GSTN has issued an advisory on 5th December 2025 for Auto suspension of GST Registration due to Non-Furnishing of Bank Account Details as per Rule 10A

What is Rule 10A

Rule 10A mentions about furnishing of the details of bank account in the common portal of Goods and Service Tax within 30 days or before furnishing of GSTR-1 or IFF as applicable.

The extract of Rule 10 of CGST Rules 2017 is reproduced hereunder:

After a certificate of registration in FORM GST REG-06 has been made available on the common portal and a Goods and Services Tax Identification Number has been assigned, the registered person, except those who have been granted registration under rule 12 or, as the case may be rule 16, shall 2[within a period of thirty days from the date of grant of registration, or before furnishing the details of outward supplies of goods or services or both under section 37 in FORM GSTR-1or using invoice furnishing facility, whichever is earlier, furnish information with respect to details of bank account on the common portal].

Updates issued by GSTN Advisory

| Requirement | Update |

|---|---|

| Furnish bank account details | Mandatory within 30 days or before filing GSTR-1/IFF |

| Consequence of delay | Automatic suspension of GST registration |

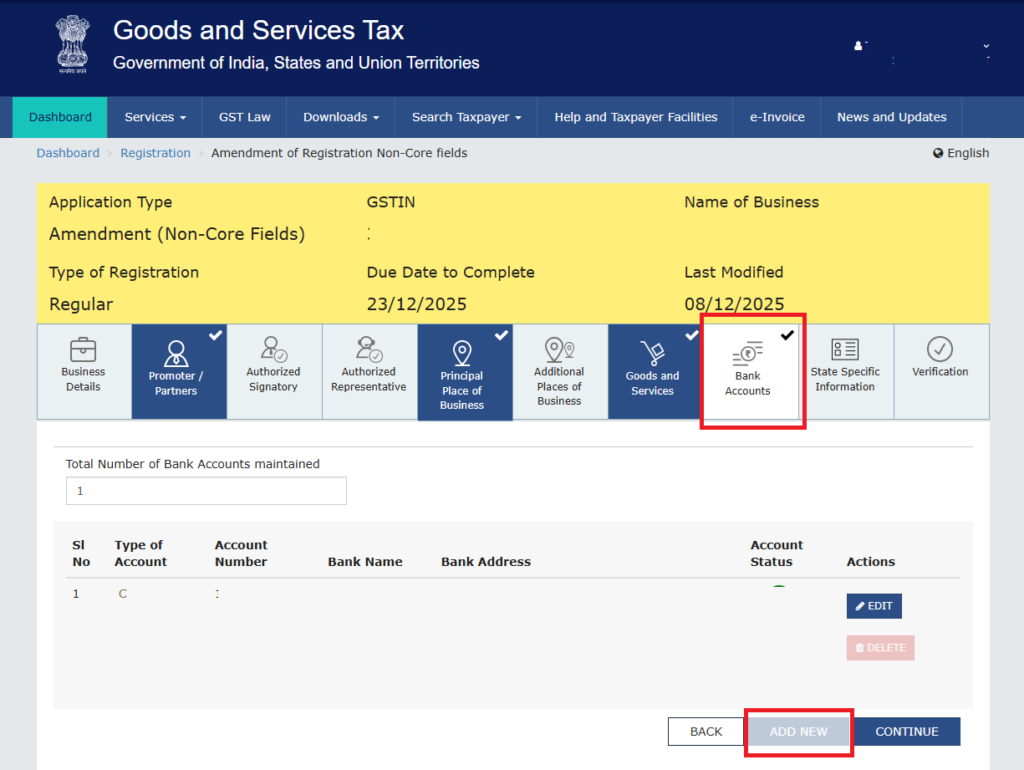

| How to update bank details | Through Non-Core Amendment of Registration |

| After updating details | Cancellation proceedings auto-dropped by GST system |

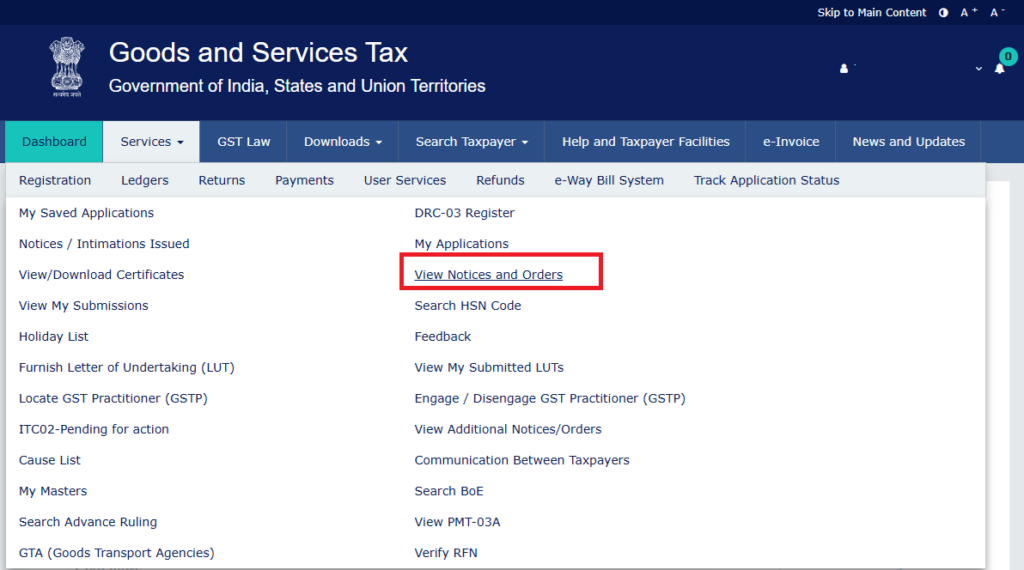

| Manual option | Use Initiate Drop Proceedings under Notices & Orders |

| Exempt categories | OIDAR & NRTP taxpayers (with exceptions) |

🥇

✨ Visit GST Blogs

Premium GST Updates

Explore our GST blogs crafted for professionals & businesses.