One of the major pre-requisite for filing Income Tax Returns and Income Tax Forms is to create a Registration in Income Tax Portal. Each PAN is required to have a separate login credentials. The official address of the Income tax portal is https://www.incometax.gov.in . The Registration enables the taxpayer to access and track all tax-related activities including responding to notices, submission of details etc.

Prerequisites for Registration in Income Tax Portal

- Valid and active PAN

- Valid Mobile Number

- Valid email ID

Other details required at the time of Registration

- Date of Birth/Incorporation

- Gender, if applicable

- Residential Status

- Address (Residential/Official)

Step-by-Step Guide for Registration in Income Tax Portal

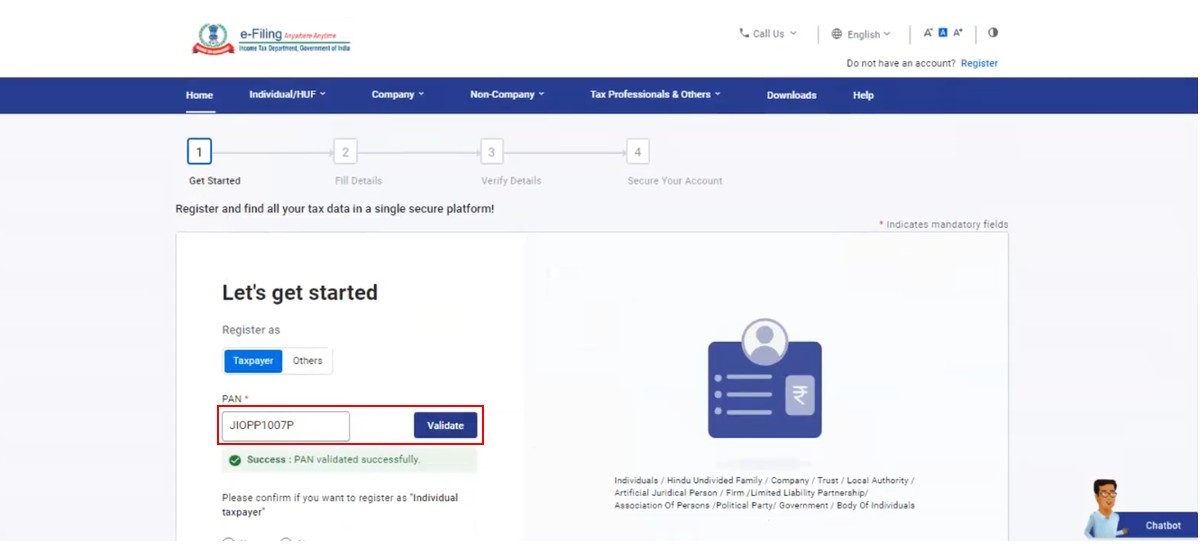

Step 1: Go to the Income Tax e-Filing portal homepage, click Register.

Step 2: Enter your PAN under Register as a Taxpayer option and click Validate. In case the PAN is already registered or invalid, an error message is displayed.

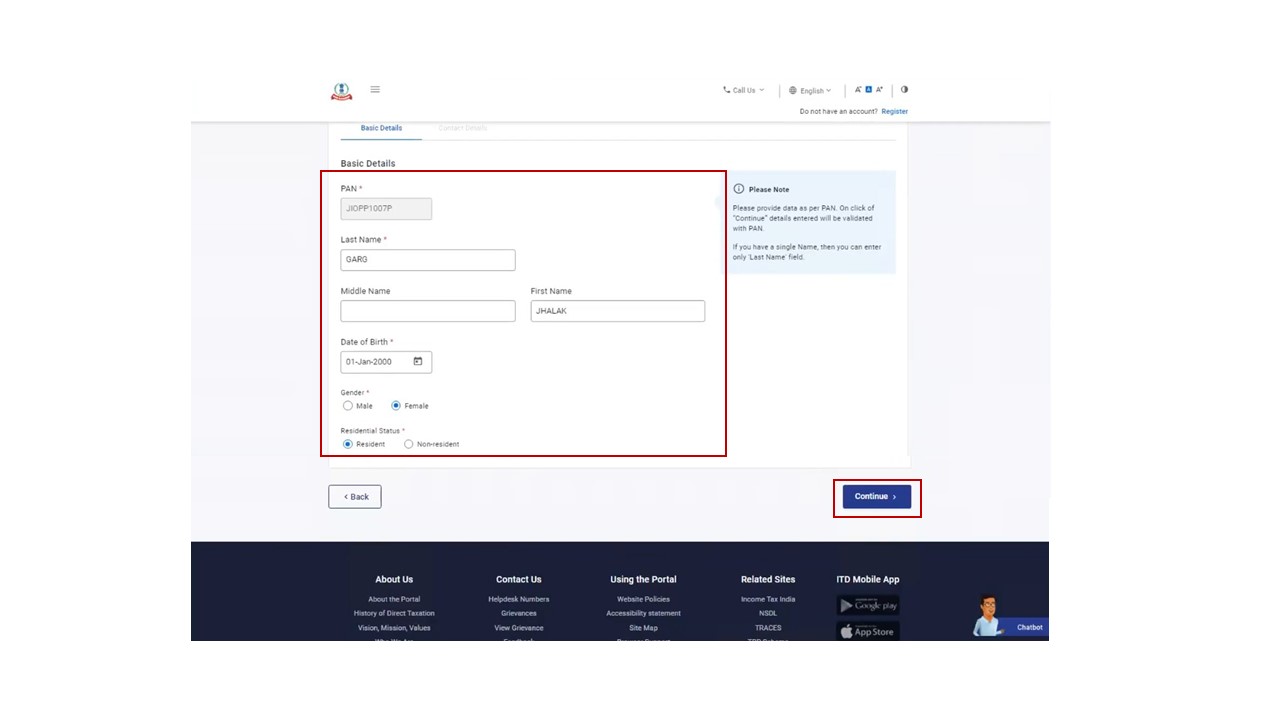

Step 3: Enter all the mandatory details including Name, DOB / DOI, Gender (if applicable) and Residential Status as per your PAN on the Basic Details page and click Continue.

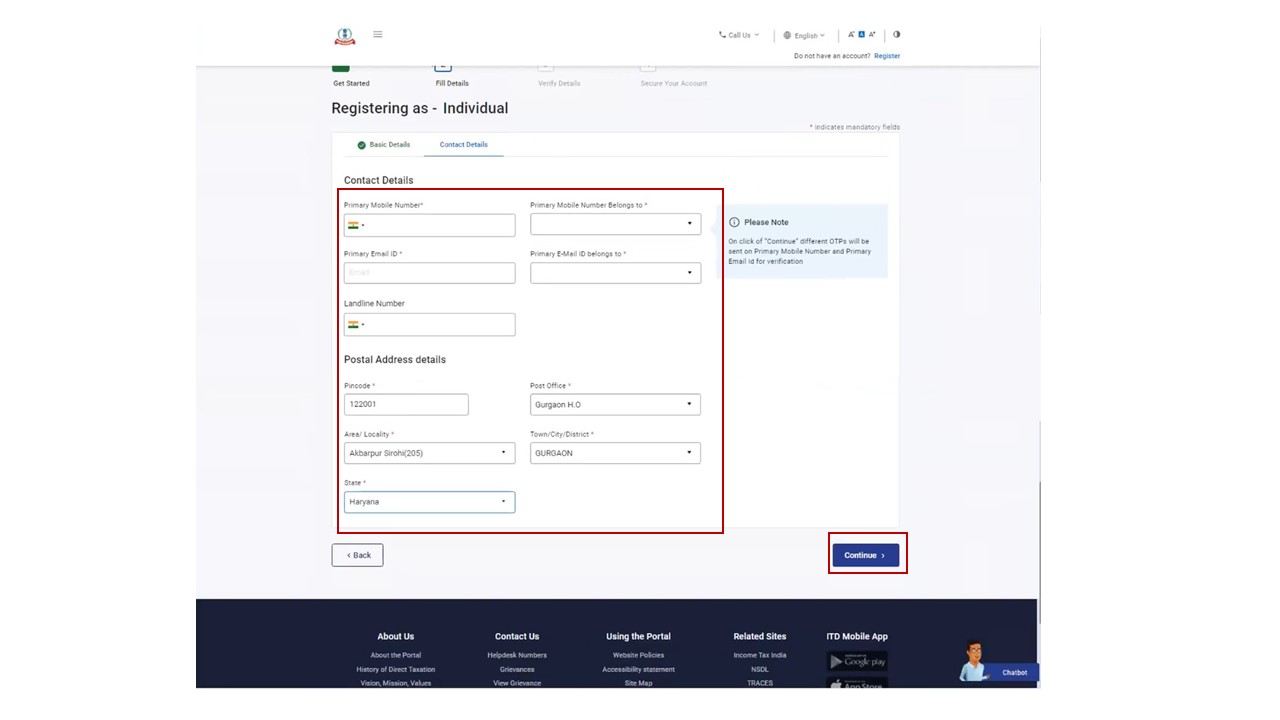

Step 4: After PAN is validated, the Contact Details page appears for individual taxpayers. Enter your Contact Details including Primary Mobile Number, email ID and Address. Click Continue.

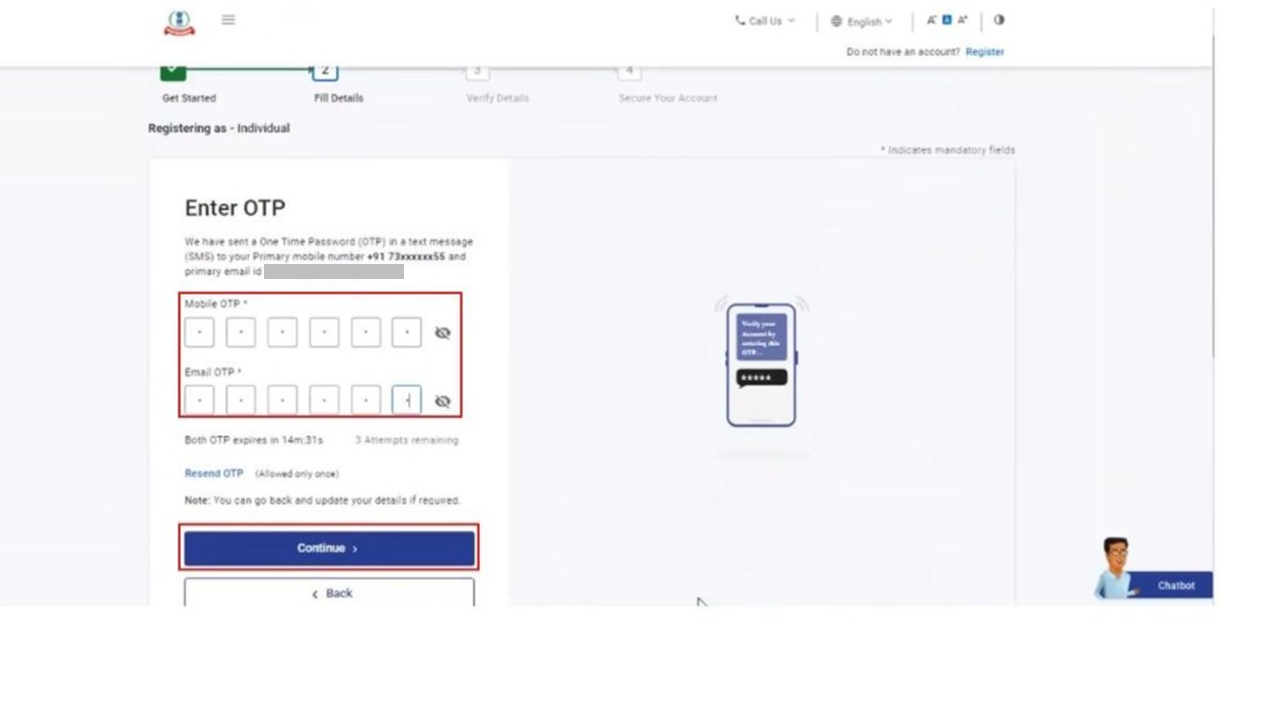

Step 5: Two separate One Time Passwords (OTPs) are sent to the primary mobile number and email ID mentioned in Step 5. Enter the separate 6 digit OTPs received on the mobile number and email ID and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

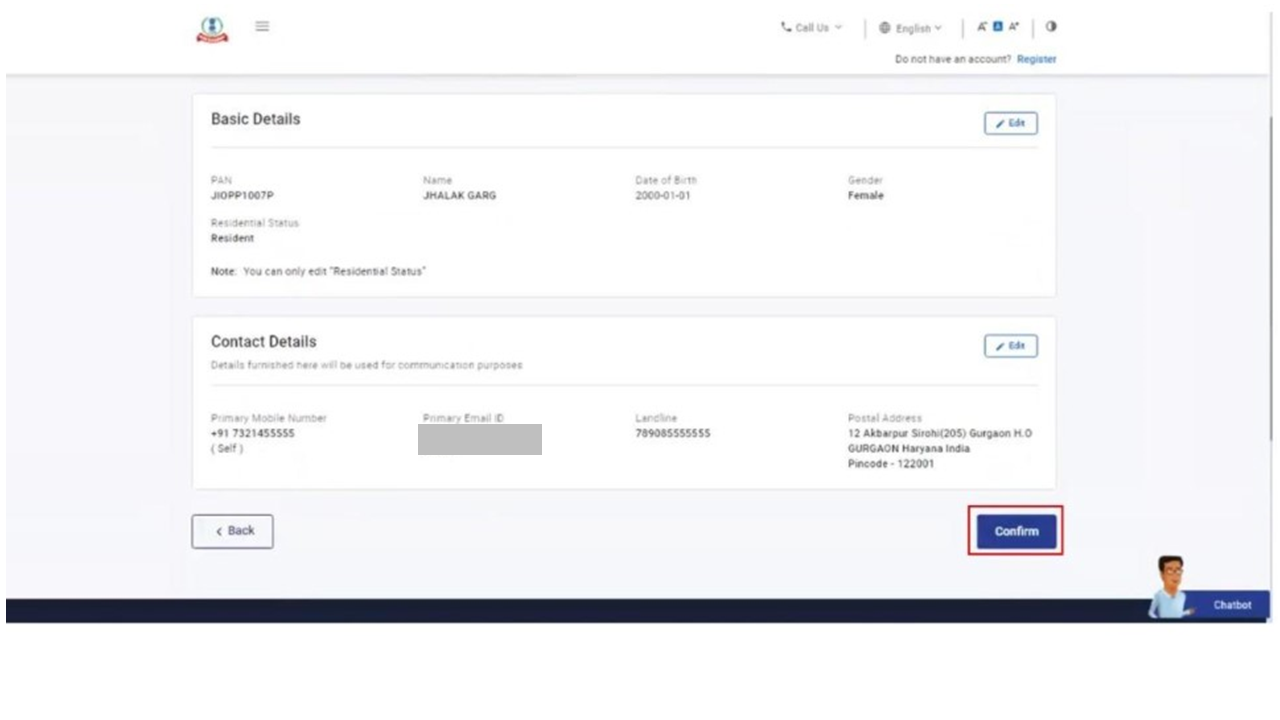

Step 6: Edit the details in the page if necessary and click Confirm.

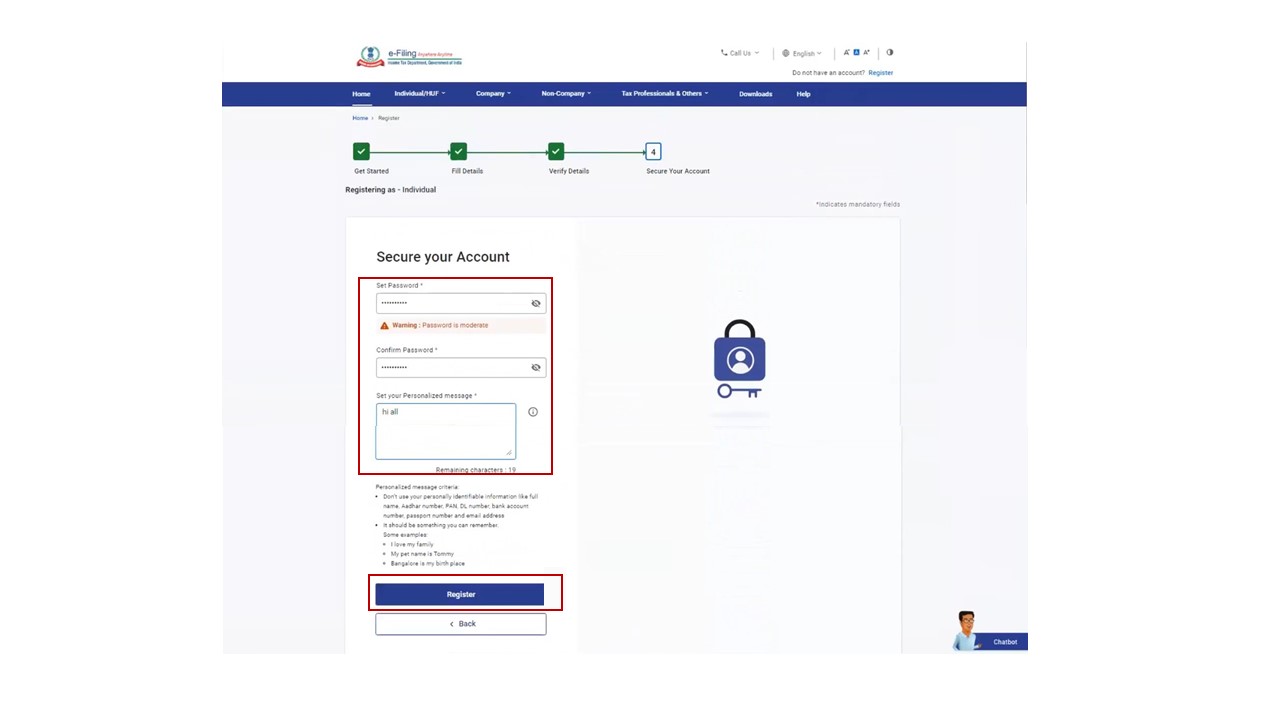

Step 7: On the Set Password page, enter your desired password in both the Set Password and Confirm Password textboxes. Enter your personalized message and click Register.

Note:

- Do not click Refresh or Back.

- While entering your new password, be careful of the password policy:

- It should be at least 8 characters and at most 14 characters.

- It should include both uppercase and lowercase letters.

- It should contain a number.

- It should have a special character (e.g. @#$%).

- While setting a personalised message, the following items are to be kept in mind

- Personal Information should be avoided

- Full Name should not be used in the personalised message

- ID proof such as Aadhar and DL number should not be used in the personalised message

- Bank details should not be used in the personalised message

- It is to be noted that personalised messages are only for identification of the account.

Step 8: When you are successfully registered, click Proceed to Login to begin the login process.

Note: Log in to the e-Filing portal and update your profile to access all the available services.

Additional Info

The income tax portal also offers registration for the following class of persons

- Tax Deductor

- Tax Collector

- External Agencies

- TIN Stakeholders

- Chartered Accountant

- E-Return Intermediary

- Non-Residents not holding and not required to have PAN

These categories offers various other functionalities in the Income Tax Portal. Right from filing of forms for self to filing reports for assessees, the registration in Income Tax Portal is a pre-requisite. The other categories may require other ID numbers such as TAN for Tax Deductors and Collectors, Membership Number for Chartered Accountants etc.

The login credential will also be required to act as and to appoint a Authorised Representative. Any change in the personal details can be made in the Income Tax Portal after login.