What is GST Refund?

GST Refunds refer to claiming of excess taxes paid by the recipient in the case of Zero rated supplies of goods or services , claiming of tax paid on deemed exports of goods, claiming unutilized input tax credit.

Situations in which GST Refund to be claimed?

In the following cases Refund under GST can be claimed:

- Export/supply to SEZ unit/ developer on payment of IGST

- Unutilized ITC in the case of Export/supply to SEZ developer/ unit on payment of IGST or in case of inverted duty structure.

- Refund of tax paid on supply of goods regarded as deemed exports.

- Refund of any balance in the electronic cash ledger after payment of tax, interest, penalty, fee or any other amount payable under this Act.

- Refund on account of tax paid on a supply which is not provided, either wholly or partially, and on which no tax invoice has been issued (tax paid on advance payment)

- Refund of tax wrongly collected and paid to the Government (i.e CGST & SGST paid treating the supply as intra-state supply which is subsequently held as inter-state supply and vice-versa).

- Refund of the IGST paid by tourist leaving India on any supply of goods taken out of India by him (Section 15 of IGST Act).

- Tax becomes refundable as a consequence of Judgement, decree, order or direction of the Appellate Authority, Appellate Tribunal or any Court.

- On finalization of provisional assessment, if any tax becomes refundable (on account of assessed tax on final assessment being less than the tax deposited by the taxpayer (Section 60).

- Refund of taxes on purchases made by UN bodies or embassies etc. (Section 54(2))

- Refund of advance tax deposited by a casual taxable person/ Non-resident taxable person (Section 54(13)).

- Refund of additional IGST paid on account of Upward revision in price of goods subsequent to exports, and on which the refund of IGST paid at the time of export of such goods has already been sanctioned (Section 54(1)).

- Refund of excess tax paid.

How to File an application for GST Refund?

The application for GST Refund has to be filed in Form GST RFD – 01. This form has to be filed online in the GST portal by logging into the portal.

The step by step procedure on how to file an GST Refund application is explained hereunder in detail.

Step 1 : Login into the GST Portal

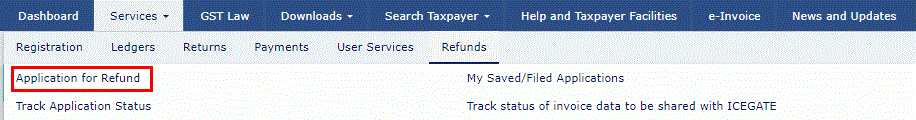

Step 2 : Navigate to Services > Refunds > Application for Refund option.

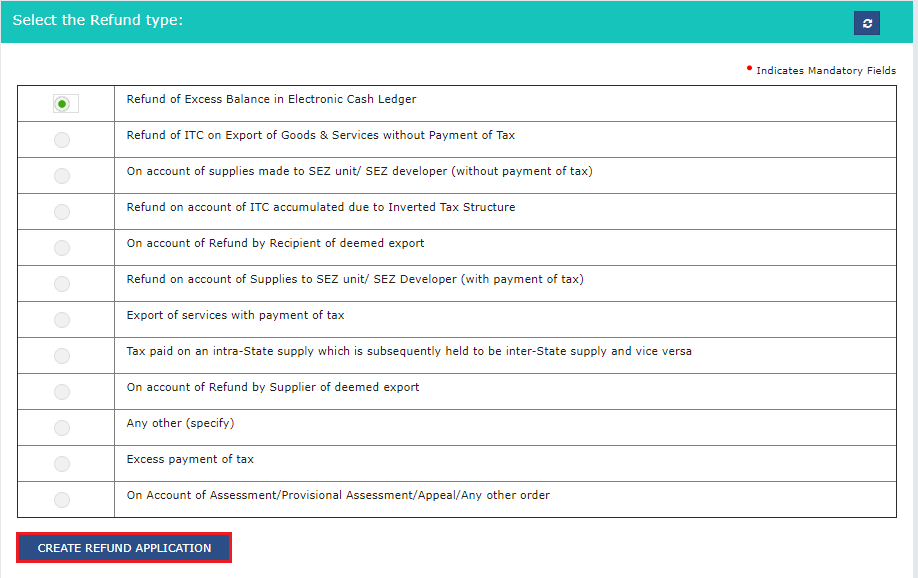

Step 3 : Select the reason for which the refund application is filed from the drop down list provided.

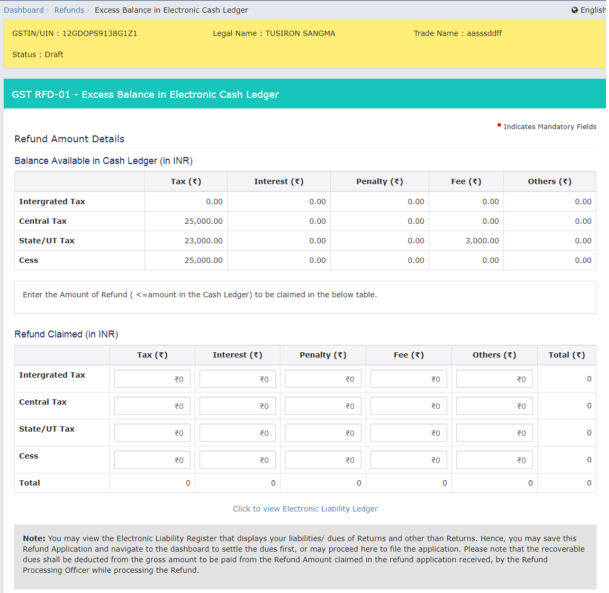

Step 4 : GST RFD – 01 page is displayed with the balance available in the Cash ledger.

Step 5 : Enter the amount of Refund to be claimed for Integrated Tax, Central Tax, State/ UT Tax and Cess in table “Refund Claimed”

Note : The amount of refund to be claimed cannot be more than the balance amount available in Electronic Cash Ledger.

You can click the hyperlink Click to view Electronic Liability Ledger to view details of Electronic Liability Ledger that displays your liabilities/ dues of Returns and other than Returns.

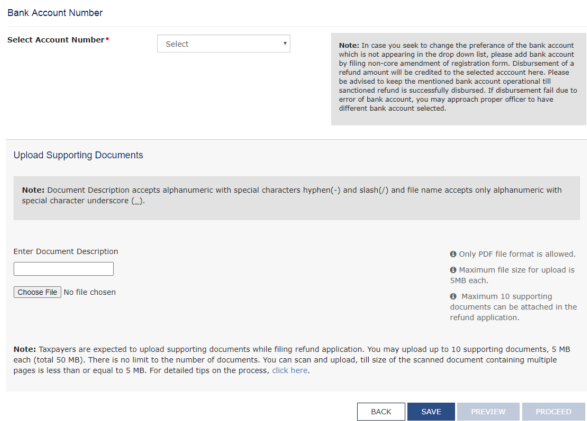

Step 5 : Select the Account Number from the Select Account Number drop-down list.

Note : In case you are a casual taxable person or Non-Resident taxpayer, whose registration was not granted and want to claim refund of excess amount available in Electronic Cash Ledger, you can login to the GST Portal using TRN (Temporary Reference Number) and enter Bank details.

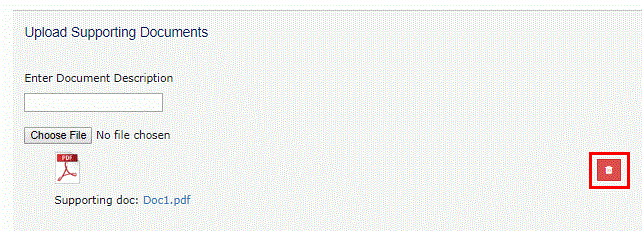

Step 6 : Under section upload Supporting Documents, you can upload supporting documents (if any). Enter the Document description, then click on the Add Document Button.

Step 7 : Click on the Save button. After saving the application a dialogue box will be appeared saying that “Your application has been saved. You can retrieve this application and submit within 15 days from today. You can access the Application from Services > Refunds > My Saved/Filed Applications and file on the GST Portal.”

Step 8 : Click on the Preview Button to preview the filled form after that click on the proceed button to be navigated to the next page.

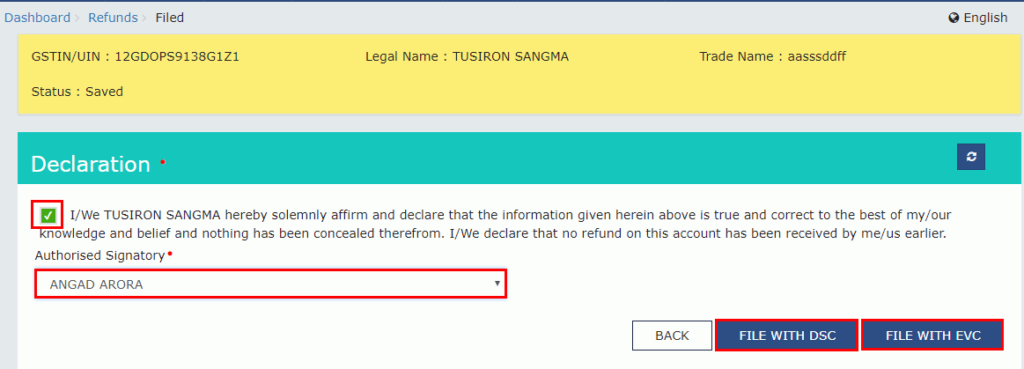

Step 9 : The next step is to submit the application either by filing it with the EVC code or by using Digital Signature (DSC).

Step 10 : After submitting the application either with an EVC or using DSC an ARN will be generated which can be downloaded for future references.

Time limit to apply for GST Refund

Any person claiming refund of tax, interest, or any other amount paid by him may make an application before the expiry of 2 Years of the Relevant Date in the prescribed form.

Meaning of Relevant Date

Relevant Date as been defined in Explanation 2 to Section 54. Let us see what is a relevant date in each case

Case 1 : In case of export of goods out of India where refund of tax paid is available in respect of goods themselves or as the case may be, the input/input services used in such goods

| (i) goods are exported by Sea or Air | Date on which the ship or the aircraft in which such goods are loaded, leaves India |

| (ii) goods are exported by Land | Date on which such goods pass the frontier |

| (iii) goods are exported by post | Date of dispatch of goods by the Post Office concerned to a place outside India |

Case 2 : Supply of goods as Deemed Exports where a refund of tax paid is available in respect of goods.

Relevant Date in this case : Date on which the return relating to such Deemed exports is furnished.

Case 3 : Supply of Zero-rated goods or services or both to a SEZ unit or developer where refund of tax paid is available in respect of such supplies.

Relevant Date in this case : Due date for furnishing return under section 39 in respect of such supplies

Case 4 : Services Exported out of India where refund of tax paid is available in respect of services themselves

| (i) supply of services had been completed prior to the receipt of payment | Date of receipt of payment in convertible foreign exchange payment or in INR wherever permitted by Reserve Bank of India |

| (ii) payment for the services had been received in advance prior to the date of issue of invoice | Date of issuance of invoice |

Case 5 : Where tax becomes refundable as a consequence of Judgement, decree, order or direction of the Appellate Authority/Tribunal or any court

Relevant Date in this case : Date of communication of such judgement, decree, order or direction

Case 6 : In case of refund of unutilised ITC on account of inverted duty structure

Relevant Date in this case : Due date for furnishing return under section 39 for the period in which claims for refund arises.

Case 7 : Tax is paid on provisionally under this Act/rules

Relevant Date in this case : Date of adjustment of tax after the final assessment

Case 8 : In case of a person, other than supplier

Relevant Date in this case : Date of receipt of goods or services or both by such person

Case 9 : Any other case

Relevant Date in this case : Date of payment of tax

- Major changes to composition dealers for payment of Reverse Charge

- Comprehensive Understanding of RCM and list of goods & services notified

- Hard Locking of GSTR 3B

- Major change in Rule 10A – Furnishing of Bank Accounts

- Understanding Changes in GSTR-9 for FY 2024-25

- GST 2.0 Reforms – Simplified tax rates