Introduction

Planning to buy a property worth more than ₹50 lakhs? Before you hand over the cheque, there’s a tax compliance you must not miss — Form 26QB.

It’s a TDS return-cum-challan that buyers must file when deducting 1% TDS on property purchases.

In this article, we’ll walk you through how to file Form 26QB, with real examples, common mistakes to avoid, and practical tips that can save you from unwanted notices and penalties.

✅ What is Form 26QB?

Form 26QB is a challan-cum-statement that must be filed by the buyer of an immovable property when:

- Property value exceeds ₹50 lakhs

- TDS of 1% must be deducted under Section 194-IA

- Must be filed within 30 days from the date of payment or credit

It covers both residential and commercial property purchases but not agricultural land.

✅ Who files it? The Buyer of the Property.

✅ TDS Rate: 1% on sale consideration.

📅 Due Date for Filing Form 26QB

| Action | Due Date |

|---|---|

| Deduct TDS | At the time of payment/credit |

| File Form 26QB | Within 30 days from the end of the month in which tax is deducted. |

| Issue Form 16B (TDS Certificate) | Within 15 days from filing 26QB |

📝 Step-by-Step Guide to File Form 26QB

Step 1: Go to the E-Filing Portal of the Income Tax Department

- Visit the Income Tax E-Filing Portal.

- Unlike other tax payments, TDS on Property Sale cannot be paid from the pre-login screen.

- To file form 26QB, you must definitely be logged into the the e-filing portal.

Step 2: Fill in the Details

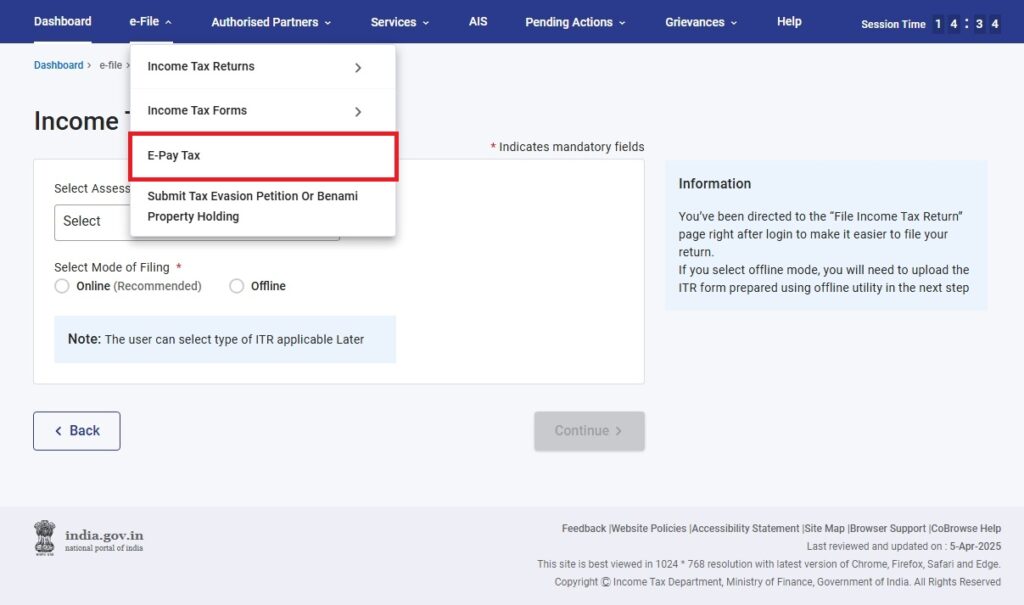

- After Logging in Select E-File -> E-pay Tax

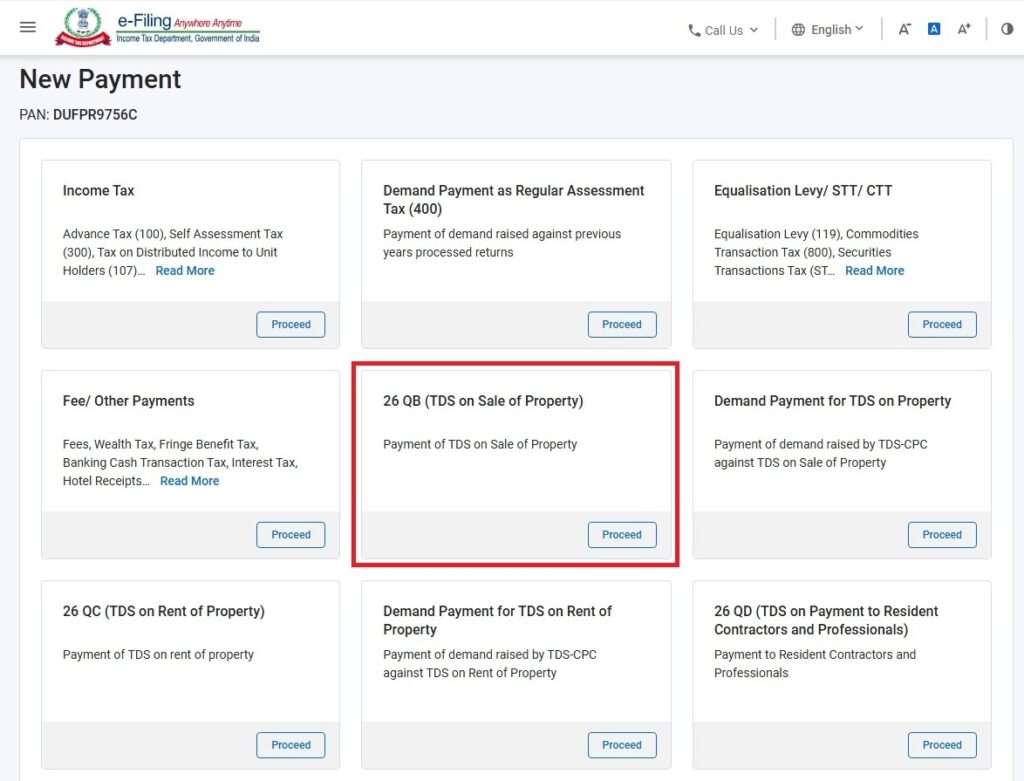

- Click on “New Payment“

- Select “26 QB (TDS on Sale of Property)“

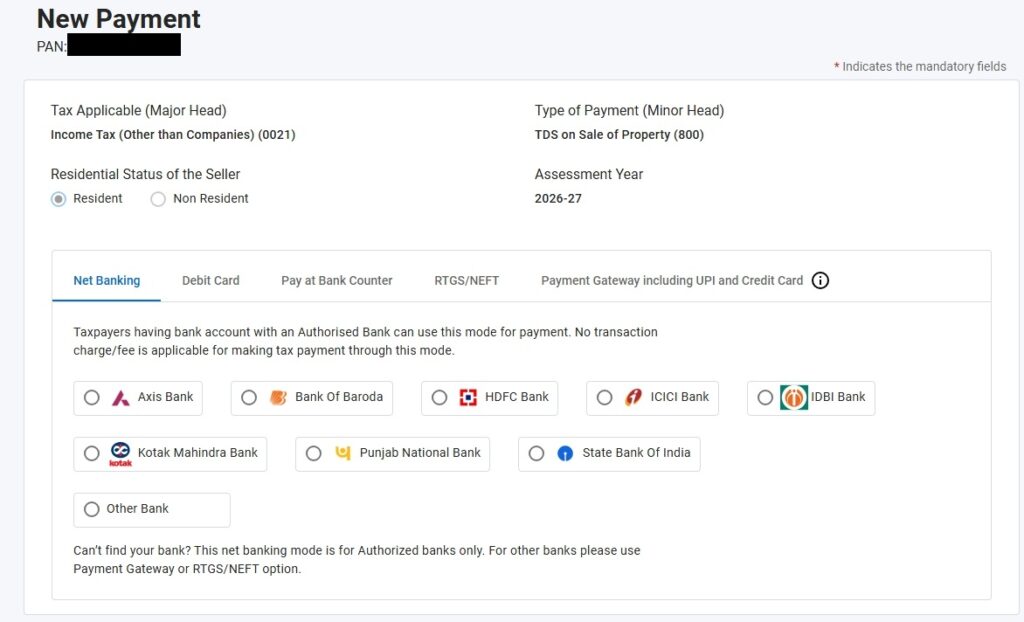

- Select the “Residential Status” of the Seller

- Enter the following details

- PAN of Seller

- Address of Property

- Nature of Property (Land/Building)

- Sale consideration amount

- Stamp Duty Value of the Property

- Date of agreement

- Date of Payment to Seller

- Date of Tax Deduction

- Amount paid

- TDS amount (1%)

- Interest and Late Fee, if any

- Whether the Payment is in Lumpsum/Installments.

- After entering the details , Click on Continue

🛑 Note: Enter the exact proper deduction and payment dates to avoid mismatch issues.

Step 3: Select Payment Type

- Select the mode of payment

- List of banks available for e-payment can be accessed here.

- Debit Card payment can be used for account holders of Following Banks

- Canara Bank

- ICICI Bank

- Indian Bank

- Punjab National Bank

- State Bank of India

- Pay at counter option is also available to generate a challan and to be remitted at the bank counter.

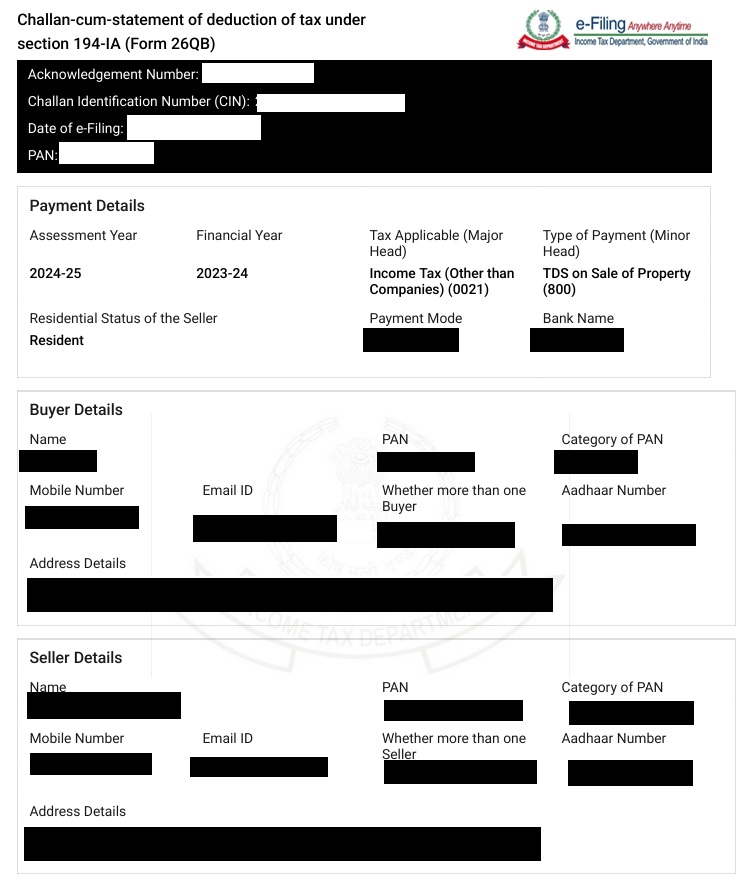

Step 4: Submit the Form and Download Acknowledgement

- After Successful Payment, Download Receipt

- The receipt will act as the Tax Challan

- Download the filed form also

- The downloaded form is the statement of tax deducted

Step 5: Download Form 16B

- Register at TRACES portal

- Download Form 16B, the TDS certificate, and issue it to the seller

❗ Common Practical Difficulties with Form 26QB

⚠️ 1. Multiple Buyers or Sellers – Filing Complexity

Problem: Each buyer-seller combination requires a separate Form 26QB

Solution:

- For 2 buyers and 2 sellers, you must file 4 forms

- The payments must be proportionately specified so that TDS mismatch can be avoided

⚠️ 2. Delay in Filing – Penalties Apply!

- ₹200 per day under Section 234E

- Penalty of up to ₹10,000 under Section 271H

- Interest @ 1% per month for late deduction

- Interest @ 1.5% per month for late deposit

💡 Example Scenario

Situation:

Ms. Priya buys a flat from Mr. Ramesh for ₹65,00,000 on 10th April 2024. She pays the entire amount on 25th April.

- Sale Price: ₹65,00,000

- TDS @1%: ₹65,000

- Buyer PAN: ABCDE1234F

- Seller PAN: RSTUV5678G

- Payment Mode: Online via Net Banking

Filing Deadline: 30th May 2024

TDS Certificate (Form 16B): Must be issued by 14th June 2024

🛡️ Tips to Avoid Issues While Filing Form 26QB

- Ensure PAN of buyer and seller are correct and valid

- Don’t delay filing even if registration is postponed

- If installment-based payment, file separate 26QB for each payment

- Avoid using ampersands (&) or special characters in name fields

✅ Conclusion

Filing Form 26QB is a one-time yet critical compliance step in any high-value property transaction. Failing to file it correctly or on time can lead to hefty penalties and notices from the tax department. With a little attention to detail and timely action, you can effortlessly manage your TDS compliance while buying property.