Introduction

Who can become an Independent Director? How to become an Independent Director? Why to become an Independent Director?

Becoming an Independent Director (ID) in India is a prestigious and impactful career move for professionals aiming to contribute to corporate governance. With the evolving regulatory landscape under the Companies Act, 2013, and allied rules, the role of an Independent Director has gained significant importance in ensuring transparency and accountability in Indian companies. This step-by-step guide, updated for 2025, will walk you through the eligibility criteria, legal provisions, registration process, and practical tips to succeed in this role—perfect for professionals, tax students, and aspiring directors.

Who is an Independent Director?

An Independent Director is a non-executive director on a company’s board who does not have any material or financial relationship with the company, its promoters, or management. As per Section 149(6) of the Companies Act, 2013, they are appointed to provide unbiased oversight, protect stakeholder interests, and enhance corporate governance.

In 2025, the demand for skilled Independent Directors continues to rise as companies align with stricter compliance norms and global best practices.

How to Become an Independent Director -> Step-by-Step Guide

Step 1: Understand the Eligibility Criteria

To qualify as an Independent Director under the Companies Act, 2013, you must meet specific criteria outlined in Section 149(6). Here’s what you need to know:

- Integrity and Expertise: You must possess relevant experience, expertise, and a reputation for integrity.

- No Conflicts of Interest: You should not be a promoter, employee, or have any pecuniary relationship with the company or its subsidiaries (except sitting fees or remuneration as allowed under the Act).

- Age and Tenure: There’s no specific age limit, but the maximum tenure is two consecutive terms of 5 years each (Section 149(10)), with a cooling-off period of 3 years before reappointment.

- Qualifications: While no mandatory academic qualification is specified, practical knowledge in finance, law, management, or taxation is highly valued.

Pro Tip: Tax students or professionals with a background in auditing, compliance, or corporate law have an edge due to their understanding of regulatory frameworks

Step 2: Register with the Independent Directors Databank

The Companies (Appointment and Qualification of Directors) Rules, 2014, amended in 2019, mandate that aspiring Independent Directors register with the Indian Institute of Corporate Affairs (IICA) Databank. Here’s how:

- Visit the MCA Portal: Go to www.mca.gov.in or the IICA Databank portal at IICA.

- Create an Account: Use your PAN and mobile number to sign up.

- Complete the Proficiency Test: If you have less than 10 years of relevant experience, you must pass an online proficiency self-assessment test within 2 years of registration (Rule 6(4)). The test covers company law, securities law, and governance principles.

- Pay the Fee: The registration fee is approximately ₹5,900 (check the portal for updates).

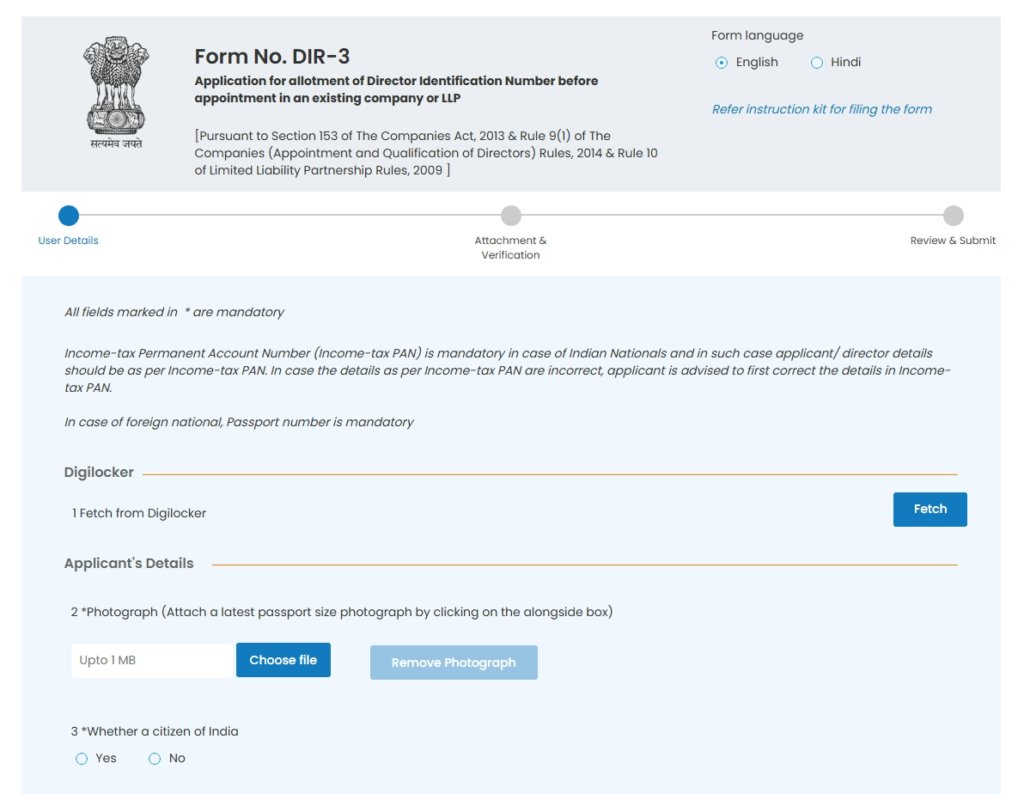

Step 3: Obtain a Director Identification Number (DIN)

Every director in India, including Independent Directors, must have a Director Identification Number (DIN) as per Section 153 of the Companies Act, 2013. Here’s how to get it:

- File Form DIR-3: Submit the e-form DIR-3 on the MCA portal with your PAN, Aadhaar, and other personal details.

- Verification: Attach a passport-sized photo, proof of identity, and address proof. The form must be certified by a practicing CA/CS/CMA.

- Fee: Pay ₹500 (subject to change).

Once approved, your DIN will be linked to your Databank profile.

Note: You will need a valid MCA v3 login to submit Form DIR-3

Step 4: Build Relevant Skills and Experience

While the Companies Act doesn’t mandate specific qualifications, companies prefer Independent Directors with:

- Industry Knowledge: Expertise in the company’s sector (e.g., IT, manufacturing, finance).

- Governance Skills: Understanding of risk management, compliance, and ethical standards.

- Networking: A strong professional network enhances your visibility to companies seeking IDs.

Consider enrolling in IICA’s certification programs, such as the Startup Board Certification Program, to sharpen your skills.

Step 5: Get Appointed by a Company

Under Section 149(4), certain companies (listed companies and public companies meeting specific thresholds) must appoint Independent Directors. The process includes:

- Nomination: The company’s Nomination and Remuneration Committee identifies suitable candidates from the IICA Databank.

- Board Approval: The board approves your appointment, followed by shareholder consent at the Annual General Meeting (AGM).

- Form DIR-12: The company files this form with the MCA to formalize your appointment.

Practical Tips for Success in 2025

- Stay Updated: Monitor MCA notifications (e.g., MCA E-Book) for the latest rules.

- Leverage Technology: Familiarize yourself with the MCA-21 portal for seamless filings.

- Network: Attend corporate governance seminars or join platforms like IICA to connect with companies.

Conclusion

Becoming an Independent Director in India in 2025 is a rewarding journey that combines legal compliance, professional expertise, and a commitment to governance. By meeting the eligibility criteria, registering with the IICA Databank, obtaining a DIN, and building your skills, you can position yourself as a valuable asset to Indian companies. Whether you’re a tax student or a seasoned professional, this role offers a unique opportunity to shape corporate India.

Ready to take the first step? Visit the MCA portal today and kickstart your journey!

Hello,

Thanks for the detailed explaination of ID.

I need guidance to take this up.

I am a professional having more than 30 years of experience in various sectors.

Currently based at Dar es Salaam, Tanzania working as COO with a group of company having diversified business interests, from mining chemicals to lab reagents, automobiles, transport and clearing & forwarding.

I am very keen to opt for the ID opportunity. Can you suggest the books or other material to sharpen the specific skills required for an ID.

Thanks.

Jitesh

Hello Mr. Jitesh,

Thank you for your kind words, and we truly appreciate you taking the time to share your background. With such a rich and diverse professional experience, you’re certainly well-positioned to explore Independent Director opportunities.

To sharpen your skills specifically for the role of an Independent Director, here are a few resources and recommendations:

Books:

1. The Independent Director: The Non-Executive Director’s Guide to Effective Board Presence by Gerry Brown & Andrew Kakabadse

2. Corporate Governance: Principles, Policies and Practices by A.C. Fernando

3. Boards That Lead by Ram Charan, Dennis Carey, and Michael Useem

Also, Independent Directors’ Databank (https://www.independentdirectorsdatabank.in/) has some online resources for improving skills.

Specific areas you might want to focus may include

1. Corporate governance & SEBI LODR norms

2. Boardroom dynamics & stakeholder management

3. Risk management & ESG integration

4. Financial literacy for board decisions

We’d be happy to guide you further if you need help navigating any of these resources. Wishing you great success on your journey toward board leadership!

Warm regards,

Team TaxRoutine

I would suggest you “Boards That Deliver: Advancing Corporate Governance from Compliance to Competitive Advantage” by Ram Charan. This is a book that focuses on how effective boards operate beyond compliance, offering real-world insights into decision-making and performance improvement.

Hi All,

I am Chartered Accountant with 38 years vast experience in working with manufacturing industry. Now with rich experience in various positions in Corporate field, I want to contribute my vast experience with industry as a role of Independent Director. This site has gives valuable inputs to move forward.

Thx