The Audit Landscape in India is a very dynamic and adaptive. It undergoes constant changes to adapt to the changing business environments. In a significant move, as per the news circulating in the media, the Ministry of Corporate Affairs might consider relaxation for Company Audits in the case of very small companies. It is reportedly stated that the ministry may pass a bill exempting the Statutory Audit requirements to Private Limited Companies having turnover of less than Rs. 1 crore.

If the same is introduced, this will be the first turnover based audit relaxation in the Statutory Audit Regime of India. Though unconfirmed, this news has received a fair share of welcome as well as criticisms from every corner of the stakeholder community.

As per the existing provisions of the Companies Act, every company in India, regardless of its size, turnover is required to appoint a Chartered Accountant as an auditor and undergo a statutory audit each year. This includes even the smallest entities like One Person Companies (OPCs) and micro-enterprises.

Is relaxation for Company Audits really the need of the hour?

The proposed relaxation in the Company Audits stems out of representations of various business organisations owing to

- High Compliance Costs

- Limited Material Issues

- Major Compliances are just paper requirements in these companies

Critics including some of the Chartered Accountant community are highlighting the risk of Compliance vacuum. The corporate regime in India has always been transparent and compliance oriented. Without the statutory audits, the integrity of the accounts of these entities could be vulnerable to significant risks potentially eroding stakeholder values. This is especially true when these entities interact with public financial institutions.

Whether this relaxation is truly the “need of the hour” hinges on broader economic priorities such as which is important? Easing burdens for small businesses versus safeguarding systemic transparency.

How reliable is the news?

The news regarding the amendments in the Company Audit Requirements is circulating in the social media based on the articles published in certain reputable websites. But whether or not the news is credible is still awaiting confirmation. As per the sources, the above proposal will be taken up in the Winter Session of the Parliament, set to begin from December 1, 2025.

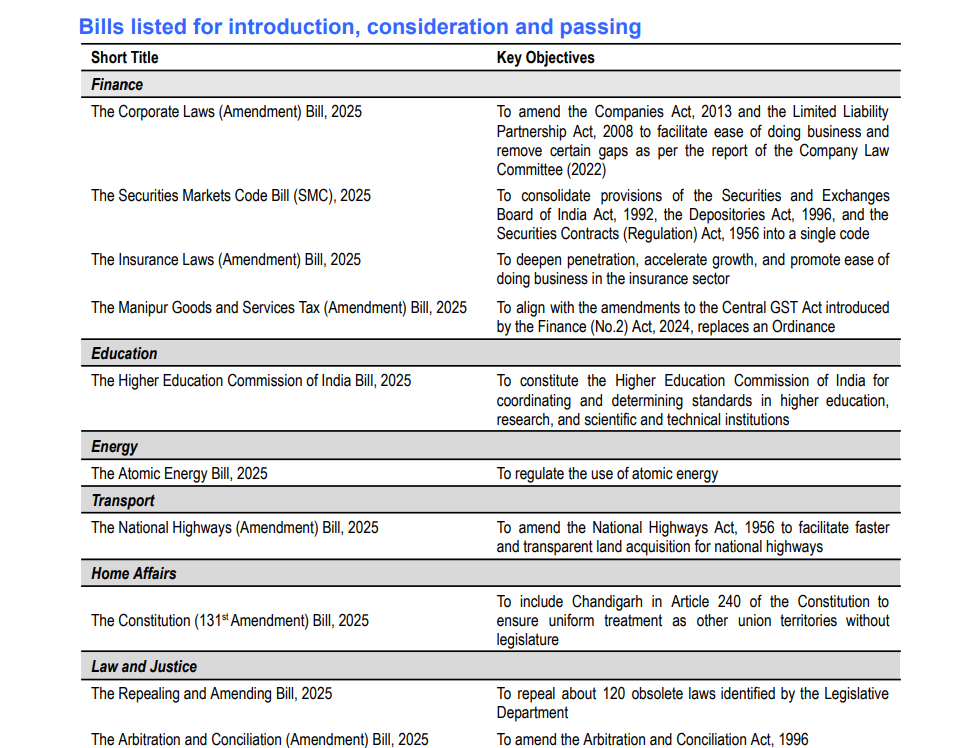

As per the verification of TaxRoutine with the official sources, the Corporate Laws (Amendment) Bill, 2025 is one of the bills in the agenda for the Winter Session of the Parliament. However, the contents of the proposed bill are yet to be confirmed and hence whether the proposal forms part of the actual bill under consideration will be confirmed only after the business is taken up in the Parliament.

As per the available information, Corporate Laws (Amendment) Bill, 2025 will be passed to amend the Companies Act, 2013 and the Limited Liability Partnership Act, 2008 to facilitate ease of doing business and remove certain gaps as per the report of the Company Law Committee (2022).

The main recommendations of the Committee regarding the Companies Act, 2013, as included in Chapter I of the Report, are as follows:

- Allowing certain companies to revert to the financial year followed in India;

- Facilitating certain companies to communicate with their members in only electronic form;

- Recognising issuance and holding of fractional shares, Restricted Stock Units and Stock Appreciation Rights;

- Easing the requirement of raising capital in distressed companies;

- Replacing the requirement of furnishing affidavits with the filing of self certification/ declaration;

- Clarifying the inclusion of ‘free reserves’ while determining the limit for buying back of a company’s equity shares;

- Prohibiting companies from recording trusts on their register of members;

- Allowing companies to hold general meetings in virtual, physical or hybrid modes;

- Creating an electronic platform for maintenance of statutory registers by companies;

- Clarifying provisions relating to Investor Education and Protection Fund;

- Strengthening the National Financial Reporting Authority;

- Reviewing and strengthening the audit framework and introducing mechanisms to ensure the independence of auditors;

- Standardising the manner for auditors to provide qualifications;

- Recognising and providing an enabling framework for the constitution of Risk Management Committees;

- Clarifying the tenure of independent directors;

- Revising provisions relating to the disqualification and vacation of the office of directors;

- Clarifying the procedure for the resignation of key managerial personnel;

- Strengthening the provisions relating to mergers and amalgamations;

- Easing the restoration of struck off companies by enabling the Regional Director to allow restoration of names of companies in certain instances;

- Recognising Special Purpose Acquisition Companies and allowing such companies, which are incorporated in India, to list on permitted exchanges;

- Prohibiting the conversion of co-operative societies into a company;

- Modernising enforcement and adjudication activities through electronic mode;

- Strengthening the incorporation and governance framework for Nidhis;

- Removing ambiguities from present provisions under the Companies Act, 2013 through changes of drafting & consequential nature.

With the proposed change not forming part of the recommendations, it would be interesting to see the contents of the Corporate Laws (Amendment) Bill.

Is there a threat to the practice of Small CA Firms?

The proposed amendment to exempt companies with annual turnover up to ₹1 crore from mandatory statutory audits under the Companies Act, 2013, could indeed pose challenges to small Chartered Accountant (CA) firms, particularly those reliant on such audits for a significant portion of their revenue. However, the extent of the “threat” depends on factors like client diversification.

Small CA practices, often located in tier-2/3 cities, mostly depend on statutory audits of micro-enterprises for steady, low complexity works. These audits though are low-fee audits, but provide assured income based on volumes involved. Chartered Accountants across the country have voiced out concerns regarding the removal of audits for the small entities.

While the Institute of Chartered Accountants of India, has been constantly stating that the number of chartered accountants required in the audit field of India is constantly increasing, restriction in the scope of audits not only poses a threat to the practice of Small CA Firms, but is also seen as a move to push the Big Firms to take up the entirety of the audit profession.

Closing Remarks

All said and done, Ease of doing Business and maintaining stricter compliance protocols are two eyes of the corporate governance. One cannot exist without the other. The profession of chartered accountancy has a very wider scope with new possibilities coming with advancement in technology and business activities. The profession has always withstood the test of time and will continue to do the same. But the collateral damage shouldn’t be as much for the profession to loose its sheen.

While, the proposed amendments in the Corporate Laws (Amendment) Bill, if passed in the Winter Session of the Parliament, may prove to be a ease of compliance requirements for the smaller businesses, the other stakeholders must remain vigilant so as to ensure their interests are properly protected.

Read More about Company Law Updated in our blogs!

Click Below for more posts!