Introduction

Reverse Charge Mechanism (RCM) is a mechanism wherein the recipient of the supply of goods or services is liable to pay GST in respect of certain notified goods or services.

As per Section 2(98) of the CGST Act, “Reverse charge” means

- the liability to pay tax by the recipient of supply of goods or services or both

- instead of the supplier of such goods or services or both

- under sub-section (3) or sub-section (4) of section 9,

- or under sub-section (3) or sub-section (4) of section 5 of the Integrated Goods and Services Tax Act.

Time of Supply under RCM

Time of supply under RCM is different than that of the supplies which are liable under forward charge.

In the case of supply of goods, the time of supply is earliest of:

- Date of receipt of goods; or

- Date of payment as per books of account or date of debit in bank account, whichever is earlier; or

- The date immediately following 30 days from the date of issue of invoice or similar other document.

In the case of supply of services, the time of supply is earliest of:

- Date of payment as per books of account or date of debit in bank account, whichever is earlier; or

- The date immediately following sixty days from the date of issue of invoice or similar other document.

Where it is not possible to determine time of supply using above methods, time of supply would be date of entry in the books of account of the recipient.

Payment of Tax under RCM and ITC Eligibility

Any amount payable under Reverse charge has to be discharged by debiting the electronic cash ledger. In other words, RCM cannot be paid through the available Input Tax credit. However, after payment of RCM through cash, the credit of the same can be taken, if he is eligible.

Invoice level information in respect of all supplies attracting reverse charge, rate wise, are to be furnished separately in the table 4B of GSTR-1. Advance paid for reverse charge supplies is also leviable to GST. The person making advance payment has to pay tax on reverse charge basis.

List of Goods and services notified under RCM

The list of goods on which RCM is applicable has been originally notified by way of Notification No.4/2017-Central Tax (Rate) dated 28th June 2017. Further these goods were amended with further notifications. The latest notification was issued on 30th December 2022 by way of Notification No. 14/2022-Central Tax (Rate).

The list of goods on which RCM is applicable is as follows:

| Description of Goods | Supplier of Goods | Recipient of Goods |

|---|---|---|

| Cashew nuts, not shelled or peeled | Agriculturist | Any registered person |

| Bidi wrapper leaves (tendu) | Agriculturist | Any registered person |

| Tobacco leaves | Agriculturist | Any registered person |

| Silk Yarn | Manufacturer of silk yarn from raw silk or silk-worm cocoons for supply of silk-yarn | Any registered person |

| Raw cotton | Agriculturist | Any registered person |

| Supply of lottery | State Government, Union Territory or any local authority | Lottery distributor or selling agent. |

| Used vehicles, seized and confiscated goods, old and used goods, waste and scrap | Central Government, State Government, Union territory or a local authority | Any registered person |

| Priority Sector Lending Certificate | Any registered person | Any registered person |

| Following essential oils other than those of citrus fruit namely: – a.Of peppermint (Mentha piperita); b.Of other mints : Spearmint oil (ex-mentha spicata), Water mint-oil (ex-mentha aquatic), Horsemint oil (ex-mentha sylvestries), Bergament oil (ex-mentha citrate), Mentha arvensis | Any registered person | Any registered person |

The list of services on which RCM is applicable is as follows:

| Description of Services | Supplier of Services | Recipient of Services |

|---|---|---|

| Transport Services | Goods Transport Agency (GTA) GTA to charge GST at 5% and is required to issue a consignment note | i. Factories (under Factories Act, 1948) ii. Societies (registered under Societies Registration Act, 1860) iii. Co-operative societies iv. GST-registered persons v. Companies or body corporates vi. Partnership firms (registered or unregistered) vii. Casual taxable persons |

| Legal Services | Individual Advocates, Senior Advocate, or a law firm (including LLPs) | Any business entity |

| Arbitrary Services | Sole arbitrator or a panel of arbitrators | Any business entity |

| Services received from Director of a company | Director of a company | To a company or a body corporate |

| Security Services | Non – Body Corporates (individuals, firms) | Registered persons |

| Renting of Motor Vehicle | Non – Body Corporates (individuals, firms) | Any Body corporate |

| Lease of Land (30 years or more) against consideration in the form of upfront amount | Central Government, State Government, Union Territory, or local authority | Any person registered under GST |

| Services supplied by a person located in non-taxable territory to a taxable person and Services of overseas Committee | Located in non-taxable territory (e.g Import of services) | Located in taxable territory |

| Renting of Residential property | Registered / unregistered person | Registered person |

| Renting of Commercial property | Unregistered person | Registered person |

| Sponsorship services | Any person | Body corporate/ Partnership Firm / LLP |

| Services of insurance Agent | Any Person | Insurance company |

| Services of Recovery Agent | Any person who is a recovery agent | Bank, Financial Institution or NBFC |

| Services of lending of securities under Securities Lending Scheme, 1997 (“Scheme”) of Securities and Exchange Board of India (“SEBI”) | Person lending securities through approved intermediaries | Borrower of the securities |

| Copyright Services | Author, music composer, photographer, artist permitting the use of copyrights | Recipient of the services |

| Services of Individual Direct Selling Agents (DSAs) | Individual DSAs | Banks or NBFCs |

| Transfer of Development rights or Floor Space Index (FSI) for construction of a project | Land owner or any person transferring such rights | Promoter / developer of the real estate project |

| Services of a Business Facilitator | Business Facilitator | Banks |

| Services of a Business Correspondent | Agent of Business Correspondent | Business Correspondent |

Reporting of RCM in GST Returns

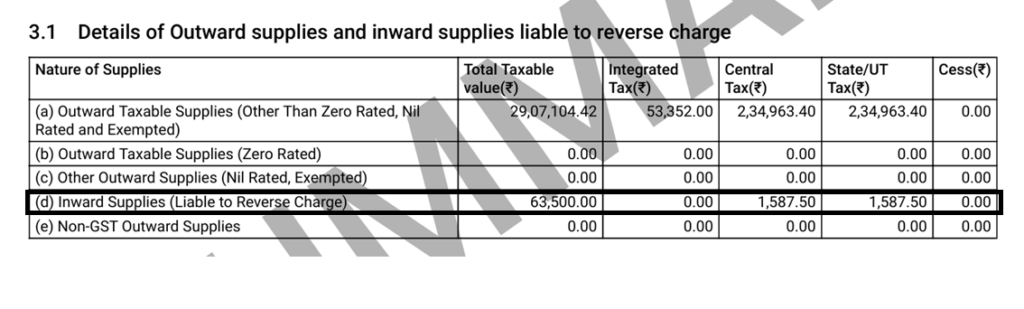

The liability payable on account of RCM has to be reported in Table 3.1(d) – Inward Supplies (liable to RCM).

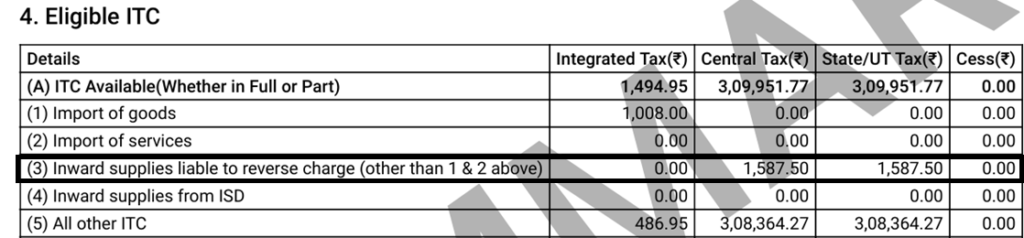

After payment of the liability on account of RCM through payment of cash, the same can be claimed as Input Tax Credit (ITC) in Table 4(A)(3) – Inward Supplies liable to reverse charge.

Conclusion

It is important for every registered person to ensure that GST liability under Reverse Charge Mechanism (RCM) is duly discharged in respect of any goods or services received that are notified under RCM.

Failure to discharge RCM liability will attract interest under Section 50 of the CGST Act, 2017 at the rate of 18% per annum, along with penalty and other consequences as may be applicable under the provisions of the Act.