The TRACES portal is a vital tool for every deductor or taxpayer handling Tax Deducted at Source (TDS) or Tax Collected at Source (TCS). It enables users to access and download TDS/TCS certificates (Form 16/16A, Form 27D), file online corrections, track challan payments, monitor refund claims, and view Form 26AS. To leverage these features, registration on the TRACES portal is mandatory.The user can be registered either as a Deductor or the Taxpayer. In this guide, we’ll walk you through the simple steps to register and get started. .The official address of the Traces portal is https://www.tdscpc.gov.in

Step by Step Guide on How to register as a Deductor

Step 1: Click on “Register as New User”, Select Category as a “Deductor” then click on“Proceed”.

Provide TAN Number in the respective allocated tab followed by verification code to proceed further.

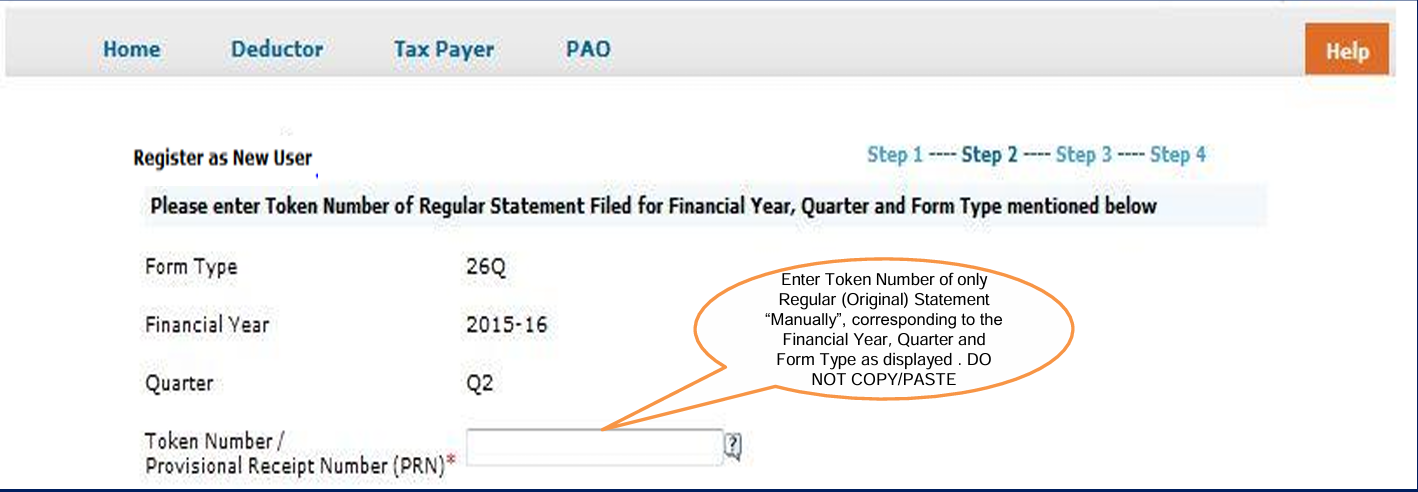

Step 2: KYC Validation : Financial Year, Form type and Quarter for which KYC required will be auto populated. Enter Token Number of the Regular (Original) Statement only, corresponding to the Financial Year, Quarter and Form Type displayed. Enter CIN/ PAN details pertaining to the Financial Year, Quarter and Form Type displayed on the screen on the basis of latest statement filed.

Note : Please DO NOT copy /paste the data .

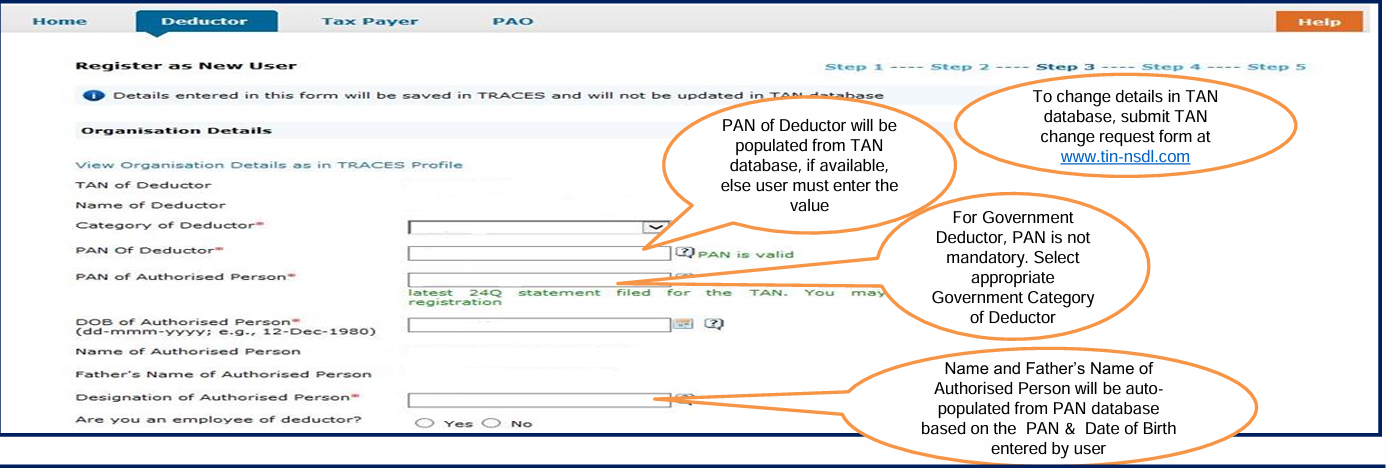

Step 3: Deductor is required to fill Organisation details such as category of Deductor, PAN of deductor, PAN of Authorised person and Date of Birth of Authorised person etc. to proceed further. For Government Deductor, PAN is NOT mandatory

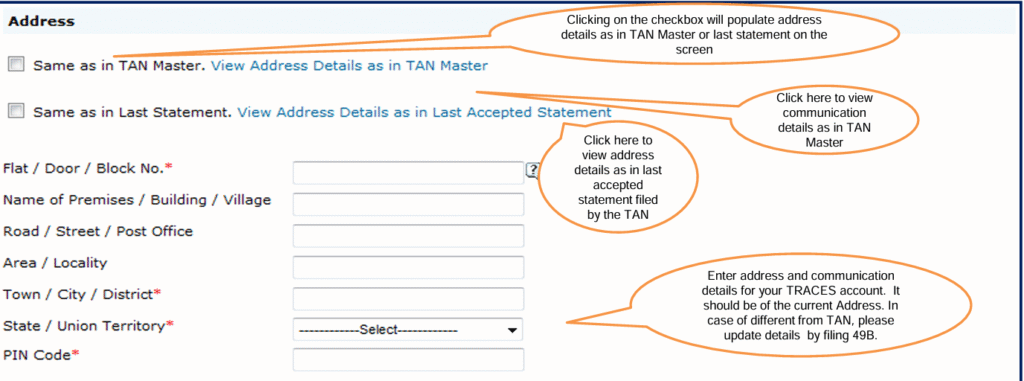

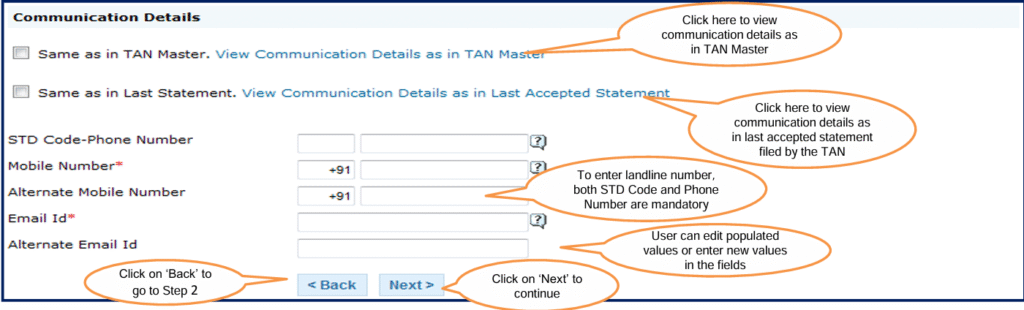

- At Step 3, you will get option to choose Communication Address Details as per TAN Master or as per Last Statement Filed.

- At Step 3, you will get option to fill mobile number/alternate mobile number/email id/ alternate email id.

Note:

- PAN Status should be active at the time of registration

- In case of individual and proprietor, PAN of Deductor and PAN of authorized person may be same. In all other cases PAN of Deductor and PAN of authorized person may be different.

Choose Communication address as per either as per TAN Statement or as per Last Filed Statement.

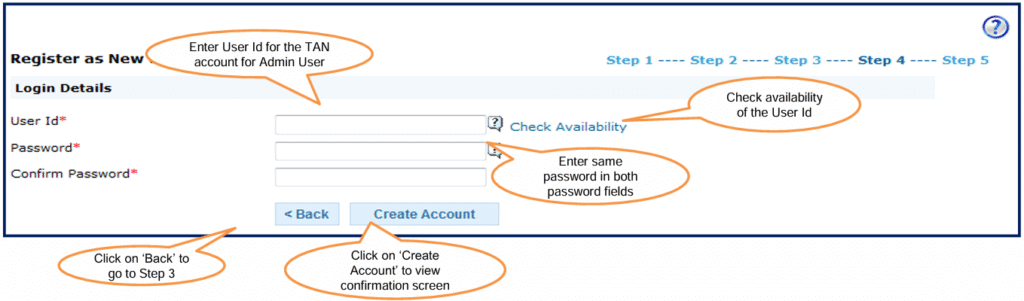

Step 4: Deductor is required to create User Id and password to proceed further.

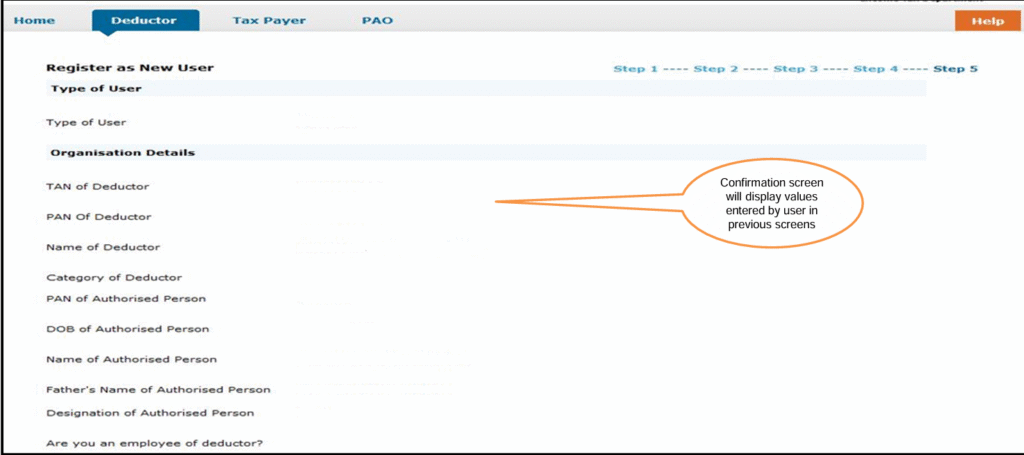

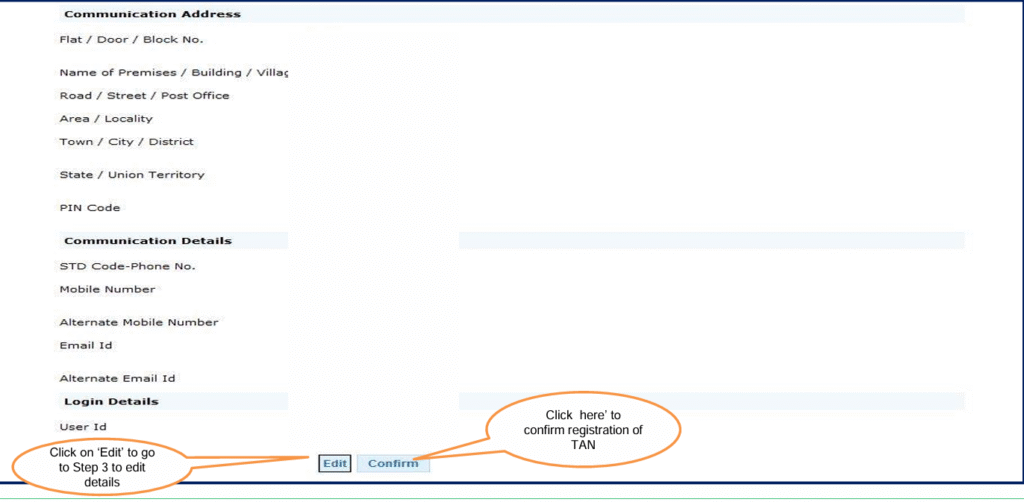

Step 5:Confirmation screen will display. Deductor can edit the details if required or else can confirm the same for successful registration.

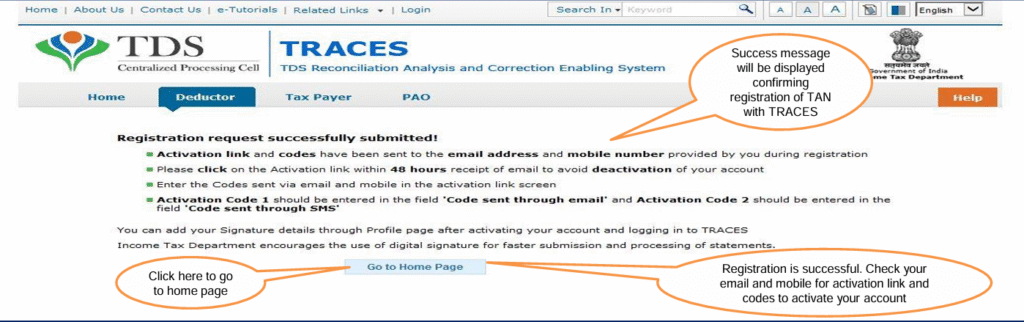

After clicking on ‘Confirm’, Registration request submitted successfully message will display on screen

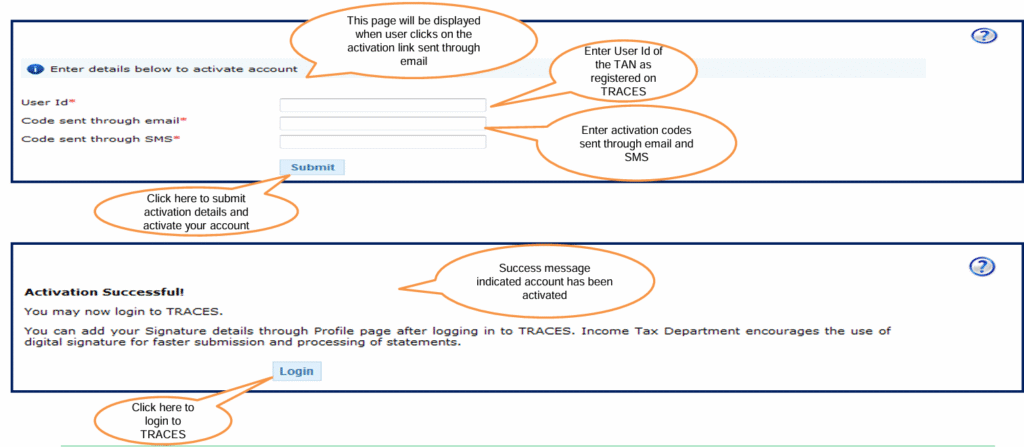

After completion of all above steps, deductor will receive activation link followed by activation code on registered email id and mobile number, which can be used for activation of account. Deductor needs to activate the account within 48 hours of Registration.

Account activation must be completed within 48 hours of registration else account will be deactivated and you will have to register again on TRACES.

In case SMS/ email is advertently deleted and 48 hours deadline to activate account has NOT passed, please enter TAN details in Step-1 of deductor Registration Form and click on “Submit”. System will display an alert message to resend the Activation link and codes. Click on ‘Ok’, the activation link and codes will be resent to your email id and mobile number.

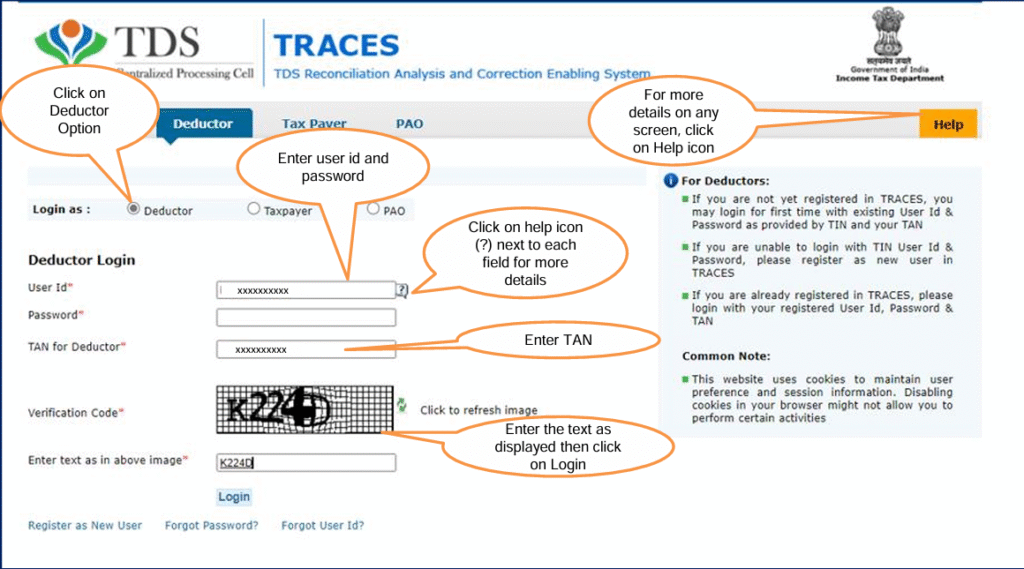

After successfully activating the account, user will be able to Login on TRACES portal.

Registeration as a Taxpayer in Traces Portal

Taxpayers will be able to perform the following activities in the portal:

- Registration

- View/Download Form 26AS/Annual Tax Statement

- Provisional TDS Certificate-16/16A/16B/27D

- Download Form 16B /16C/16D

• Verify TDS Certificate - View/Download Aggregated TDS Compliances Report

- Manage profile, change password

- Perform 26QB/26QC correction

- Digital Signature Registration

- View Default Summary 26QB/26QC/26QD

- Download Justification Report -26QB/26QC/26QD

- Raise Request for Resolution

- Register Digital Signature Certificate

- Request for Form 13

- Request for Refund-26QB etc

Step by Step Guide on How to register

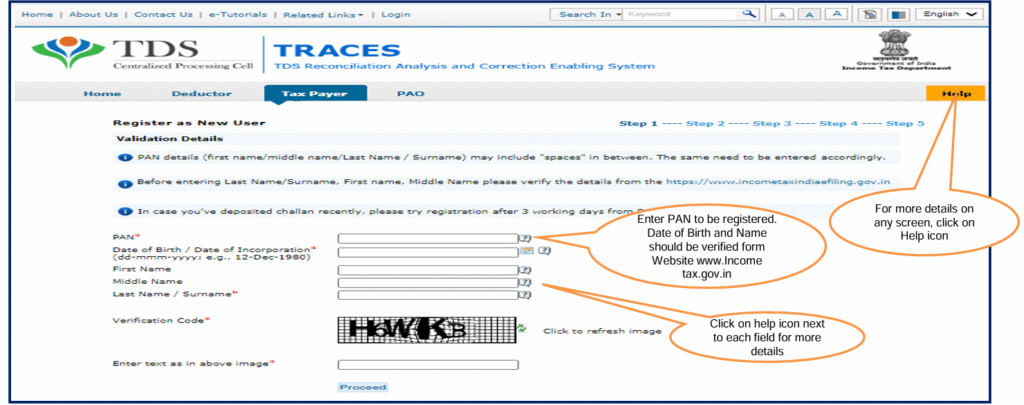

Step 1: Click on Register as a new User and Select Type of User as ‘Tax Payer’.

Enter PAN to be registered. Date of Birth and Name (First Name, Middle Name or Last Name/Surname) as per the PAN database.

Step 2 : Taxpayer can choose from Option 1,Option 2 ,Option 3 or Option 4 to proceed further.

Option 1: Details can be filled from Form 16/16A/27D provided Deductor.

Option 2:Details can be filled from the challan paid by the Taxpayer for Self Assessment Tax, Advance Tax and TDS on property and TDS on Rent.

In case you have paid challan for Self Assessment Tax, Advance Tax ,TDS on property and TDS on Rent after April 1, 2011 you can select this option. Enter challan serial number and amount for the selected assessment year for any tax paid by the Tax Payer.

Option 3: Details can be filled From 26AS/Annual Tax Statement and correction ID/ Request ID will be provided by the current Buyer, this option can be used for seller / Buyers registration for approval in 26QB correction.

For approval in 26QB correction, Seller and Buyer can select this option and proceed with registration procedure.

Option 4: User can register themselves by Aadhaar /VID Authentication.

In case of Authentication through Aadhaar/VID , taxpayer can select this option and proceed with registration procedure.

- After clicking on Aadhaar Number option, a pop-up will be displayed where user can view steps to use Aadhar Authentication

- Select Aadhar option and enter the 12 digit Aadhar number. If you select VID option then enter the 16 digit VID number.

- After successful validation with Aadhaar or VID, a pop-up will be displayed to enter OTP. User need to enter OTP received on registered mobile number/email Id registered With UIDAI.

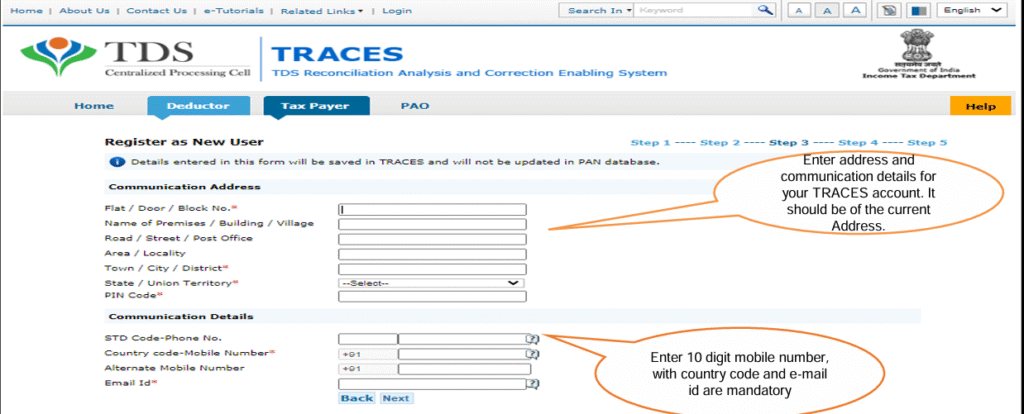

Step 3: Taxpayer is required to fill Communication Address and Details such as House Number, Block, Mobile Number and Email ID to proceed further.

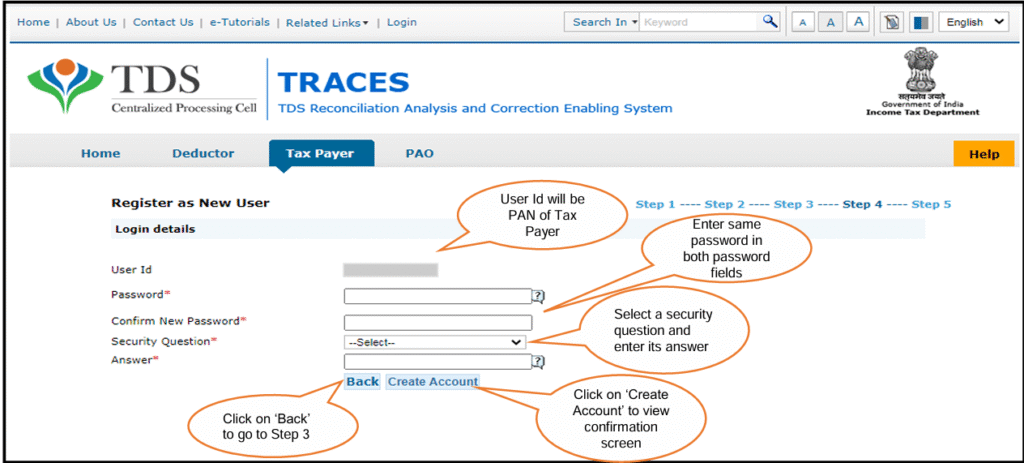

Step 4: Taxpayer is required to create a password followed by the security question to proceed towards Step 5.

Step 5: Taxpayer can see all the details filled earlier and can even edit the details if required or else can confirm the same to proceed further.

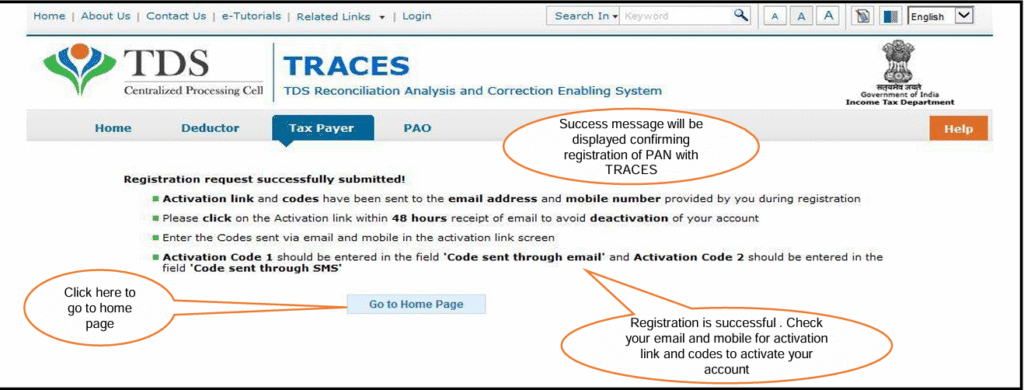

After confirmation success message will be appear on the screen stating “Registration request submitted successfully‘.

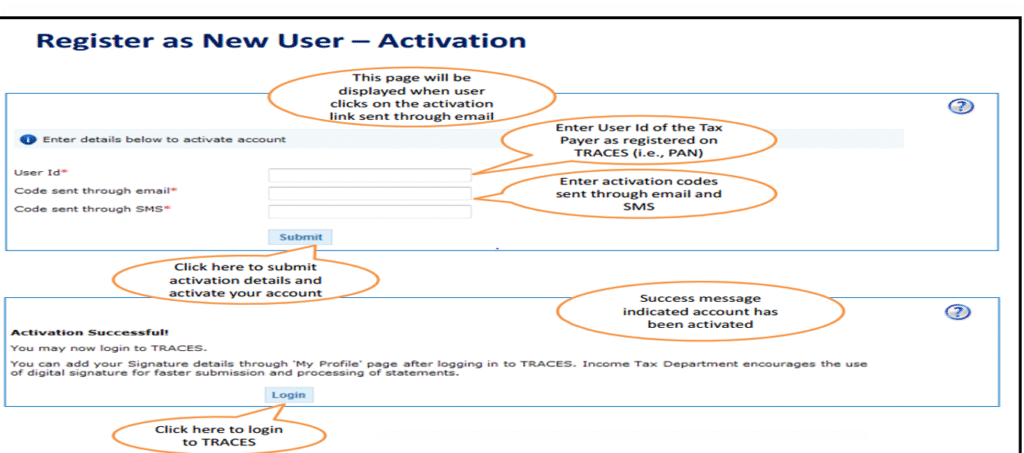

Then taxpayer will receive an “Activation link” followed by “Activation codes” on registered Email id and Mobile number, which can be used for activation of account.

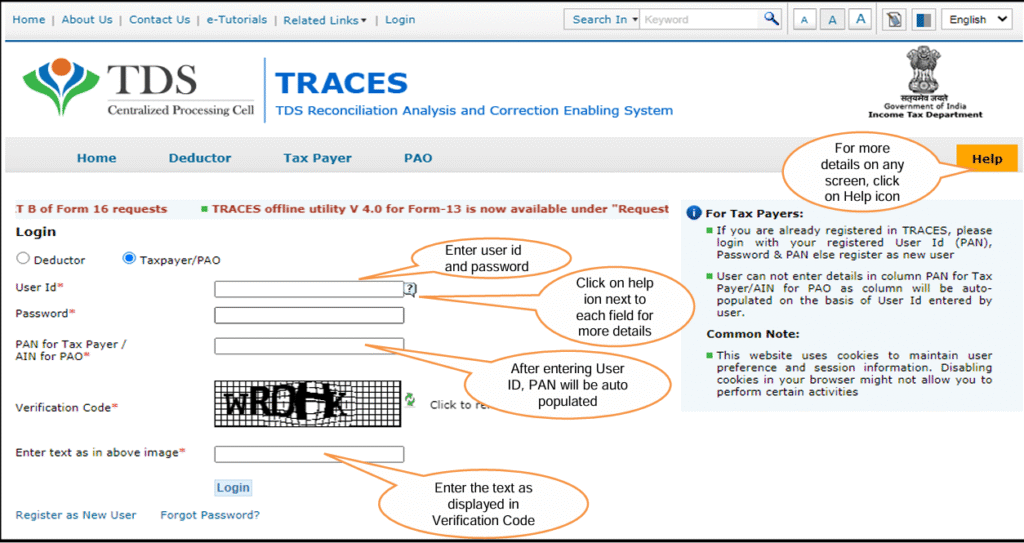

Once the account is activated, Taxpayer will be able to login to the Traces Portal by selecting Taxpayer login.

Source : Traces portal

🔗Suggested Contents:

Registration in Income Tax Portal for e-Filing as Taxpayer

Wonderful, what a website it is! This website gives helpful information to us, keep it up.