Table of Contents

Introduction

Invoice Management system (IMS) was introduced in the GST portal with effect from 1st October 2024. This system was introduced to streamline the input tax credits to be availed by the recipient and to avoid claim of fake input tax credits.

Acceptance of Invoice Management system has been mandatory from 1st April 2025 in the GST Portal.

What is Invoice Management System (IMS)

Invoice Management System is a facility in GST system, where the invoices/records saved/filed by the supplier in GSTR-1/1A/IFF, can be accepted, rejected or kept pending by recipients in order to correctly avail ITC.

Need for IMS

Invoice Management system was introduced by the GST department to help the taxpayers to:

- Streamline the availment of Input Tax credit by the recipients.

- To reduce the mismatch between GSTR 2B and GSTR 3B

- To accept or reject the credit notes issued by the supplier to recipient.

How to access IMS window

To access the IMS window, the taxpayers can follow the following steps:

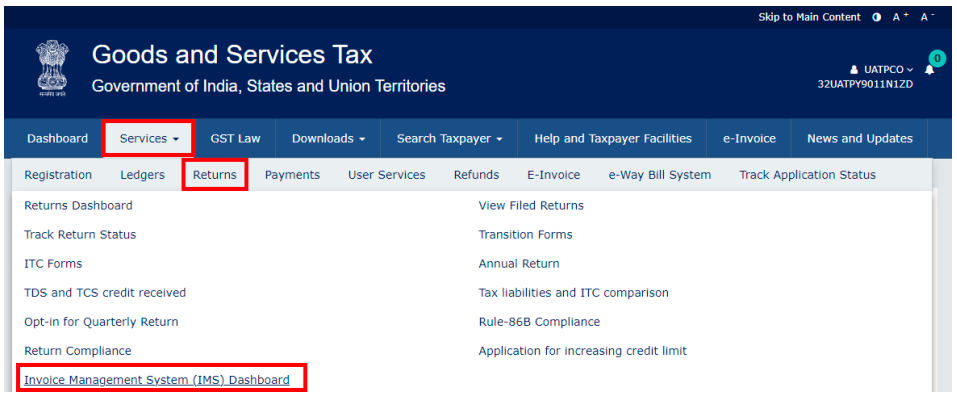

First taxpayers have to login to their GST portal > then navigate to Services Tab > Returns > Invoice Management System (Dashboard).

When will IMS be generated?

IMS will be available from 14th of the Subsequent month for which return is being filed.

For example: if the taxpayer is filing return for the month of March 2025, IMS will be available from 14th April for acceptance by the taxpayers.

If the taxpayer has not filed GSTR 3B for the previous month GSTR 2B will not be generated even after accepting the invoices in the IMS dashboard.

What are the actions available under the IMS dashboard:

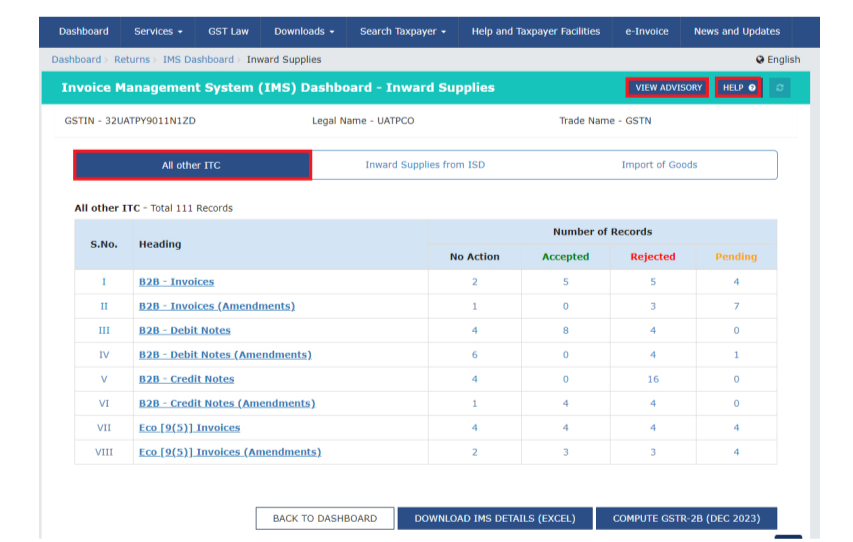

For B2B and B2BA the following actions are available:

- Accept – Taxpayer can accept the credit if the invoice belongs to him. The accepted invoices will become part of the “ITC available” section of GSTR 2B and will be auto-populated in GSTR 3B of Table 4.

- Reject – Taxpayer can reject the credit if the invoice does not belong to him. The rejected invoices will become part of the “ITC rejected” section of the GSTR 2B. Input Credits which are rejected will not be auto populated in the GSTR 3B.

- Pending – Taxpayer can withheld the credit if either the taxpayer does not know whether it is his credit or not or the taxpayer has not received the invoice. The invoices which are kept under pending will either not get reflected in GSTR 2B or will not be auto populated in the GSTR 3B. These invoices will remain in the IMS dashboard until further action is taken by the taxpayer.

For the following invoices only the option of accept or reject are available. There is no option for keeping the action in pending

- Original Credit Notes

- Upward amendment of the credit note irrespective of the action taken by the recipient on the original credit note

- Downward amendment of the credit note if the original credit note was rejected by the recipient

- Downward amendment of Invoice/ Debit note where original Invoice/ Debit note was accepted by taxpayer and respective GSTR 3B has also been filed

Documents which are not part of Invoice Management System (IMS) but will be available in GSTR 2B

Input Tax Credits from the following taxpayers will not be available in the IMS dashboard but will be available in GSTR 2B:

- Return filed by non-resident taxpayers

- Return filed by Input Service Distributors

- ICEGATE Documents

- RCM Input

- Documents where ITC is ineligible due to POS rules and Section 16(4) of CGST Act

- Where ITC is to be reversed as per Rule 37A

Disclaimer

The content provided in this post is for general informational purposes only and does not constitute professional advice. While every effort is made to ensure the accuracy and reliability of the information, it may not reflect the most current legal or regulatory developments. Readers are advised to consult with a qualified professional or refer to official government resources for specific advice related to Goods and Services Tax (GST).