This article will take you deep into the step by step process of how to download the Public Documents of a company or Limited Liability Partnership from the MCA portal

What are Public Documents?

The term “Public Documents” is not expressly defined in the Companies Act, 2013. However, the provision to make the documents available to the public is contained in Section 94.

Section 94(2) of the Companies Act, 2013 states that “The registers and their indices, except when they are closed under the provisions of this Act, and the copies of all the returns shall be open for inspection by any member, debenture-holder, other security holder or beneficial owner, during business hours without payment of any fees and by any other person on payment of such fees as may be prescribed.”

Thus any document filed with the Registrar of Companies (ROC) or any register statutorily required to be maintained by the company under the provisions of the companies act become available to the general public by virtue of the words “any other person” available in Section 94(2). In simple words, the following documents can be termed as public documents.

- Incorporation Documents (Certificate of Incorporation, Memorandum, Articles etc)

- Annual Returns (including shareholding information, directorship details etc)

- Financial Statements (Balance Sheet, Profit and Loss Account, Cash Flow Statements etc)

- Changes in Company (Change in Directors, Auditors etc)

- E-Forms filed with the ROC (MSME-1, CSR forms etc)

- Any other documents filed with the ROC

- attachments included in any of the above documents

How to download Public Documents

Step 1 : Login to the MCA Portal using V3 Login

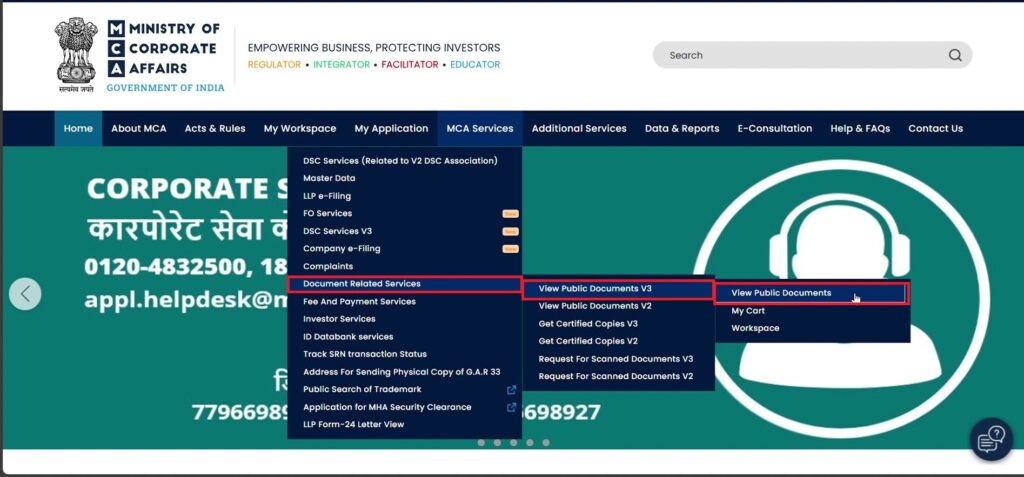

Step 2 : Click on the MCA Services then navigate to Document Related Services then navigate to View Public Documents V3 then navigate to View Public Documents

(Please note that it is important to login to the MCA portal to download any public document. If you do not have a login, you may register by clicking in the link given here – Registration Link)

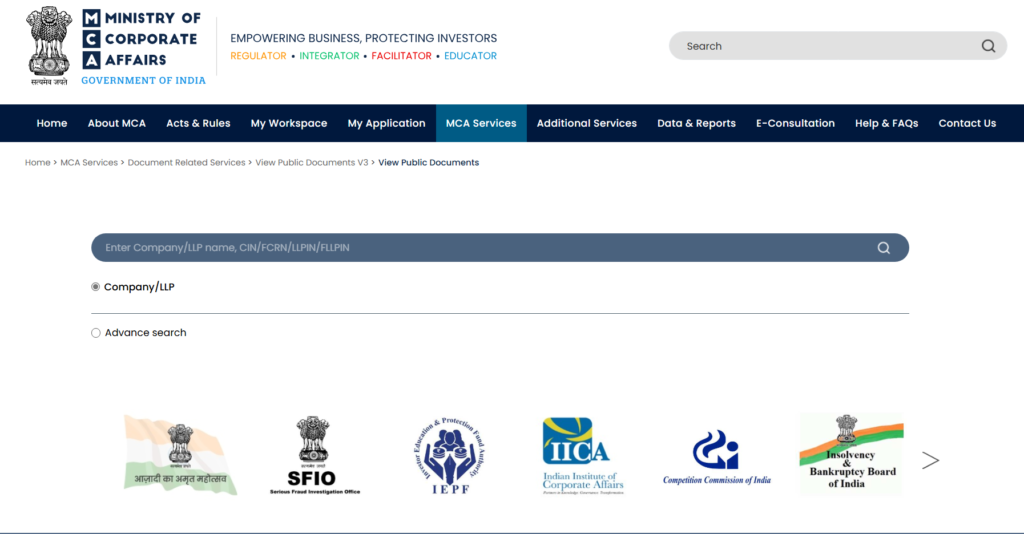

Step 3 : Enter the Company Name / LLP Name / CIN/FCRN/LLPIN/FLLPIN to search the name of the company or LLP for which you need to view the documents.

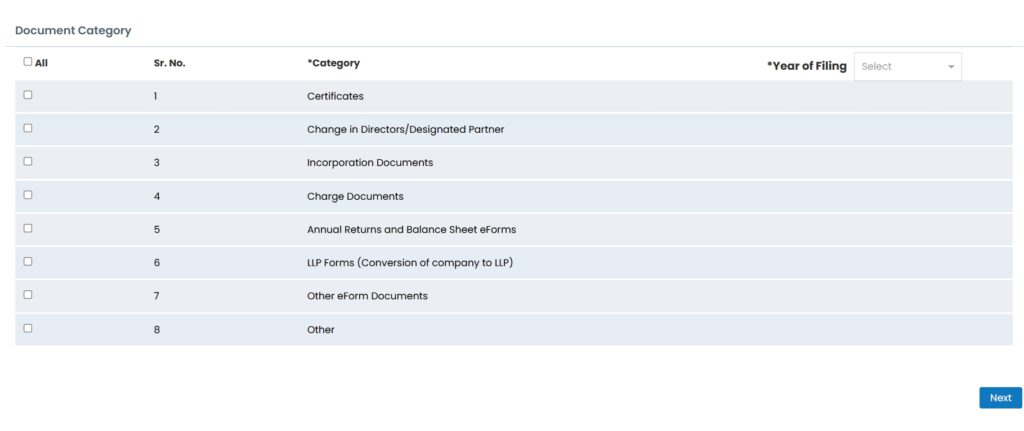

Step 4 : Select the documents which are required to be download along with the Year of filing for which the documents are required to be viewed.

Step 5 : Add Company/LLP to the Cart and Get the Fee Details

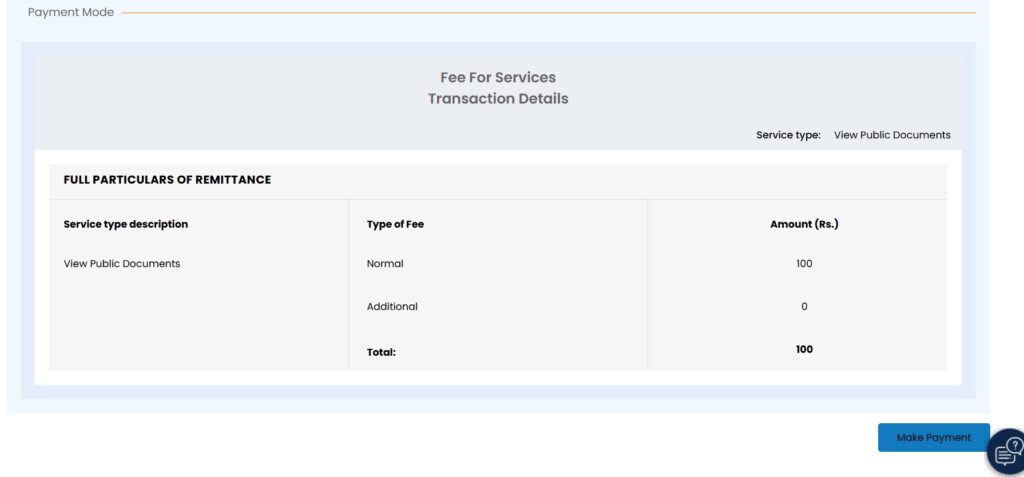

Step 6 : The page will be navigated to Payment mode .

The Fees Details are as under:

- If a company is added to the Cart – Fee is Rs.100 per Company

- If a LLP is added to the Cart – Fee is Rs.50 per LLP

Step 7 : Click on Make payment to navigate to the confirmation of the information.

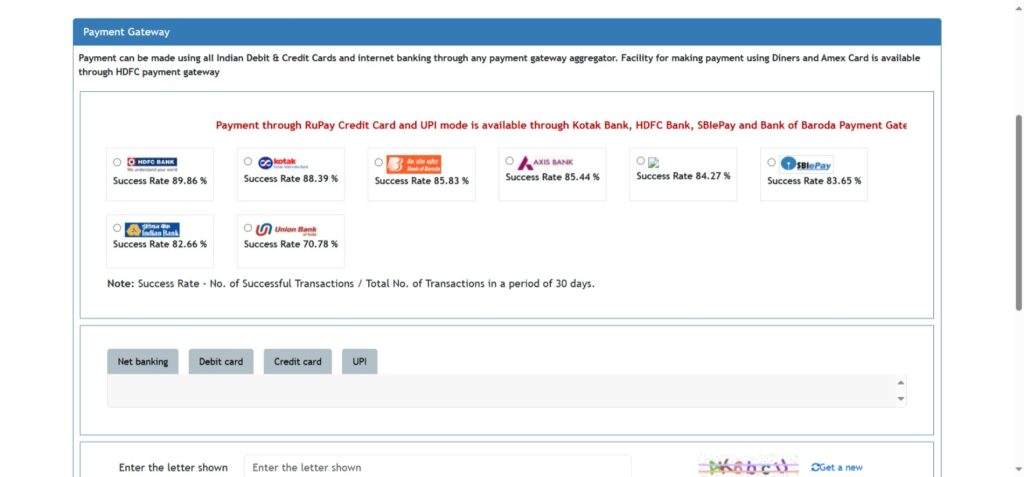

Step 8 : After confirming the information the page will be navigated to the payment gateway page.

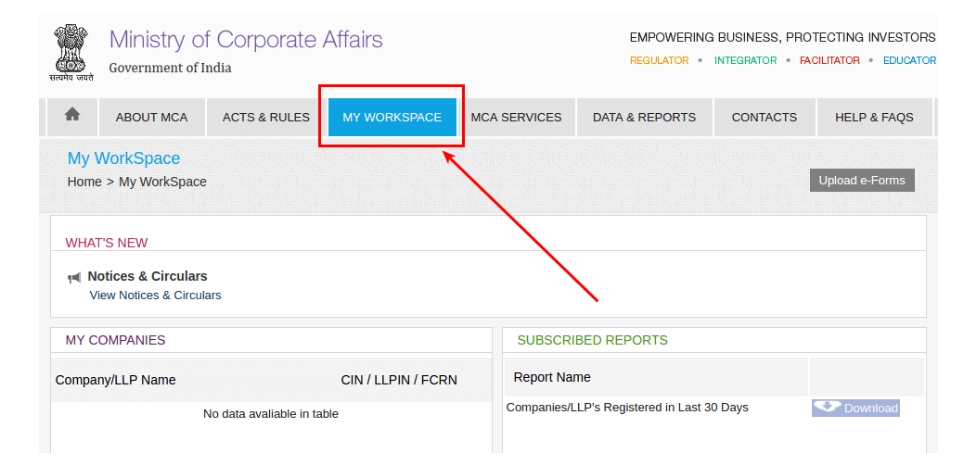

Step 9 : After the payment is made an acknowledgement receipt will be generated. After this to download the documents you need to navigate to My workspace.

Step 10 : After you navigate to My workspace you can see the companies / LLPs which you have purchased.

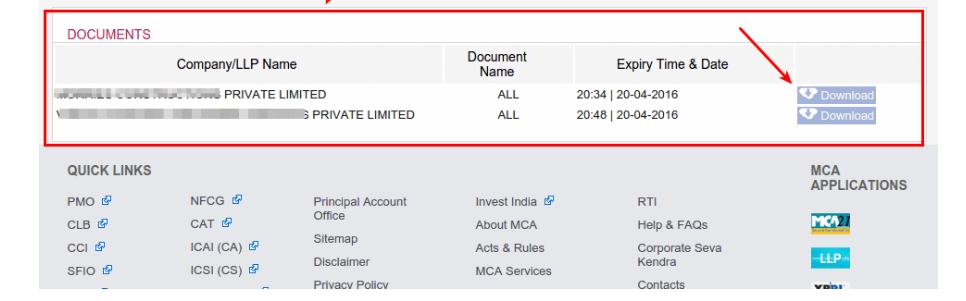

Step 11 : Click on the Download button for each company that you want to check the Public Documents.

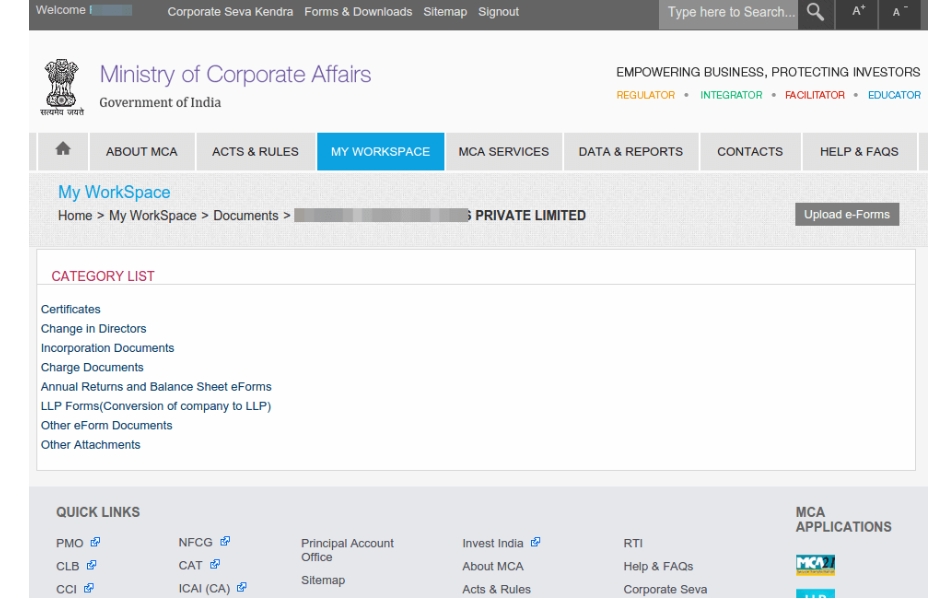

Step 12 : When you Click on Download option, you will see the company name and list of Categories for Documents. Click on each category to browse documents for that company.

Step 13 : Click on the Category Name, you will be taken to the Document List. Click on the Document Name, to download the PDF version of the document. Please do not forget to save the document in your local computer.

- Tax Implications of Fast-Track Mergers in India

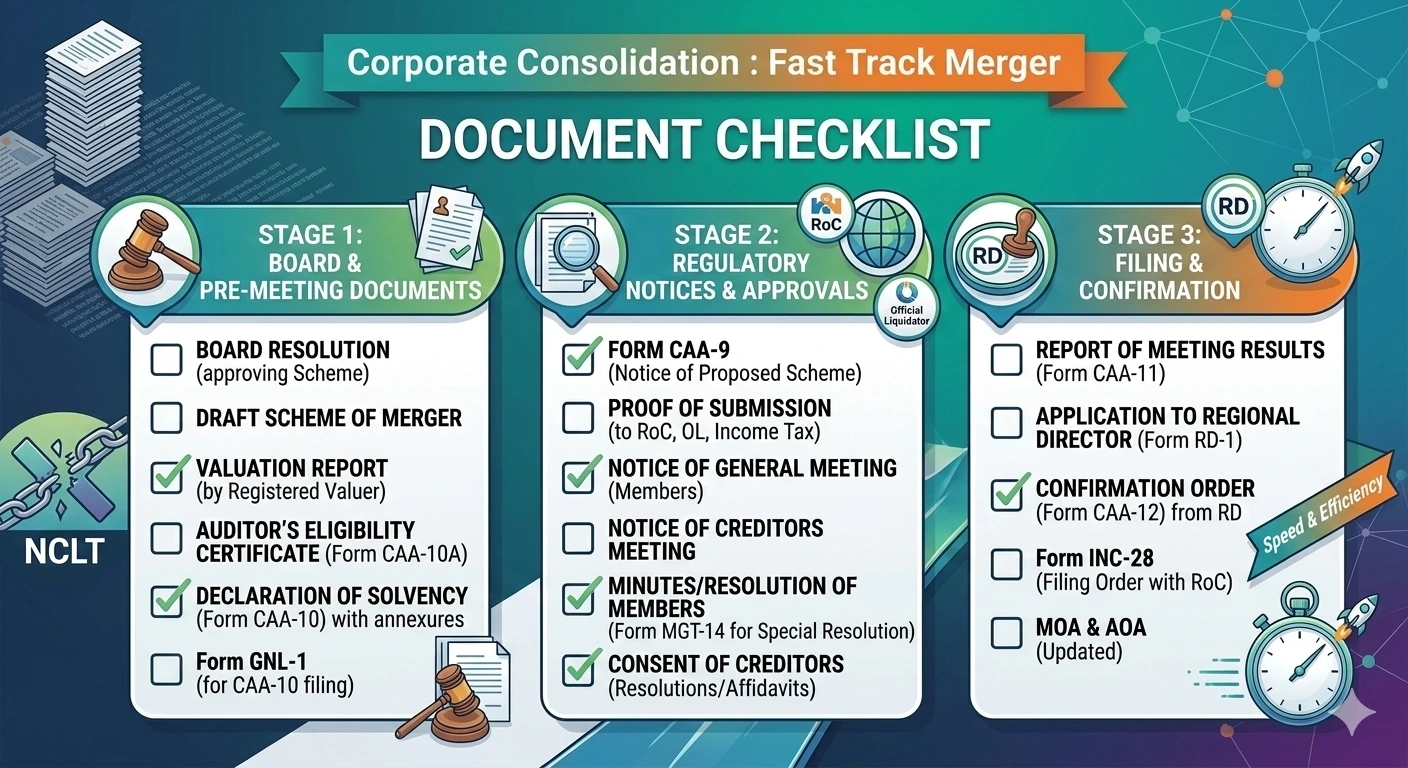

- Fast-Track Merger Document Checklist (Section 233 – Practitioner Guide)

- Streamlining Corporate Consolidation: A Guide to Fast Track Mergers for Group Companies

- Compliance Calendar March 2026

- GST Cash Ledger vs. Income Tax “Cash Ledger”: Concept and Challenges

- Multiple GST SCNs for same year permissible : Madras HC

Remarkable issues here. I am very satisfied to

look your post. Thanks a lot and I’m having a look forward to contact you.

Will you please drop me a mail?