Why did the tax section cross the Finance Act? Probably to escape the auditor’s glare and join its friends in the great “Omitted” lounge, where old tax provisions sip coffee and reminisce about the good old assessment years. Meanwhile, other sections just get quietly benched, left to gather dust with a polite “not applicable” sign—like wallflowers at a tax code party.

Jokes aside! Ever noticed how some tax sections pull a full Houdini and disappear, while others politely stick around with a “not applicable from…” note? It’s like some provisions get a dramatic farewell party while others just quietly slip out the door.

Welcome to the fascinating world of legislative drafting, where even the exits are intentional. Let’s break it down the differences between Omission vs Non-applicability and delve into when the sections are omitted and when the applicability is restricted to a certain date.

Exits: Omission vs Non-Applicability

When a tax provision is no longer needed, lawmakers have two primary tools to phase it out:

1. Omission

This is a complete removal of a section from the statute, as if it never existed beyond a certain date.

Example:

Section 88 (Rebate on Life Insurance Premia, Contribution to Provident Fund etc) was omitted by the Finance Act, 2023, effective 01-04-2023. The government decided to wind down the rebate altogether, and removed the section entirely from the Act as it had no relevance at present.

2. Non-Applicability

Here, the provision remains in the law but is made inoperative from a specified date. This helps preserve its relevance for past assessments or references.

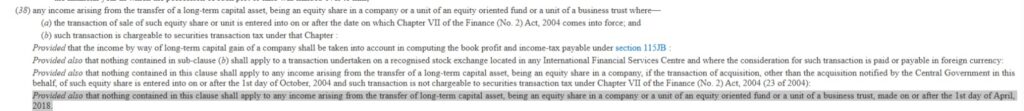

Example:

Section 10(38) (exemption on long-term capital gains from listed shares) was not omitted. Instead, a proviso was inserted via the Finance Act, 2018, making it inapplicable from AY 2019–20 onward. Section 112A was introduced to tax such gains going forward.

Why the Different Approaches?

There’s no black-and-white rulebook dictating when to omit a section versus marking it inapplicable. However, these choices are typically made based on:

| Criterion | Omission | Mark as Not Applicable |

|---|---|---|

| Permanent policy shift | ✅ Yes | ❌ No |

| Needed for pending litigation/audits | ❌ No | ✅ Yes |

| Time-bound provision | ❌ Rarely | ✅ Common |

| Clarity during transition period | ❌ No | ✅ Yes |

| Possible revival in future | ❌ No | ✅ Yes |

Reassessments and Inapplicable Sections – Still Relevant?

Yes, absolutely. Even if a section is no longer applicable for future years, it remains enforceable for the period it was in force, especially for reassessment proceedings under Section 147 of the Income Tax Act.

Take Section 10(38). While it’s inapplicable from AY 2019–20, it still governs capital gains exemptions for earlier years (say, AY 2016–17 or AY 2017–18), and will be used in any assessments, appeals, or reassessments for those periods.

The Savings Clause

A savings clause is like a legal seatbelt. It’s inserted when a provision is repealed or omitted to preserve the effect of the old law in pending matters.

Example:

“Notwithstanding such repeal, anything done or any action taken under the repealed provision shall be deemed to have been done or taken under the corresponding new provision.”

Why It Matters:

Without a savings clause, courts rely on interpretative principles (like under the General Clauses Act, 1897) to decide whether old rights and obligations still hold.

When a savings clause is included, there’s no ambiguity. It makes clear that:

- Past assessments using the repealed/omitted section are valid.

- Ongoing proceedings are unaffected.

- Transitional situations are protected.

Judicial Take: Omission Without Savings

In General Finance Co. v. ACIT [(2002) 257 ITR 338 (SC)], the Supreme Court clarified that an omitted provision still applies to periods when it was in force, unless clearly stated otherwise.

However, where savings clauses are included (as they often are), it provides a rock-solid foundation for retrospective application to past years without any room for doubt.

Summary: Key Takeaways

- Omission = Clean slate. Law ceases to exist from that date.

- Non-applicability = Section still exists but is frozen in time.

- Savings clause = Legal assurance that the past isn’t lost.

- Courts apply the law as it stood during the relevant year, even if it has since been omitted or made inapplicable.

Conclusion

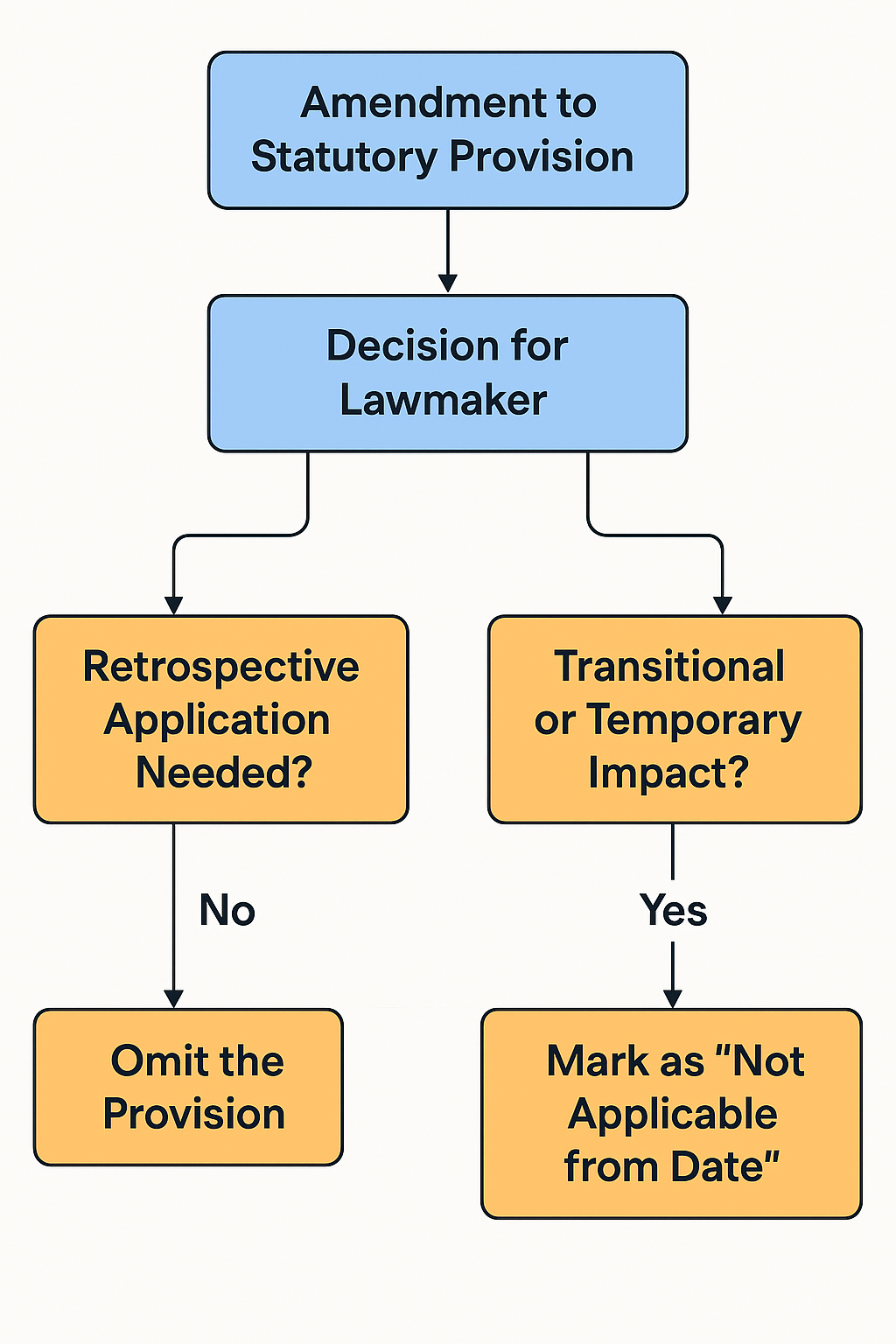

The following flowchart outlines how the legislative team decides whether to omit or mark inapplicable, based on the utility, period, and policy intent:

Tax laws may change with every Budget speech, but the way they enter—and exit—the statute is no accident. It’s a thoughtful, deliberate process built on precedent, clarity, and sometimes, a bit of legal foresight wrapped in a savings clause.