Section 12A of income tax act provides crucial tax exemptions for charitable organizations, making it an essential registration for trusts and NGOs operating in India. Without this registration, your organization could face significant tax burdens that reduce the funds available for your charitable activities.

For many non-profit entities, Section 12A registration under the Income Tax Act serves as the gateway to financial sustainability. Indeed, this registration exempts income used for charitable purposes from taxation, consequently allowing organizations to maximize their social impact. Furthermore, completing your registration through the Income Tax Portal has become more streamlined in recent years, though the process still requires careful attention to detail.

This comprehensive guide walks you through the entire Section 12A registration process, from determining your eligibility to submitting the required documents and understanding what happens after your application. Whether you’re establishing a new trust or bringing an existing organization into compliance for 2025, following these steps will help secure your tax-exempt status.

What is Section 12A Registration and Why It Matters

Under the Indian tax framework, Section 12A registration serves as the legal gateway for non-profit entities to claim income tax exemptions. This critical provision enables organizations working for social welfare to maximize their impact by reducing their tax burden.

Definition and purpose of 12A registration

Section 12A of the Income Tax Act, 1961 establishes the formal registration process that allows charitable and religious organizations to claim complete tax exemptions under Sections 11 and 12 [1]. Primarily, this provision applies to charitable trusts, non-profit organizations (NPOs), non-government organizations (NGOs), welfare societies, religious institutions, and Section 8 companies [2].

The purpose behind this registration is straightforward—it acknowledges that these organizations work for the general welfare of society rather than profit generation [2]. Essentially, the government recognizes that such entities perform valuable services that might otherwise fall to public authorities, thus justifying special tax treatment.

It’s important to understand the distinction between the exemptions Section 12A unlocks:

- Section 11 exempts income derived from property held for religious and charitable purposes [1]

- Section 12 provides exemption on voluntary contributions received by charitable or religious trusts [1]

Without proper registration under Section 12A, all financial transactions and receipts of an organization become taxable, regardless of their charitable nature [1]. For instance, if an NGO receives a ₹10 lakh donation but lacks 12A registration, that entire amount becomes subject to taxation [1].

How it benefits charitable trusts and NGOs

Registration under Section 12A offers numerous substantial benefits that extend beyond basic tax relief:

- Tax exemption on income: Organizations can claim exemption on income allocated toward charitable or religious purposes [3]. Additionally, when setting up operations, trusts and NGOs receive a 15% tax rebate on income that is reinvested into charitable activities [1].

- Access to government funding: Registration is mandatory for receiving grants from both Central and State governments [1]. This official recognition serves as legitimate documentation of an organization’s existence and social objectives [4].

- Enhanced credibility: The 12A certificate acts as valid proof of the entity’s legitimate existence [4]. This certification builds trust among potential donors who gain confidence that the organization meets regulatory standards [2].

- International funding access: Organizations with 12A registration can more easily secure funds from international agencies and organizations [4].

- Proof of legitimate existence: The registration provides official verification that can be used when applying for various schemes, grants, or loans [4].

Previously, Section 12A registration was granted as a one-time permanent approval. However, significant changes have been implemented as of April 1, 2021. Now, new registrations are valid for only 5 years and must be renewed accordingly [3]. For newly formed organizations, a provisional registration lasting 3 years is initially provided [3].

It’s worth noting that private or family trusts cannot avail themselves of these exemptions and are not eligible for Section 12A registration [1]. The benefits are specifically designed for organizations working toward broader social welfare objectives rather than private interests.

Who Can Apply for 12A Registration?

Not every charitable entity qualifies for tax exemptions under Section 12A of the Income Tax Act. The registration process includes specific eligibility criteria that organizations must meet to benefit from these provisions.

Eligible entities under the Income Tax Act

The Income Tax Department has established clear guidelines on which organizations can apply for Section 12A registration. Primarily, entities engaged in social welfare activities without profit motives qualify for this registration [5]. These include:

- Public Charitable Trusts: Organizations established for relief to the poor, education, medical relief, and environmental preservation [6]

- Religious Trusts: Institutions focused on religious activities and charitable purposes [7]

- Societies: Those registered under the Societies Registration Act of 1860 with charitable objectives [8]

- Section 8 Companies: Companies incorporated under Section 8 of the Companies Act 2013 for promoting charitable purposes [8]

- Non-Governmental Organizations (NGOs): Non-profit organizations working for social welfare [7]

To qualify under Section 12A, the organization must align with the definition of “charitable purpose” as outlined in the Income Tax Act. This includes activities related to poverty relief, education, medical assistance, environmental conservation, or any other objective serving public utility [6].

Moreover, since April 1, 2021, significant changes have affected the registration validity period. Notably, new registrations are now valid for only 5 years and require renewal thereafter [3]. For newly formed organizations, a provisional registration lasting 3 years is initially provided [3].

When applying, organizations must submit Form 10A along with supporting documentation such as trust deeds, registration certificates, and activity reports [2]. Applications should be submitted at least one month prior to the commencement of the financial year for which the registration is sought [3].

Conditions that disqualify an organization

Despite meeting the basic eligibility criteria, certain conditions may disqualify an entity from receiving tax exemptions under Section 12A:

- Private or Family Trusts: Trusts established for the benefit of specific families or private interests cannot qualify for Section 12A registration [5]. The focus must be on broader public welfare rather than private gain.

- Profit Motive: The presence of a profit motive in the organization’s activities is a fundamental disqualifying factor [6]. The tax authorities evaluate whether the entity genuinely operates without profit intention.

- Caste or Community Specificity: A charitable organization working exclusively for a specific caste or community will be disqualified from tax exemptions [9]. The benefits must extend to the general public without discriminatory restrictions.

- Commercial Activities Exceeding Limits: If an organization engages in trade or commerce, the registration is granted only if receipts from such activities are less than 20% of the total receipts [6]. Excessive commercial involvement undermines the charitable character of the entity.

- Additional Business Income: Trusts or NGOs that generate substantial income through other business activities may lose their eligibility for exemptions [5].

Furthermore, organizations must maintain proper accounting records and follow specific donation acceptance procedures to remain eligible. For instance, cash donations may be accepted only up to ₹2,000, with larger amounts requiring electronic transfers or checks [9].

Understanding these eligibility criteria and disqualifying conditions is essential before proceeding with a Section 12A registration application, as they determine whether your organization can benefit from the valuable tax exemptions this registration provides.

Documents You Need Before Applying

Preparing the right documentation is a crucial step before initiating your Section 12A registration application. The Income Tax Department requires several specific documents to verify your organization’s charitable status and ensure compliance with regulations.

Trust deed or incorporation certificate

The foundation document of your organization is the first requirement when applying for Section 12A registration. Depending on your entity type, you’ll need to provide:

- A self-certified copy of the trust deed if you’re a charitable trust [10]

- The incorporation certificate if you’re a Section 8 company [1]

- Society registration certificate for registered societies [11]

- Memorandum of Association and Articles of Association (MOA & AOA) where applicable [11]

In case your organization was established without a formal instrument, you must submit a self-certified copy of any document that evidences the creation of your trust or institution [10]. Additionally, if your organization has modified its objectives since formation, include self-certified copies of documents showing these changes [10].

It’s worth noting that all copies must be self-certified by an authorized representative of your organization to be considered valid for the application process.

PAN card and financial statements

Financial documentation forms the backbone of your Section 12A application:

- PAN card of the trust or organization (mandatory for all applicants) [7][12]

- Audited annual financial statements for up to three years immediately preceding the application year [10][6]

- For existing organizations with business income under section 11(4A), copies of audit reports under section 44AB for the previous three years [3]

The financial statements serve as evidence of your organization’s activities and demonstrate that funds have been utilized for charitable purposes. These documents help the Income Tax Department assess whether your organization genuinely operates on a non-profit basis.

First-time applicants need not worry if they don’t have three years of financial history—you’ll simply provide whatever statements are available since your organization’s inception.

List of trustees and activity report

The Income Tax Department also needs information about your governance structure and operational activities:

- Complete list of trustees, members, or directors with their contact details [11][1]

- KYC (Know Your Customer) details of all members [7]

- Comprehensive note detailing the activities of your trust or institution [10][7]

- List of contributors along with their addresses and PAN details (where applicable) [11]

The activity report is especially important as it demonstrates that your organization is genuinely engaged in charitable work. This document should provide a clear picture of how your organization serves its stated objectives and benefits the public.

In addition to these core requirements, certain organizations may need to submit:

- Self-certified copy of registration under the Foreign Contribution Regulation Act (FCRA) if registered under such Act [3]

- Self-certified copy of existing order of registration under section 12A, 12AA, or 12AB (for organizations already holding these registrations) [3]

- DARPAN Portal registration details (if registered there) [3]

Assembling these documents properly is vital for a smooth application process. Furthermore, ensuring all copies are self-certified and up-to-date will help avoid unnecessary delays in processing your Section 12A registration.

How to Apply for 12A Registration Online?

The application process for Section 12A registration has moved entirely online, making it more accessible for trusts and NGOs across India. Once you’ve gathered all required documents, you’re ready to navigate the Income Tax Portal to file your application.

Step-by-step guide to filing Form 10A

Filing Form 10A requires careful attention to detail as you work through the Income Tax Department’s e-filing portal:

- Visit the official Income Tax Portal at www.incometax.gov.in

- Log in* using your organization’s PAN as the user ID and your password

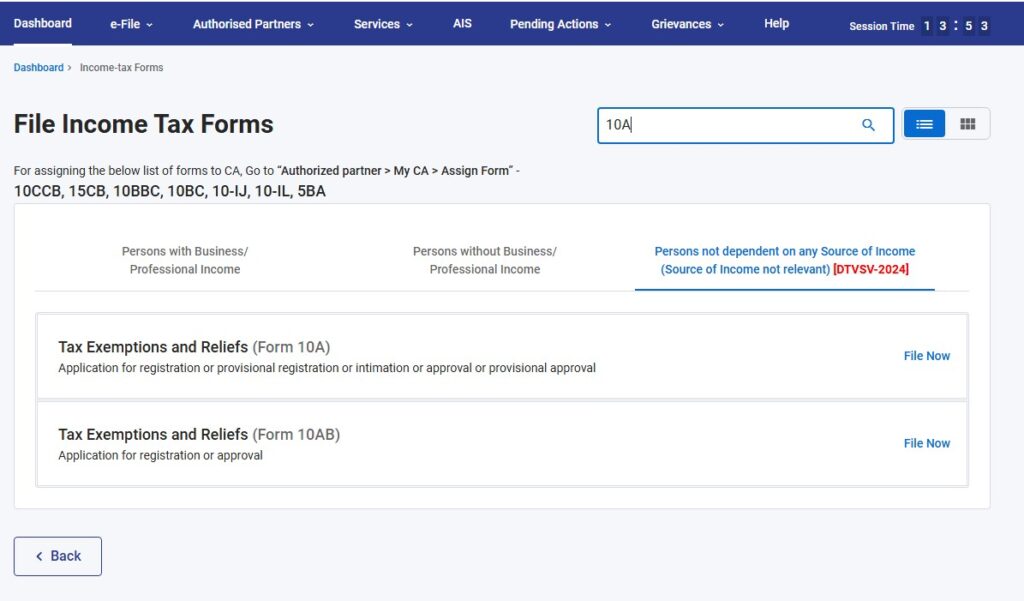

- On the menu bar, click on the e-File tab, then select Income Tax Forms

- Navigate to File Income Tax Forms option

- Under “Persons not dependent on any source of income/Source of income not relevant” tab, select Form 10A

- Choose the current Assessment Year from the dropdown menu

- Select Prepare and Submit Online as your submission mode

- Fill in all required details section by section (Form 10A has 8 sections)

While completing Form 10A, remember to save your progress after finishing each section. The form requires information about your incorporation details, registration information, key persons, financial information, and if applicable, religious activities.

*If you don’t have a login credential in the Income Tax Portal, Click here to know the steps for registration in the Income Tax Portal

Using digital signature or EVC

Upon completion of your application, verification is mandatory through either:

- Digital Signature Certificate (DSC): The authorized signatory of your organization must verify the application using their digital signature. This is the preferred method for trusts that routinely file digital returns.

- Electronic Verification Code (EVC): Alternatively, you can verify using an EVC if you don’t have a digital signature. The system will send a verification code to your registered mobile number or email.

The person authorized to verify income tax returns under section 140 of the Income Tax Act must complete this verification process.

Where and how to submit the form

After filling all sections and attaching required documents, submit your application directly through the Income Tax Portal:

- Review all information for accuracy

- Upload all mandatory attachments in the specified formats

- Click the Submit button

- Complete verification using DSC or EVC

- Save the acknowledgment number for future reference

Your application will be forwarded to the Principal Commissioner of Income Tax (PCIT) or Commissioner of Income Tax (CIT) for review. While the process is completely online, occasionally the commissioner may request additional documents or clarifications.

First-time applicants should note that although registration was previously a one-time process, under new rules introduced in 2021, registrations are now valid for 5 years for existing organizations, while new entities receive provisional registration for 3 years.

What Happens After You Apply?

Once your Form 10A is submitted through the Income Tax Portal, your application enters a critical review phase. The waiting period begins as your documents make their way to the Principal Commissioner or Commissioner of Income Tax for thorough evaluation.

How the Commissioner reviews your application

After receiving your application, the Commissioner examines all submitted documents to verify the genuineness of your organization’s charitable activities [8]. Subsequently, they may request additional information or documents to further assess your operations [6]. This examination focuses on two key aspects:

- The authenticity and charitable nature of your activities

- Compliance with other applicable laws relevant to your organization’s objectives [4]

The Commissioner may also conduct inquiries as deemed necessary to validate your organization’s claims [13]. This verification process ensures that only genuine charitable organizations receive tax exemptions under Section 12A of the Income Tax Act.

Possible outcomes: approval or rejection

Following the review, your application will meet one of two outcomes:

- Approval: If satisfied with your application, the Commissioner issues a written order confirming your eligibility for Section 12A registration [8]. On approval, you’ll receive Form 10AC containing a sixteen-digit alphanumeric Unique Registration Number (URN) [3].

- Rejection: If the Commissioner finds deficiencies or is unsatisfied with your application, they can reject it [8]. Importantly, no rejection order can be passed without giving you a reasonable opportunity to be heard [4].

Timeline for receiving your registration certificate

The timeline for obtaining your Section 12A registration typically ranges from 1 to 3 months, depending on the completeness of your application and verification speed [14]. In certain cases, the process might extend up to 6 months [14].

Under Section 12AA(2), the Commissioner must communicate either approval or rejection within six months from the end of the month in which your application was received [4]. Once approved, you can download your 12A certificate directly from the Income Tax Portal [14].

For new organizations, a provisional registration valid for 3 years is granted, whereas regular registrations remain valid for 5 years before requiring renewal [15].

Conclusion

Obtaining Section 12A registration undoubtedly represents a crucial step for any charitable organization operating in India. Throughout this guide, we’ve explored the fundamental aspects of this registration process that exempts your income used for charitable purposes from taxation.

First and foremost, eligibility remains restricted to genuine charitable entities working for public welfare rather than personal gain. Additionally, the documentation requirements—including trust deeds, financial statements, and activity reports—serve as evidence of your organization’s legitimate charitable status. The online application process, while streamlined through Form 10A, still demands careful attention to detail and proper verification.

The regulatory landscape has changed significantly since 2021. Previously permanent registrations now last only 5 years, while new organizations receive provisional 3-year registrations. Therefore, understanding renewal requirements becomes essential for maintaining your tax-exempt status.

The commissioner’s review process, though potentially time-consuming, ensures that tax exemptions benefit only qualified charitable entities. After approval, your organization can significantly reduce its tax burden, thereby maximizing the resources available for your charitable mission.

Section 12A registration ultimately provides more than tax benefits—it builds credibility with donors, opens doors to government funding, and establishes your organization’s legitimacy in the charitable sector. Although the process requires careful preparation and documentation, the financial advantages and enhanced reputation make it worth the effort for eligible organizations committed to social welfare causes.

References

[1] – https://www.linkedin.com/pulse/12a-80g-abhishek-thakur

[2] – https://incometaxindia.gov.in/_layouts/15/dit/pages/viewer.aspx?grp=rule&cname=cmsid&cval=103120000000007311&k=&isdlg=1

[3] – https://www.incometaxforngos.org/12a-registration

[4] – https://taxguru.in/income-tax/section-12-12a-12aa-12ab-analysis-registration-procedure-exemption-faqs.html

[5] – https://www.taxbuddy.com/blog/section-12a

[6] – https://www.indiafilings.com/learn/12a-registration/

[7] – https://cleartax.in/s/insights-on-section-12a-of-the-income-tax-act-1961-ita

[8] – https://www.indiafilings.com/12a-registration

[9] – https://tax2win.in/guide/section-12a-of-income-tax-act

[10] – https://incometaxindia.gov.in/Pages/i-am/trust.aspx?k=Registration

[11] – https://www.taxmanagementindia.com/visitor/detail_article.asp?ArticleID=8337

[12] – https://ebizfiling.com/blog/documents-required-for-section-12a-and-80g-registration/

[13] – https://www.taxmanagementindia.com/visitor/detail_article.asp?ArticleID=11735

[14] – https://taxguru.in/corporate-law/long-online-section-12a-registration-process-take.html

[15] – https://www.indiafilings.com/12a-80g-registration