It is a pleasant morning in the month of May! You withdraw Rs. 1,000/- from your bank account through an ATM and Alas!!!! Your account gets debited by Rs. 1,023/- and you think it may be an error. But no. That is how it is going to be! Perplexed? Read on

ATM charges hiked! This is the trending topic of discussion for almost two days now. But what has actually changed? To know that you must first understand what are the ATM charges.

ATM: A brief History

Automated Teller Machines (ATMs) have revolutionised banking in India, with their introduction marking a milestone in financial accessibility. The first ATM was installed by the Hong Kong and Shanghai Banking Corporation (HSBC) in Mumbai on June 27, 1987. The ATMs allowed customers to withdraw cash from their bank account, without having to physically visiting the bank, making it easier for the common man to avoid queues in this fast paced world. India noticed this technology two decades later than the rest of the world had adopted it. By 1999, there were over 1,500 ATMs across the country, and the banking industry saw exponential growth after that.

According to the latest RBI estimates, there are around 2,19,000 Automated Teller Machines (ATMs) operating in India. In spite of the growth of Cashless payment options like the UPI, ATMs still thrive to operate. However, as per recent reports, Banks in India are reportedly reducing the number of ATMs in operation to curtail high cash circulation and promote a digital cashless economy.

ATM Charges

Why ATM Charges?

Banks in India impose ATM charges primarily to cover the costs of operating and maintaining ATM infrastructure. These charges help banks recover expenses like:

- Cash replenishment

- Security and surveillance

- ATM maintenance and software

- Interchange fees (paid when you use another bank’s ATM)

Further the following are also to be considered when discussing why banks charge ATM related charges.

- Infrastructure Cost: Setting up and maintaining ATMs is expensive. It includes rent, power, maintenance, and security.

- Inter-Bank Transactions: If you use another bank’s ATM, your bank pays a fee to the ATM-owning bank (interchange fee). This is passed on to the customer after a free limit.

- Regulatory Guidelines: The RBI (Reserve Bank of India) allows limited free transactions, and charges can be levied beyond that.

What are the Types of Charges?

Different banks charges various kinds of charges. Some of those charges are as follows.

- Transaction Charges – charged for exceeding certain transaction limit

- Declining Fee – charged for declined transactions (on account of insufficient balance)

- Annual Maintenance Charges – Charged for holding the Debit Card

- International Withdrawal Charges – Charged for using the withdrawal services overseas

- Other Charges – some banks even charge for non-financial transactions like balance enquiry, mini statement etc

ATM Charges Hiked?

The Reserve Bank vide amendment to circular no. RBI/2021-22/52 on 28th March, 2025, has permitted banks to increase charges on ATM cash withdrawals beyond the free monthly usage by 2 rupees, raising the fee to 23 rupees per transaction from 1 May.

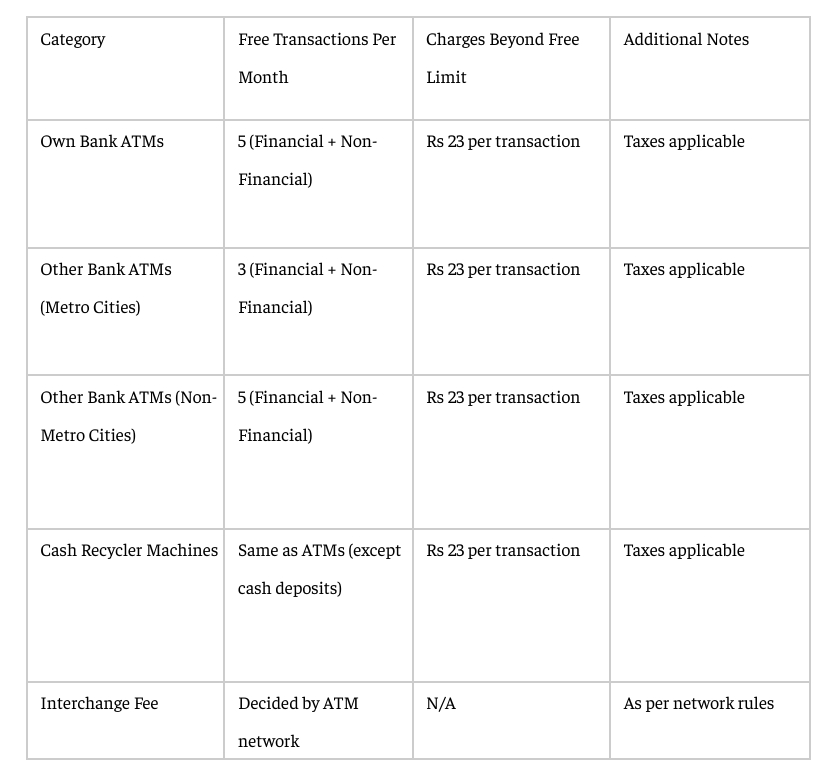

As per the latest amendments, customers are entitled to five free transactions (inclusive of financial and non-financial transactions) per month from their own bank’s Automated Teller Machines (ATMs). They are also eligible for free transactions from other banks’ ATMs- three transactions in metro centres and five in non-metro centres.

“Beyond the free transactions, a customer may be charged a maximum fee of 23 rupees per transaction. This shall be effective from 1 May 2025, the RBI stated in a circular. Currently, banks are allowed to charge 21 rupees per transaction after a customer has exhausted the free transaction limit.

🔗Access the amended circular from here.

Conclusion

The news that ATM Charges hiked, though might seem to be a panicking content, in essence, it is a minor increase over the existing charges to improve recovery of expenses for the banks providing the ATM services. This could mean increase of banks’ revenue for even better administration and maintenance for enhancement of services