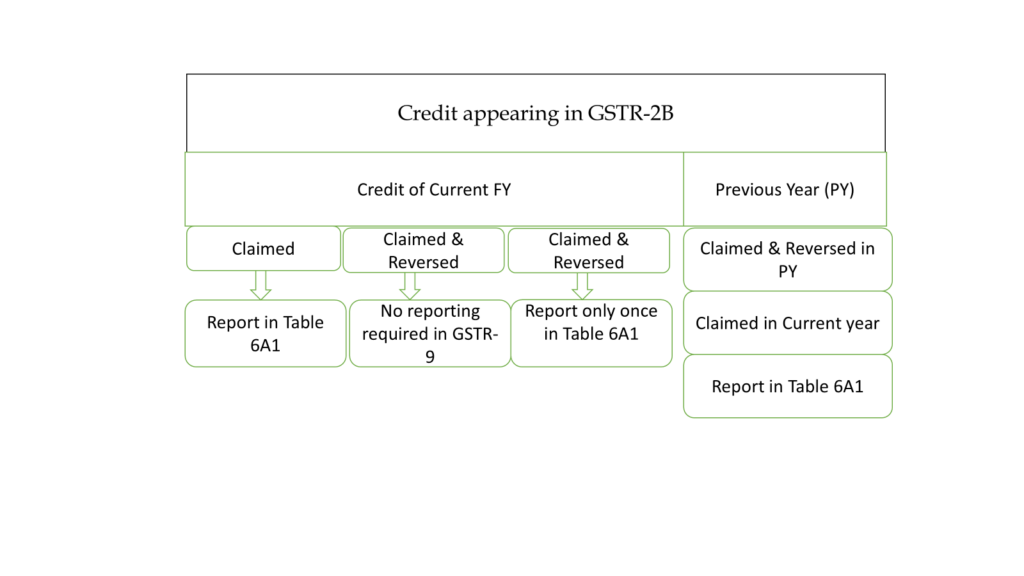

Table 6A1: ITC of any preceding financial year availed in this financial year (which is included in 6A above).

In this column taxpayers are required to report the ITC of previous year (i.e F.Y 23-24) claimed in the current financial year (i.e F.Y 24-25)

Table 6A2: Net ITC of the Financial year – This is an auto-populated figure

Note: Table 6A1 and 6A2 has been introduced from the current year.

Table 6B to 6E: Details of ITC availed in the current financial year are to be reported as inputs, input services and capital goods.

Table 6F: Import of services (excluding inward supplies from SEZs)

Table 6G: Input Tax credit received from ISD

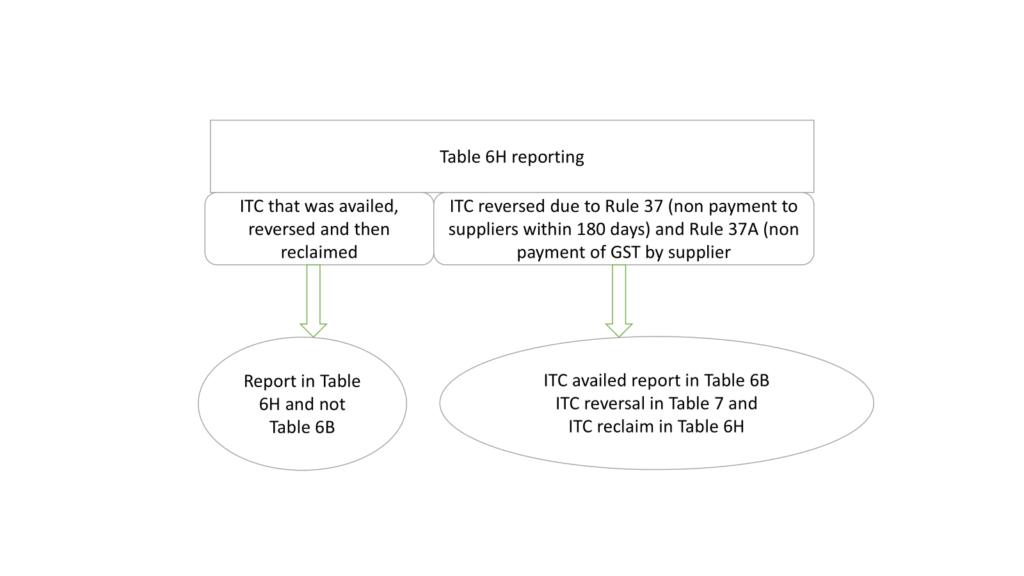

Table 6H: Amount of ITC reclaimed under the provisions of the Act

In this column ITC which was reclaimed in the current financial year is to be reported.

Table 6I: Sub-total (B to H above)

Table 6J: Difference (I – A2 above)

Table 6K: Transition Credit through TRAN-1 (including revisions if any)

Table 6L: Transition Credit through TRAN-2

Table 6M: ITC availed through ITC-01, ITC-02, and ITC-02A (other than GSTR-3B and TRAN Forms)

Table 6N: Sub-total (K to M above)

Table 6O: Total ITC availed (I + N above)

Table 7: Details of the ITC Reversed and Ineligible ITC for the financial year.

7A : As per Rule 37 – Reversal as per Rule 37 are to be reported here.

Rule 37 refers to non payment to creditors within 180 days time limit

7A1 : As per Rule 37A – Reversal as per Rule 37A are to be reported here.

Rule 37A refers to reversal of credit by the recipient before 30th November on account of non payment of tax by the supplier before 30th September of the next financial year.

7A2 : As per Rule 38 – Reversals as per Rule 38 are to be reported here.

Rule 38 – reversal of 50% credit for banking companies.

7B : As per Rule 39 – Reversals as per Rule 39 are to be reported here. This column is applicable to ISD suppliers

7C: As per Rule 42 – Reversals as per Rule 42 are to be reported here (Common Credit reversals and ITC relating to exempt supplies- Inputs and Input services)

7D: As per Rule 43 – Reversals as per Rule 42 are to be reported here (Common Credit reversals and ITC relating to exempt supplies-Capital goods)

7E: As per section 17(5) – Reversals as per section 17(5) are to be reported here (Ineligible / blocked credits)

7F : Reversal of TRAN-1 credit

7G: Reversal of TRAN-2 credit

7H1 : Other reversals

7I : Total ITC Reversed (Sum of A to H above)

7J : Net ITC Available for Utilization (6O – 7I)

Table 8: Details of ITC for the financial year

8A: ITC as per GSTR-2B [Table 3(I) thereof] – ITC of FY 24-25 reported in GSTR 2B(up to Oct 25 return due date) but does not include ITC of FY 23-24 reported in GSTR 2B of FY 24-25

8B: ITC as per sum total of 6(B) above – Only includes amounts reported in Table 6B.

8C: ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during the financial year but availed in the next financial year upto specified period – ITC of current financial year claimed in subsequent financial year within 30th November. This column does not include ITC claimed and reversed in FY 24-25 and reclaimed in FY 25-26

8D: Difference [A-(B+C)]

8E: ITC available but not availed

8F: ITC available but ineligible

8G: IGST paid on import of goods (including supplies from SEZ)

8H: IGST credit availed on import of goods (as per 6(E) above) in financial year

8H1: IGST Credit availed on Import of goods in next financial year

8I: Difference (G-H-H1)

8J: ITC available but not availed on import of goods (Equal to I)

8K: Total ITC to be lapsed in current financial year (E + F + J)

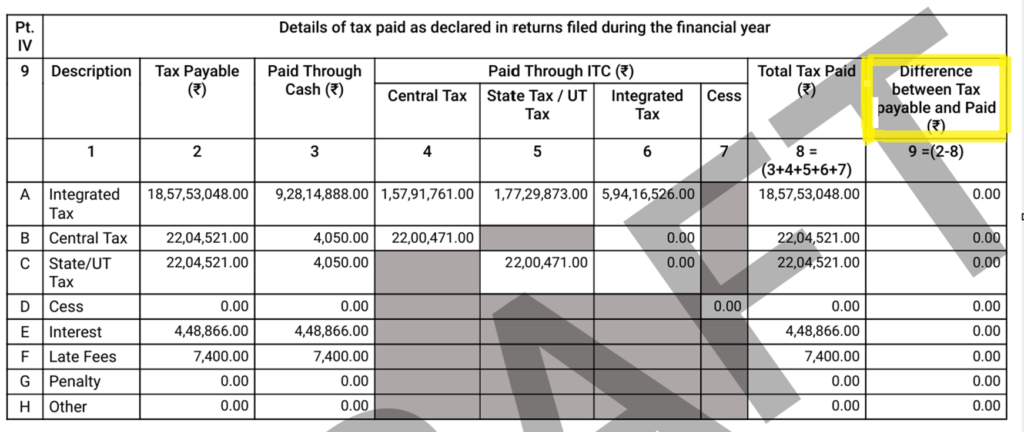

Table 9: Details of tax paid as declared in returns filed during the financial year

The details of tax payable and taxes paid is to be reported. A new column has been inserted which is the Difference between tax payable and tax paid.

Particulars of the transactions for the financial year declared in returns of the next financial year till the specified period

Table 10: Supplies / tax declared through Invoices / Debit Note / Amendments (+)

Table 11: Supplies / tax reduced through Amendments / Credit Notes (-)

Table 12: ITC of the financial year reversed in the next financial year (Mandatory from FY 24-25)

Table 13: ITC of the financial year availed in the next financial year (Mandatory from FY 24-25)

Note : Table 13 should consist of only ITC of FY 24-25 claimed late in FY 25-26 and ITC of FY 24-25 reversed (other than rule 37/37A) and reclaimed in FY 25-26.

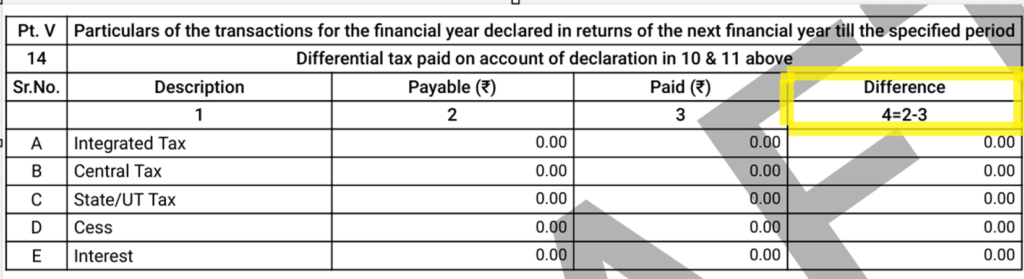

Table 14: Particulars of the transactions for the financial year declared in returns of the next financial year till the specified period – Being the differential tax paid on account of Table 10 & 11

A new column has been inserted which is the Difference between tax payable and tax paid.

Table 15: Particulars of Demands and Refunds

Table 16: Information on supplies received from composition taxpayers, deemed supply under section 143 and goods sent on approval basis

Table 17 : HSN Wise Summary of outward supplies – Optional for taxpayers having annual turnover up to ₹ 1.50 Cr and no B2B supply otherwise, mandatory to fill this table

- 6-digit HSN reporting for registered persons having aggregate turnover > Rs. 5 Crores

- 4-digit HSN reporting for registered persons having aggregate turnover < Rs. 5 Crores

Table 18: HSN Wise Summary of inward supplies.

Table 19: Late Fee payable & paid -Late fee will be payable if annual return is filed after the due date.

Conclusion

GSTR 9 (Annual Return) is a consolidation of the outward supplies and ITC claims made in the monthly returns. The Amendments inserted in FY 2024-25 GSTR 9 requires the taxpayers to report the details in their appropriate columns to avoid discrepancies.

Access the GST Portal

File GST returns, view notices & complete all GST tasks