Understanding the taxation of dividends in India is crucial for investors aiming to optimize their returns in 2025. With evolving tax laws, staying informed about how dividends are taxed, the types of dividends, disclosure requirements in Income Tax Returns (ITR), and the treatment in the hands of companies is essential.

This blog post breaks down these aspects, highlighting the intricacies involved to help you navigate dividend taxation effectively.

What is a Dividend?

A dividend is a portion of a company’s profits distributed to its shareholders as a reward for their investment. It’s a popular source of passive income for investors in stocks, mutual funds, or other financial instruments. However, dividends are subject to taxation in India, and the rules governing them have seen significant changes in recent years.

Types of Dividends in India

Before diving into taxation, let’s explore the different types of dividends recognized under Indian tax laws:

- Regular Dividends

These are periodic payouts (monthly, quarterly, or annually) declared by a company from its profits. They can be:- Final Dividend: Declared at the Annual General Meeting (AGM) after the financial year ends.

- Interim Dividend: Paid during the financial year, based on interim profits.

- Deemed Dividends

Under Section 2(22)(e) of the Income Tax Act, certain payments, such as loans or advances to shareholders with substantial shareholding in closely, held companies, are treated as dividends for tax purposes. This prevents companies from distributing profits tax-free. - Dividends from Foreign Companies

Dividends received from foreign companies by Indian residents are also taxable, often subject to Double Taxation Avoidance Agreements (DTAAs) to avoid paying tax twice. - Mutual Fund Dividends

Dividends from mutual funds, whether equity-oriented or debt-oriented, are treated similarly to company dividends for taxation purposes. Though some experts argue that the dividends paid by Mutual Funds are in the nature of Income & Capital Distribution and not dividend distribution. - Stock Dividends

Instead of cash, companies may issue additional shares to shareholders. While not immediately taxable, they impact capital gains tax upon sale.

Understanding these types helps investors anticipate their tax obligations based on the source and nature of dividends.

Taxation of Dividends in India

Since the Finance Act, 2020, the taxation of dividends has shifted significantly. Here’s how dividends are taxed:

1. Taxability in the Hands of Shareholders

- Resident Individuals: Dividends are taxable under the head “Income from Other Sources” as per the individual’s applicable income tax slab rates (ranging from 0% to 30%, plus surcharge and cess). For high-income earners (income above ₹1 crore), the effective tax rate can reach 35.88%.

- Non-Resident Individuals: Dividends are taxed at 20% (plus surcharge and cess), subject to relief under DTAAs. Non-residents must provide documents like Form 10F and tax residency certificates to avail lower treaty rates.

- Companies: Domestic companies receiving dividends are taxed at their applicable corporate tax rates (15%, 22%, or 30%, depending on the tax regime). Section 80M allows a deduction for dividends distributed to shareholders to avoid cascading tax effects.

2. TDS on Dividends

- Companies and mutual funds deduct Tax Deducted at Source (TDS) at 10% on dividend payments exceeding ₹10,000 in a financial year for residents (increased from ₹5,000, effective April 1, 2025, per Union Budget 2025). Without a valid PAN, the TDS rate rises to 20%.

- For non-residents, TDS is deducted at 20% (or lower DTAA rate, if applicable).

- Residents with income below the basic exemption limit can submit Form 15G (or Form 15H for senior citizens) to avoid TDS.

🔗Related Content: Rationalisation of TDS and TCS Provisions

3. Advance Tax Liability

If the tax liability on dividend income exceeds ₹10,000 in a financial year, shareholders must pay advance tax. This applies only after the dividend is declared or paid, reducing the burden of estimating income in advance.

4. Deductions Available

- Shareholders can claim a deduction of up to 20% of gross dividend income for interest expenses incurred to earn dividends (e.g., interest on loans taken to buy shares). Other expenses, like commissions, are not deductible.

Treatment in the Hands of the Company

Before 2020, companies paid Dividend Distribution Tax (DDT) at 15% (effective rate ~20.56% with surcharge and cess), and dividends were tax-free for shareholders. The abolition of DDT shifted the tax burden to shareholders, but companies still have responsibilities:

- TDS Deduction: Companies must deduct TDS on dividend payments as per the rates mentioned above and deposit it with the government.

- Reporting Requirements: Companies report dividend payments and TDS details in Form 26Q (for residents) or Form 27Q (for non-residents).

- Section 80M Compliance: Domestic companies receiving dividends can claim a deduction under Section 80M for dividends distributed to their shareholders, ensuring no double taxation on inter-corporate dividends.

This shift has made dividend distribution more attractive for companies, as they no longer bear the DDT burden, encouraging profit-sharing with investors.

Disclosure of Dividend Income in ITR

Proper disclosure of dividend income in your Income Tax Return (ITR) is mandatory to ensure compliance and avoid penalties. Here’s how to report it:

- Head of Income: Report dividend income under “Income from Other Sources” in ITR forms (ITR-1, ITR-2, ITR-3, or ITR-4, depending on your income profile).

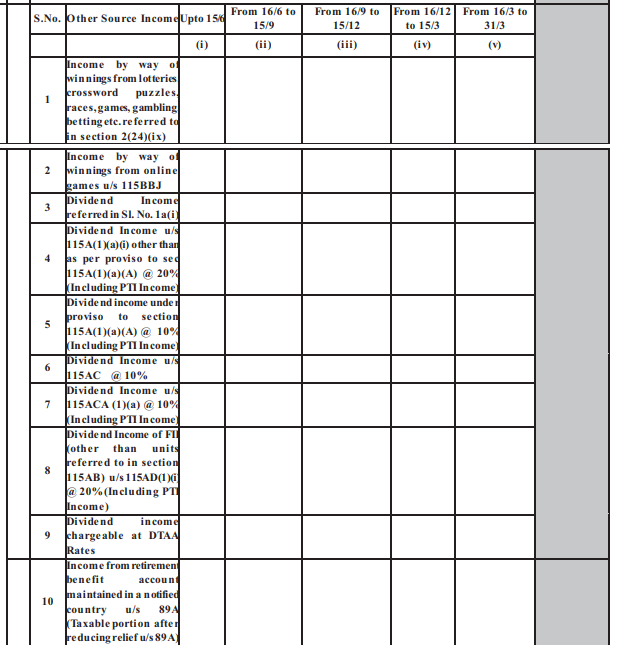

- Quarterly Breakup: Since FY 2020-21, ITR forms require a quarter-wise breakup of dividend income (e.g., April-June, July-September, etc.) to align with advance tax calculations.

- TDS Credit: Claim credit for TDS deducted by the company or mutual fund, as reflected in Form 26AS or AIS (Annual Information Statement).

- Foreign Dividends: Report dividends from foreign companies under the same head, claiming foreign tax credits under Section 90/91 or DTAA provisions to avoid double taxation.

- Pre-Filled ITRs: The Income Tax Department pre-fills dividend income details based on third-party data. Always cross-check these entries for accuracy.

Use the appropriate ITR form based on your income sources, and consult a tax professional if you’re unsure about complex cases like foreign dividends or deemed dividends.

Issues involved in Dividend Taxation

Dividend taxation in 2025 comes with several nuances that investors must navigate:

- Double Taxation Concerns

- Dividends face taxation at two levels: first, the company pays corporate tax on profits, and then shareholders pay tax on dividends. This effective tax rate can reach ~48.51% for high-income individuals, discouraging dividend payouts.

- For foreign dividends, double taxation is mitigated through DTAAs, but claiming credits requires meticulous documentation.

- Deemed Dividend Complexity

- Loans or advances to shareholders with substantial interest (10% or more voting power) in closely-held companies are treated as dividends under Section 2(22)(e). This rule aims to curb tax evasion but can complicate legitimate transactions.

- Exceptions exist for loans in the ordinary course of business, but proving intent is challenging.

- TDS Threshold and Compliance

- The increased TDS threshold of ₹10,000 benefits small investors, but those receiving dividends from multiple sources may still face TDS deductions, requiring refund claims during ITR filing.

- Non-residents face higher compliance burdens, needing to submit Form 10F, tax residency certificates, and declarations to avail DTAA benefits.

- Advance Tax Calculations

- Estimating dividend income for advance tax is tricky, as dividends are declared at the company’s discretion. The rule allowing advance tax liability post-declaration helps, but investors must stay vigilant.

- Mutual Fund Dividends

- Dividends from mutual funds are taxed similarly to company dividends, but investors often overlook this, assuming mutual fund returns are tax-free. This misconception can lead to underreporting.

- Impact on Investment Decisions

- High tax rates on dividends may push investors toward capital gains (taxed at 12.5% for long-term gains above ₹1.25 lakh in 2025), affecting company policies on profit retention versus distribution.

Conclusion

The taxation of dividends in India in 2025 reflects a balance between simplifying compliance for companies and ensuring revenue for the government. With the abolition of DDT, shareholders bear the tax burden, making it critical to understand the types of dividends, TDS rules, ITR disclosure requirements, and the company’s role. The intricacies—double taxation, deemed dividends, and compliance challenges require careful planning to maximize returns.

Stay informed, report your income diligently, and consult a tax professional to navigate the complexities of dividend taxation. By doing so, you can make informed investment decisions and optimize your tax liability in 2025.