The Goods and Service Tax (GST) has issued a significant update on filing of GSTR-3B from the period November-2025 through its advisory issued on 5th December 2025.

Key Update in GSTR-3B

With the issuance of this advisory certain fields in GSTR-3B permanently becomes frozen while certain fields are editable.

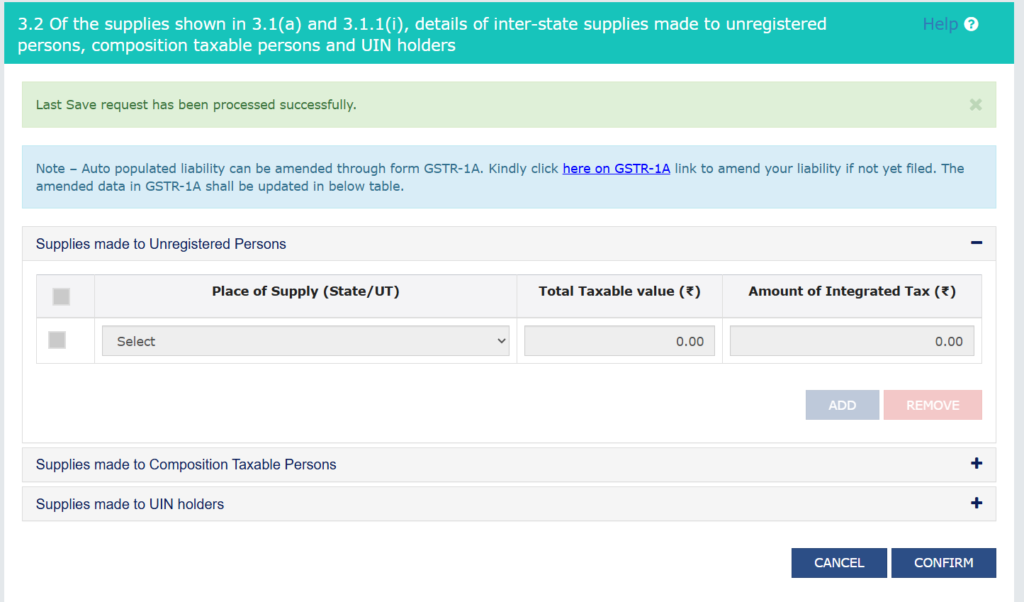

From November 2025 onwards value in Table 3.2

- Will be auto-populated from GSTR-1 / GSTR-1A/ IFF

- Non-editable.

What is hard locking of GSTR 3B

Hard locking of GSTR 3B refers to specific fields in GSTR 3B becomes non editable and are permanently locked by the system without allowing the taxpayers to modify the details in the Table.

The hard locking system does not allow the taxpayers to edit or modify the outward tax liability ensuring alignment with both GSTR 1/GSTR 1A and GSTR 3B.

Why was hard locking introduced

Hard locking was introduced to ensure the correctness of the outward supplies and to avoid discrepancies between GSTR 1 and GSTR 3B.

The hard locking system will also improve data accuracy by avoid fake invoicing, excess claim or incorrect claim of ITC by the recipients.

How to correct auto populated values

The auto populated values in GSTR 3B if any are to be modified can be done through filing GSTR 1A before filing GSTR 3B. The amendments made in GSTR 1A will be reflected in the GSTR 3B for the said month.

Advisory issued by GSTN

Advisory issued by GSTN is as follows:

- Table 3.2 of Form GSTR-3B captures the inter-state supplies made to unregistered persons, composition taxpayers, and UIN holders out of the total supplies declared in Table 3.1 & 3.1.1 of GSTR-3B and is auto-populated from corresponding supplies declared in GSTR-1, GSTR-1A, and IFF in the requisite tables.

- It is to inform you that from November-2025 tax period onwards, value of supplies auto-populated in Table 3.2 of GSTR-3B from the returns/forms mentioned above, shall be made non-editable. The GSTR-3B shall be filed henceforth with the system generated auto-populated values only in table 3.2.

- Further, in case any modification/amendment is required in the auto-populated values of Table 3.2 of GSTR-3B, then the same can be done through GSTR-1A for the same tax period. The values thus reported in GSTR-1A shall change the auto-populated values of table 3.2 in GSTR-3B instantly and the taxpayers can file their GSTR-3B with the updated values. Moreover, the amendment of such supplies can always be reported in Form GSTR-1/IFF filed for subsequent tax periods.

- To ensure that GSTR-3B is filed accurately with the correct values with no hassle of frequent amendments, it is advised to report the correct values in GSTR-1, GSTR-1A, or IFF. This will ensure the auto-populated values in Table 3.2 of GSTR-3B are accurate and compliant with GST regulations.

FAQ’s issued by GSTN

- What are the recent changes related to reporting supplies in Table 3.2?Starting from the November 2025 tax period, the auto-populated values in Table 3.2 of GSTR-3B for inter-state supplies made to unregistered persons, composition taxpayers, and UIN holders will be non-editable, and taxpayers will need to file their GSTR-3B with the system-generated auto-populated values only.

- How can I rectify values in Table 3.2 of GSTR-3B if incorrect values have been auto-populated after November 2025 period onwards due to incorrect reporting of the same through GSTR-1?If incorrect values are auto-populated in Table 3.2 after November 2025, then the taxpayers need to correct the values by making amendments through Form GSTR-1A for the same tax period. The values thus reported in GSTR-1A shall change the auto-populated values of table 3.2 in GSTR-3B instantly and the taxpayers can file their GSTR-3B with the updated values.

Moreover, the amendment of such supplies can always be reported in Form GSTR-1/IFF filed for subsequent tax periods. - What should I do to ensure accurate reporting in Table 3.2 of GSTR-3B?Taxpayers should ensure that their supplies are reported correctly in their GSTR-1, GSTR-1A, or IFF. It is advised to review the draft GSTR-1 or GSTR-1A before filing so that any mistakes in the statement can be corrected therein. This will ensure that the accurate values are auto-populated in Table 3.2 of GSTR-3B.

- Till what time/date I can amend values furnished in GSTR-1 through Form GSTR-1A?As there is no cut-off date for filing Form GSTR-1A before GSTR-3B which means Form GSTR-1A can be filed after filing Form GSTR-1 and till the time of filing Form GSTR-3B. Hence, any amendment required in auto-populated values of table 3.2, same can be carried out through Form GSTR-1A till the moment of filing of GSTR 3B. Advisor issued by GSTN with regard to Form GSTR 1A can be be accessed from here.

Facing Issues Due to Hard Locking of GSTR-3B?

Hard locking of GSTR-3B can result in blocked amendments, mismatches, notices, and penalties. Our expert-led GST services help you stay compliant and resolve issues efficiently.

✔ GST Returns Review & Rectification

Detailed verification of returns, ITC mismatches, and corrective guidance.

✔ GST Notice Handling

Drafting and filing professional replies to GST notices.

✔ End-to-End GST Compliance

Monthly returns, annual returns, reconciliation, and advisory support.