Every taxpayer who has been opted to pay the Goods and Service Tax (GST) under Composition Scheme are required to file a Quarterly Return. Quarterly return is to be filed in Form GST CMP-08. In this post I will take you through how to file Form GST CMP-08 in detail.

Introduction to Form GST CMP-08

Form GST CMP-08 is used to declare the details or summary of self-assessed tax which is payable for a given quarter by taxpayers who are registered as composition taxable person or taxpayer who have opted for composition levy.

Taxpayers who either have registered as composition taxable person through Form GST REG-01 or taxpayers who have opted for composition levy through Form GST CMP-02, need to file Form GST CMP-08.

Due Date for filing Form GST CMP-08 is 18th of the month succeeding the quarter.

Step by Step Guide on How to file Form GST CMP-08

Step 1 : Login to the GST Portal using the valid login credentials.

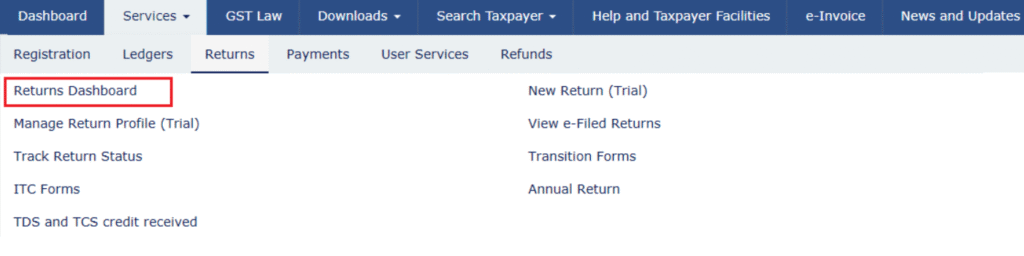

Step 2 : Navigate to Services > Returns > Returns Dashboard.

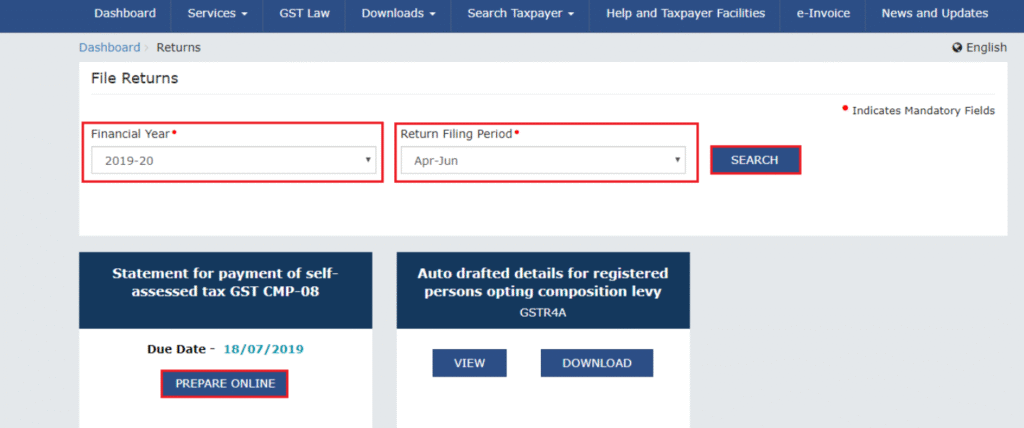

Step 3 : Select the Financial Year and the Quarter for which the return is to be filed. Then select the search button to process the year and quarter. After that Select the Statement for payment of Self-assessed tax GST CMP-08.

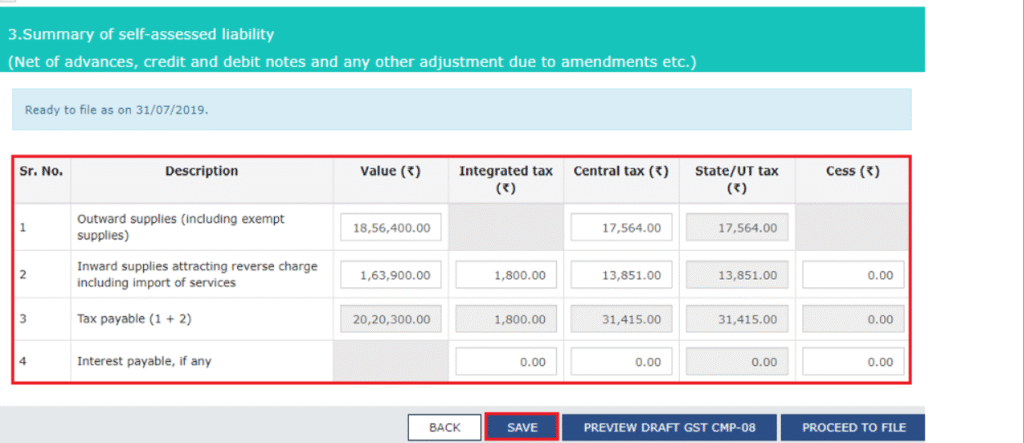

Step 4 : Fill the details in Table 3 of the Form and click on the save button. After saving the details a message will be displayed with Save request is accepted successfully.

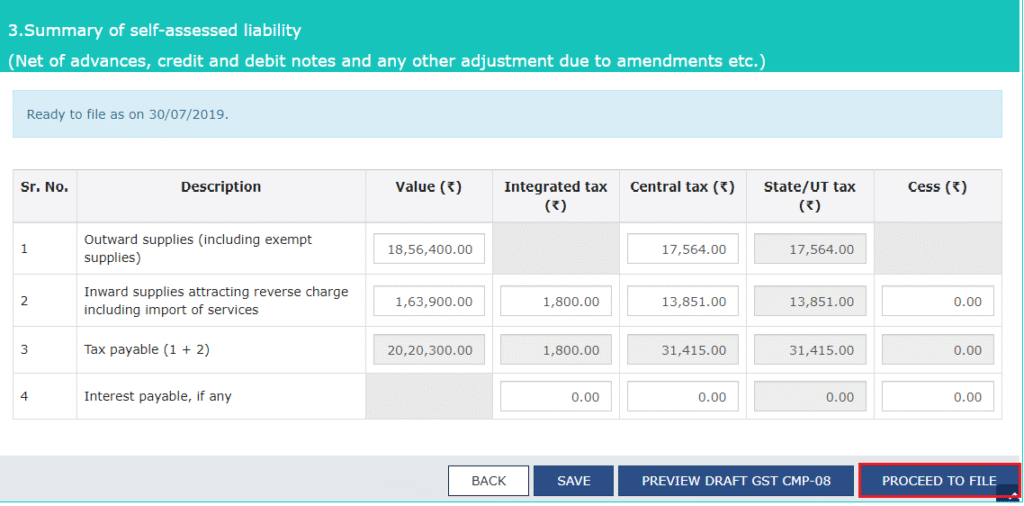

Step 5 : After saving the details click on Preview Draft GST CMP-08 to preview the details filled in the return. Then click on Proceed to File.

A message will be displayed stating that Compute Liabilities request has been received, please check status in sometime.

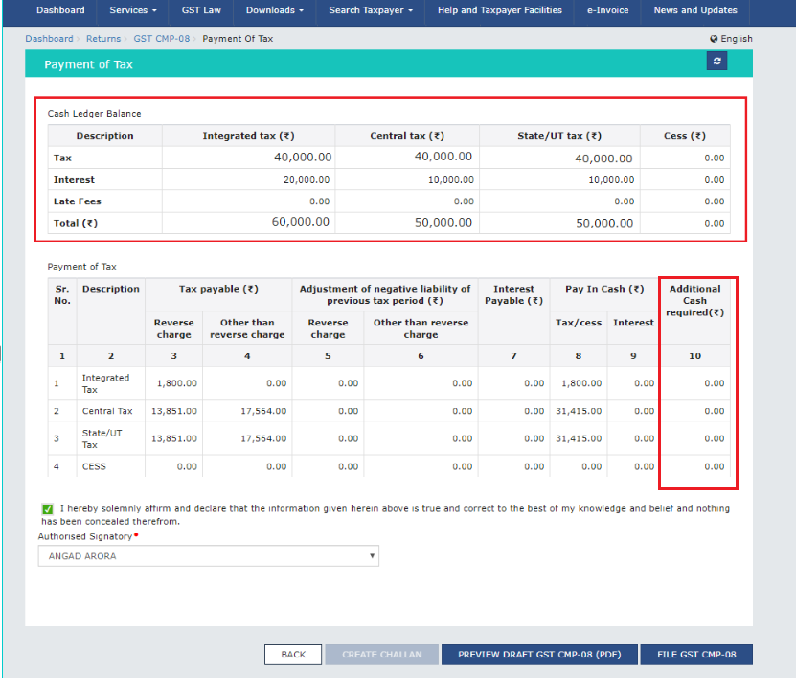

Step 6 : The next page is Payment of Taxes.

Note : The available cash ledger balance will be displayed in the payment of taxes.

- If cash balance is available in the Electronic Cash Ledger more than the tax liability payable no cash is required to be added and can be proceeded with the further steps.

- If there is no cash balance or inadequate cash balance is available in the Electronic Cash Ledger add the required amount by clicking on Create challan to make the payment and to set off the tax liability.

Before filing the return ensure that the additional cash required has become NIL (Zero)

🔗Related Content

How to make payment in GST Portal

Step 7 : After the payment of tax, click on the preview button, the form will be displayed in a PDF format. The next step is to click on the declaration and select the Authorised Signatory from the drop down menu.

Step 8 : Click on File GST CMP-08. Then a warning message will be displayed for offsetting the tax liability. Click on Yes button to proceed further.

Step 9 : This is the last step for submitting the application. Submit the application by clicking either of the option.

- File with DSC

- File with EVC

- File with STAK

In case of NIL Return

In case of NIL GST CMP-08 is required to be filed select the checkbox for File Nil GST CMP-08. On clicking the checkbox the following details will be displayed:

- Not made any outward supply (commonly known as sales); AND

- Not have any liability due to reverse charge (including import of services); AND

- Do not have any other tax liability.

The next step will be to file the Form as stated from Step 7 to Step 9 mentioned above.

NIL Return through SMS

The steps to file NIL CMP-08 through SMS are as under:

Step 1 :Send SMS to 14409 number to file Nil Form CMP-08. Format of the SMS is NIL space<Return Type>space<GSTIN>space<Return Period>.

Step 2 :After receiving the SMS GST portal will check for validations.

Note:

- If validations for filing Nil Form CMP-08 are satisfied, you will receive a “Verification CODE” on the same mobile number from which you have sent the SMS to complete the filing process.

- If validations for Nil filing are not satisfied, you will receive appropriate response/ error message on the same mobile number from which you have sent the SMS.

Verification Code is usable only once and will expire within 30 minutes. Please do not share it with anyone.

Step 3 :Send SMS again on the same number 14409 with Verification Code to confirm filing of Nil Form CMP-08. Format of the SMS to be send is CNF space<Return Type>space<Code>

Note: Taxpayers are required to compose a new text message to send it to 14409.

Step 4 : After successful validation of “Verification Code”, GST Portal will send back ARN to same mobile number and on registered e-mail ID of the taxpayer to intimate successful Nil filing of Form CMP-08.

The draft form is enclosed hereunder:

Form-CMP-08🔗Suggested Contents:

Understanding the Composition Scheme under GST: Entry, Forms, and Returns

Unveiling the process of GST Refunds

A deep analysis of the Invoice Management System (IMS), 2025