Finance Bill 2025 Passed in Lok Sabha

The Lok Sabha on Tuesday, the 25th of March, 2025 passed the Finance Bill 2025, clearing a major legislative step toward implementing the proposals outlined in the Union Budget 2025-26. The Bill was moved by the H’ble Finance Minister, Mrs. Nirmala Sitaraman with 35 amendments being proposed by the Government. The Bill was passed with majority in the Lok Sabha.

The Bill in Lok Sabha

The Finance Bill, 2025 was Tabled before the Parliament in the Lok Sabha by the H’ble Finance Minister on February 1, 2025 proposing various tax reforms, with a total expenditure of Rs 50.65 trillion, an increase of 7.4 per cent over the revised estimate of Rs 47.16 lakh crore for the current fiscal year 2024-25. The bill was presented to the members for further consideration.

The H’ble Finance minister re-presented the Bill with 35 further amendments proposed by the Government including certain significant amendments on 24.03.2025. This bill was discussed in the house. Economic mismanagement, provisions relating to surveillance, FII outflow and unilateral zero tariff for agriculture products, alongside inequity were among the major discussions in the house and it continued its discussion on the finance bill beyond its usual sitting time.

Finance Minister on Tuesday (March 25, 2025) said the Finance Bill 2025 provides unprecedented tax relief, and the 13.14% projected growth in personal income tax collection is “realistic” and supported by solid data. Replying to the discussions on Finance Bill 2025, the Fin Min also said the customs duty rationalisation announced in the Budget will support manufacturing units, domestic value addition, promote exports, facilitate trade and also provide relief to the common people.

Key Amendments (since the Bill was Introduced)

The Government has carried out 35 amendments to the Finance Bill, 2025 since it was introduced on 01.02.2025. Some of the major amendments are discussed here.

i. Abolition of Equalisation Levy

Section 146 of the Finance Bill proposes to remove the equalisation levy of 6% imposed on online advertisement services offered by various companies including Google, Meta etc.

The removal of the levy, popularly known as the “Google Tax” comes at a time when the United States has been threatening India with regulatory tariffs. The proposed amendment in the backdrop of India and the United States negotiating a trade agreement, with India looking to avoid reciprocal tariffs.

ii. Changes in Processing of Returns

Section 42 of the Finance Bill proposes to add a new sub clause to Section 143 of the Income Tax Act w.r.t any inconsistencies in the information furnished in the return of any preceding previous years.

iii. Total Undisclosed Income

Sections 49 and 50 of the Finance Bill introduces a new term “Total Undisclosed Income” in the place of “Total Income” in cases relating to search and seizure.

iv. Definition of Capital Asset

The Finance Bill, 2025 proposes to amend the definition of “capital asset” to include securities held by investment funds referred to in section 115UB, i.e., Category I and Category II Alternative Investment Funds regulated under the SEBI (AIF) Regulations, 2012

🔗 CBDT has issued new FAQs regarding the amendments proposed by the Government. Click here to access the FAQs

New Income Tax Bill

The Finance Minister told Parliament that the “New Income Tax Bill” will be taken up for discussion in the Monsoon Session, which will start in July.

She also said the Bill, which was introduced in the House on February 13, is currently being vetted by the Select Committee.

What Next?

With the passing of the Finance Bill 2025, the Lok Sabha has concluded its role in the Budget approval process and the baton has been passed to the upper house.

The Bill will now move to the Rajya Sabha for consideration. After the Rajya Sabha approves the Bill, the Budget process for 2025-26 will be complete, and the Finance Bill, 2025 shall stand enacted as “Finance Act, 2025“

🔗 The amended Finance Bill, 2025 (as passed by the Lok Sabha) is available in our Resources Section or you may click the download button below to download the file

Our Latest Posts:

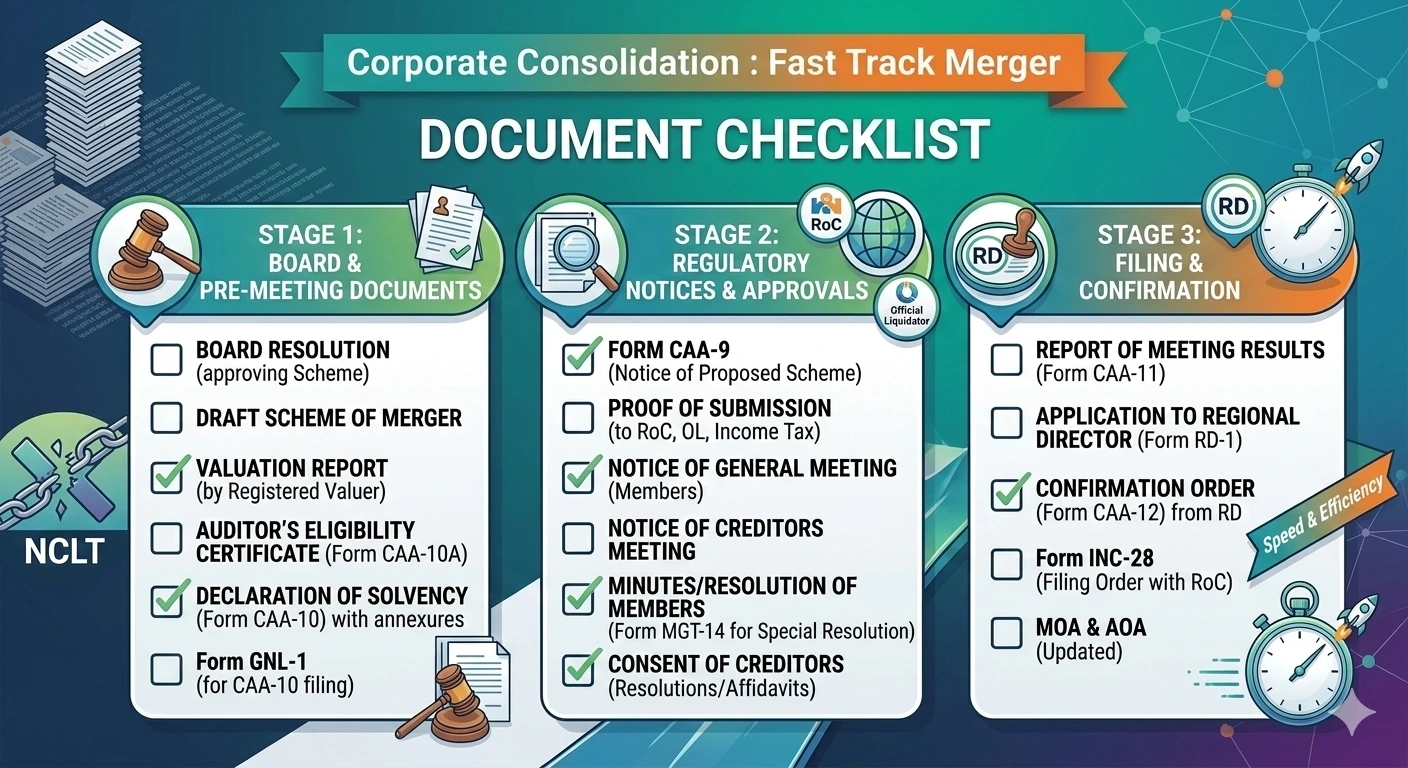

- Tax Implications of Fast-Track Mergers in India

- Fast-Track Merger Document Checklist (Section 233 – Practitioner Guide)

- Streamlining Corporate Consolidation: A Guide to Fast Track Mergers for Group Companies

- Compliance Calendar March 2026

- GST Cash Ledger vs. Income Tax “Cash Ledger”: Concept and Challenges

- Multiple GST SCNs for same year permissible : Madras HC