Taxation of Virtual Digital Assets has been a hot topic of discussion over the past few years. The rise of Virtual Digital Assets (VDAs) like cryptocurrencies, NFTs, and tokenized assets has transformed the financial landscape globally, and India is no exception. As these digital assets gain traction, the Indian government has introduced a robust taxation framework under the Income Tax Act to regulate and monitor their transactions.

With the Income Tax Bill, 2025 set to replace the Income Tax Act, 1961, starting April 1, 2026, this blog explores the current taxation provisions for VDAs, the need for such taxation, its disadvantages, and how the rules have evolved over the years. Let’s dive right in.

What Are Virtual Digital Assets (VDAs)?

Virtual Digital Assets (VDAs) were defined under Section 2(47A) of the Income Tax Act, (introduced in the Finance Act, 2022). The definition states that VDAs are any information, code, number, or token (excluding Indian or foreign fiat currency) generated through cryptographic means or otherwise, capable of being transferred, stored, or traded electronically.

This includes cryptocurrencies like Bitcoin and Ethereum, NFTs, and other blockchain-based assets.

Source: Income Tax India

Are the transactions in VDAs legal?

The legality of transactions in Virtual Digital Assets (VDAs) in India has been a subject of evolving clarity. As of 2025, VDAs such as cryptocurrencies and NFTs are not recognized as legal tender by the Reserve Bank of India (RBI), meaning they cannot be used as an official medium of exchange or payment for goods and services in place of the Indian Rupee.

However, the H’ble Supreme Court’s 2020 ruling in Internet and Mobile Association of India v. RBI overturned the RBI’s 2018 circular banning banks from dealing with crypto entities, effectively legalizing VDA transactions. The government has since then, regulated these transactions under the Income Tax Act, taxing income from VDAs under Section 115BBH and imposing a 1% TDS under Section 194S, signaling tacit acceptance of their legality for trading and investment purposes.

Nonetheless, the absence of a comprehensive regulatory framework beyond taxation and the looming Digital Rupee (CBDC) suggest that while VDA transactions are permissible, they operate in a grey area, subject to future legislative developments.

Provisions for Taxation of Virtual Digital Assets

As of 2025, the taxation of VDAs in India is governed by the following key provisions of the Income Tax Act:

Section 115BBH:

Tax Rate

Income arising from the transfer of VDAs, whether through sale, exchange, or any other disposal, is taxed at a flat rate of 30%, irrespective of the taxpayer’s income slab. This is supplemented by applicable surcharge and a 4% health and education cess, pushing the effective tax rate higher for high-income individuals.

Allowable Deductions

The only deduction permitted is the cost of acquisition of the VDA.

For example, if you buy Bitcoin for ₹10 lakh and sell it for ₹15 lakh, only the ₹10 lakh can be deducted, and the ₹5 lakh profit is taxed at 30%.

No other expenses such as transaction fees, wallet maintenance costs, or electricity expenses for mining are deductible, making this a stringent provision compared to other asset classes like stocks or real estate.

No Loss Set-Off or Carry-Forward

Losses incurred from VDA transactions cannot be offset against gains from other VDAs or any other head of income. Moreover, these losses cannot be carried forward to future years.

For instance, if you lose ₹2 lakh on an Ethereum trade but gain ₹3 lakh on a Bitcoin trade in the same year, you’ll still pay tax on the full ₹3 lakh gain without adjusting for the loss. Though there is a loss available in the same year, it cannot be offset against the gains. Thus the present provisions of the Income Tax Act, taxes the real gains while ignoring any losses or expenses.

Meaning of Transfer

The term “transfer” under Section 115BBH includes not just sales but also swapping one VDA for another, gifting VDAs, or staking rewards converted to income, ensuring a broad tax net.

Section 194S:

Section 194S mandates a 1% TDS on payments made for the transfer of VDAs if the transaction value exceeds ₹50,000 in a financial year (or ₹10,000 for specified persons, such as non-residents or those without a PAN linked to Aadhaar). This applies to individuals, exchanges, or peer-to-peer transactions.

The responsibility to deduct TDS typically falls on the payer. For example, if you sell ₹1 lakh worth of Bitcoin on an exchange, the exchange deducts ₹1,000 as TDS before crediting your account. In P2P transactions without an intermediary, the buyer must deduct and deposit the TDS, which complicates compliance for individual traders.

Income Tax Bill, 2025 Updates:

The Income Tax Bill, 2025, classifies VDAs as “undisclosed income” under search and seizure operations (Section 247), aligning them with traditional assets like gold or jewellery.

If undisclosed VDA gains are detected during raids, a 60% tax plus a 50% penalty on the tax amount (effectively up to 90% taxation) can be imposed.

The definition of VDAs has been broadened to explicitly include “crypto-assets utilizing cryptographic security and distributed ledger technology,” ensuring no loopholes remain.

The Bill refines the definition of VDAs under Section 2(47A) to explicitly cover “crypto-assets utilizing cryptographic security and distributed ledger technology or similar mechanisms,” closing loopholes that might exclude emerging digital assets like tokenized real estate or metaverse properties.

With the bill offering to empower the tax officer to access digital records, it would prove to be difficult for tax evaders for non-disclosure.

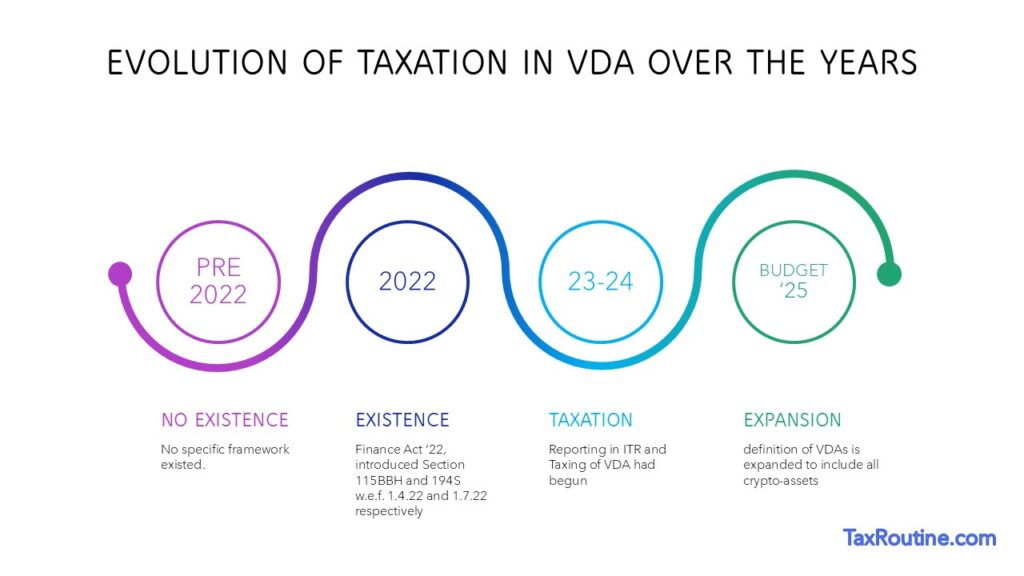

VDA Taxation Over the Years

The taxation of VDAs in India has evolved significantly since its inception:

- Pre-2022: No specific framework existed. Crypto gains were taxed as capital gains or business income based on individual interpretation, leading to ambiguity.

- Budget 2022: The Finance Act, 2022, introduced Section 115BBH and Section 194S, formalizing a 30% tax and 1% TDS on VDAs, effective April 1, 2022, and July 1, 2022, respectively.

- 2023-24: Schedule VDA was added to ITR forms, mandating detailed reporting of crypto transactions.

- Budget 2025: The definition of VDAs was expanded to include all crypto-assets using distributed ledger technology. Reporting entities (e.g., banks, exchanges) were required to submit transaction data, effective April 1, 2026.

- Income Tax Bill, 2025: Set to replace the 1961 Act, it integrates all prior amendments, introduces harsher penalties for undisclosed VDAs, and enhances digital scrutiny powers, effective April 1, 2026.

Conclusion: Balancing Regulation and Innovation

The taxation of VDAs in India reflects a cautious yet firm approach to regulating a nascent asset class. While it ensures revenue and oversight, the high tax rates, lack of loss offsets, and privacy concerns pose challenges for investors and the industry.

As the Income Tax Bill, 2025 is still under review, stakeholders hope for reforms such as reducing the tax rate to below 30% or allowing loss carry-forwards to foster a more balanced and favourable ecosystem.

Also See:

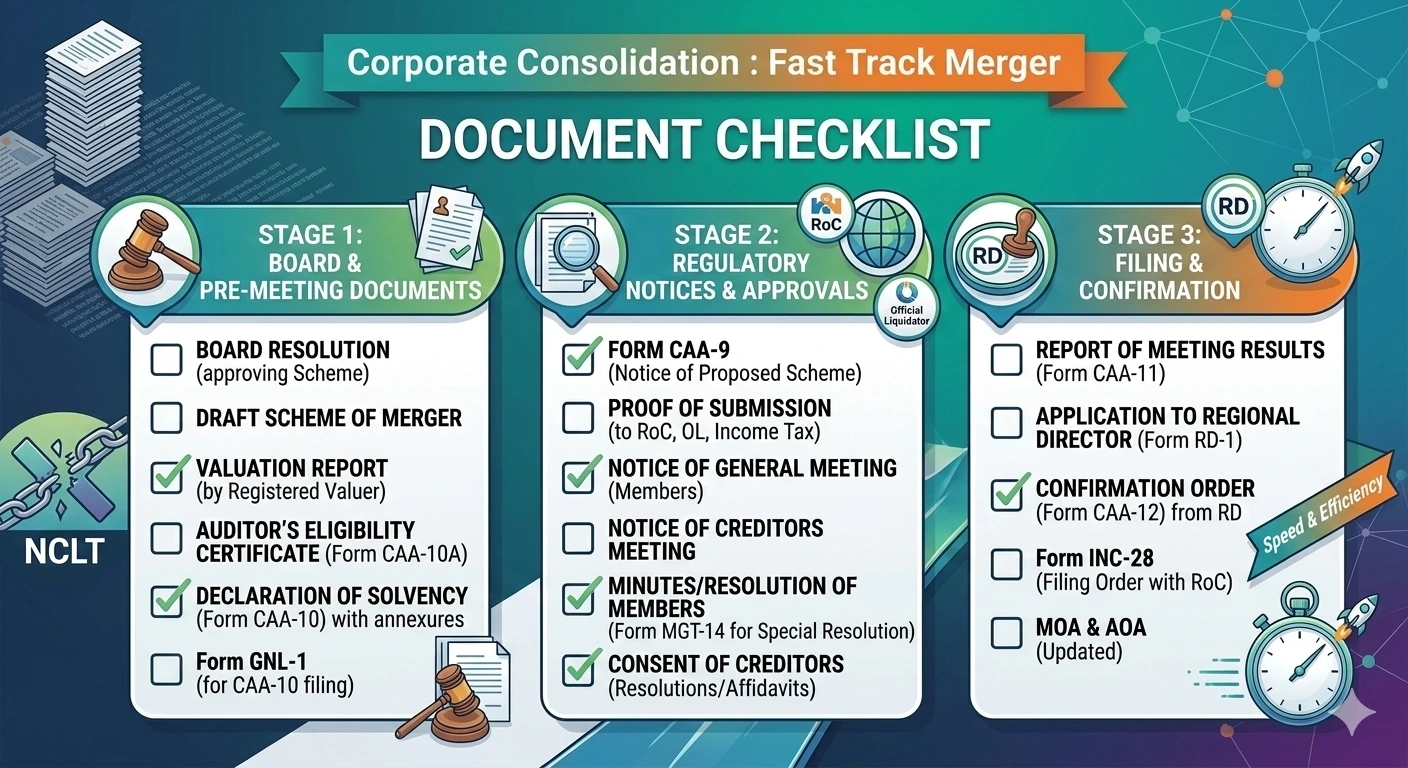

- Tax Implications of Fast-Track Mergers in India

- Fast-Track Merger Document Checklist (Section 233 – Practitioner Guide)

- Streamlining Corporate Consolidation: A Guide to Fast Track Mergers for Group Companies

- Compliance Calendar March 2026

- GST Cash Ledger vs. Income Tax “Cash Ledger”: Concept and Challenges

- Multiple GST SCNs for same year permissible : Madras HC