The Ministry of Corporate Affairs (MCA), in a measure of further rationalisation, has amended the definition of a “Small Company” with effect from December 01, 2025. The revised definition provides new upper limit of Turnover and Paid up Capital for determination of a Small Company.

The Background

The definition of Small Company is defined under Section 2(85) of the Companies Act. As per the Act, the definition is as follows:

(85) “small company’’ means a company, other than a public company,—

(i) paid-up share capital of which does not exceed fifty lakh rupees or such higher amount as may be prescribed which shall not be more than ten crore rupees; and

(ii) turnover of which as per profit and loss account for the immediately preceding financial year does not exceed two crore rupees or such higher amount as may be prescribed which shall not be more than one hundred crore rupees:

Provided that nothing in this clause shall apply to—

(A) a holding company or a subsidiary company;

(B) a company registered under section 8; or

(C) a company or body corporate governed by any special Act

Section 2(85) of the Companies Act 2013 hard‑codes only the outer caps (paid‑up capital “not more than” Rs. 10 Crores and turnover “not more than” Rs. 100 Crores) and expressly allows “such higher amount as may be prescribed,” which is done via the Companies (Specification of Definition Details) Rules. This drafting technique delegates the power to prescribe and change operative limits to the Central Government by notification, instead of routing every change through Parliament.

The definition is structured through rules so that the Government can revise thresholds for paid‑up capital and turnover flexibly, without needing a formal amendment to the Act each time economic conditions change.

Using rules has allowed the MCA to revise the small‑company thresholds multiple times (for example in 2021, 2022 and 2025) to expand coverage of the definition and reduce compliance burden in line with “ease of doing business” objectives.

Small Company Definition

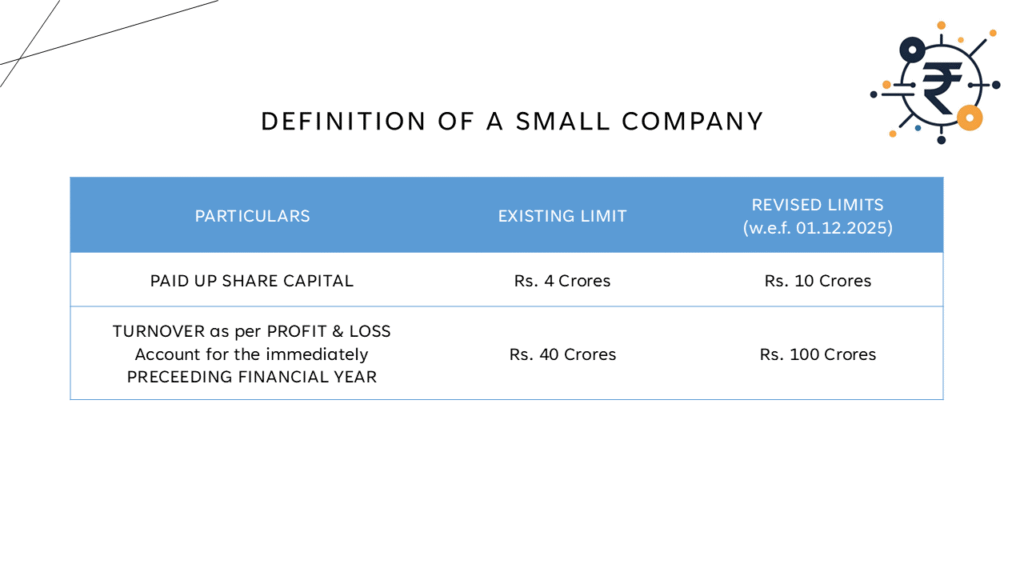

The definition of Small Companies is notified through Rule 2(t) of the Companies (Specification of Definition Details) Rules, 2014. The definition was previously amended in 2021 and 2022 to enhance the limits of the definition.

As per the latest amendment, the definition is now enhanced to the maximum limits specified under the Act.

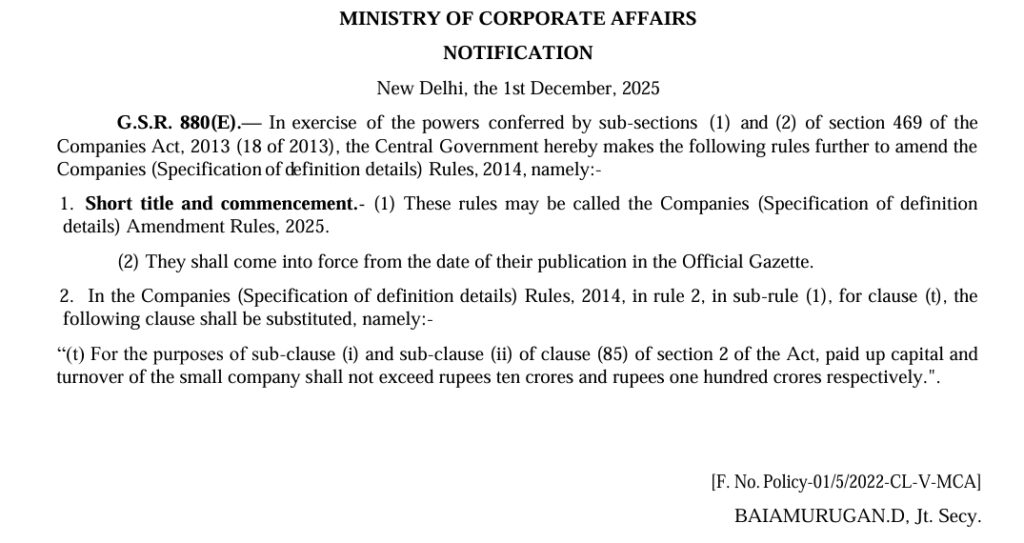

The amended Clause 2(t) reads as follows

For the purposes of sub-clause (i) and sub-clause (ii) of clause (85) of section 2 of the Act, paid up capital and turnover of the small company shall not exceed rupees ten crores and rupees one hundred crores respectively.

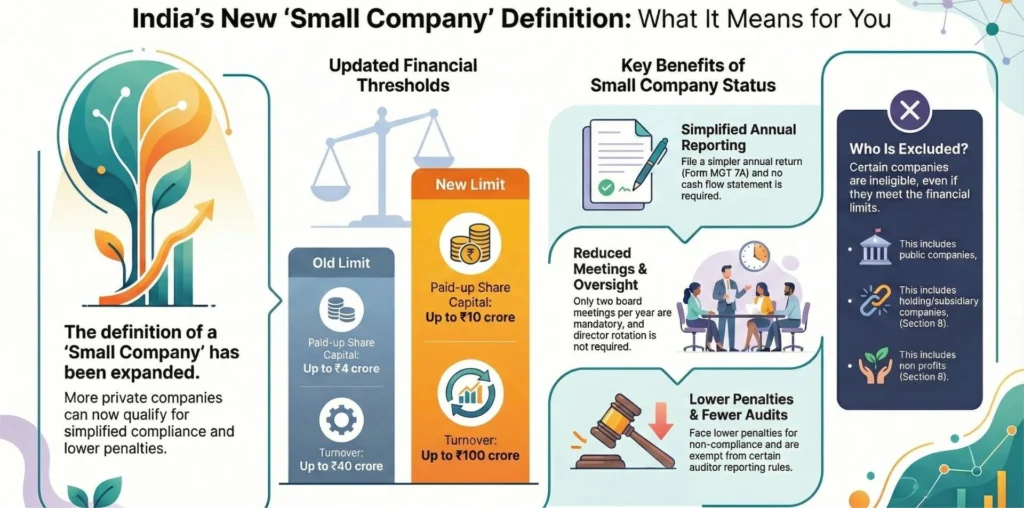

What Changes Now?

With the Enhancement in the Definition Limits, many companies now qualify as “Small Companies”. All these companies will get to enjoy the exemptions and relaxations available to the Small Companies.

| Particulars | Small Company | Other-than-Small Company |

|---|---|---|

| 1. Financial Statements (Sec 2(40)) | No need to include Cash Flow Statement | Cash Flow Statement mandatory |

| 2. Lesser Compliance Burden in Board Meetings (Sec 173) | Minimum 2 Board Meetings per year | Minimum 4 Board Meetings per year |

| 3. Annual Return Signing (Sec 92) | Can be signed by Company Secretary or Director | Must be signed by Company Secretary as per applicability; if no CS, then Director |

| 4. Internal Financial Controls Reporting (Sec 143 & 134) | No requirement to include IFC reporting | Mandatory IFC reporting |

| 5. Auditor Rotation (Sec 139) | Not applicable | Mandatory for certain class of companies |

| 6. CARO applicability | Not applicable | Applicable |

| 7. Auditor’s Report – Relevance of Internal Audit | Internal audit provisions generally not applicable | Applicable for prescribed class of companies |

| 8. Lesser Stringent Penalties (Sec 446B) | Lesser penalties for officer in default | Full penalties apply |

| 9. Filing of Annual Return (MGT-7A) | Simplified form MGT-7A | Full form MGT-7 |

| 10. Remuneration to Directors (Sec 197) | No need for special resolution for excess remuneration within ceiling | Stricter compliance |

whoah this blog iis excellent i love reading your posts.

Keep up the good work! You know, a lot of persons are looking round for this information, you can aid

them greatly.